Over the weekend we had the official PMIs:

China August Manufacturing PMI 49.1 (expected 49.5), Services 50.3 (expected 50.0)

More detail:

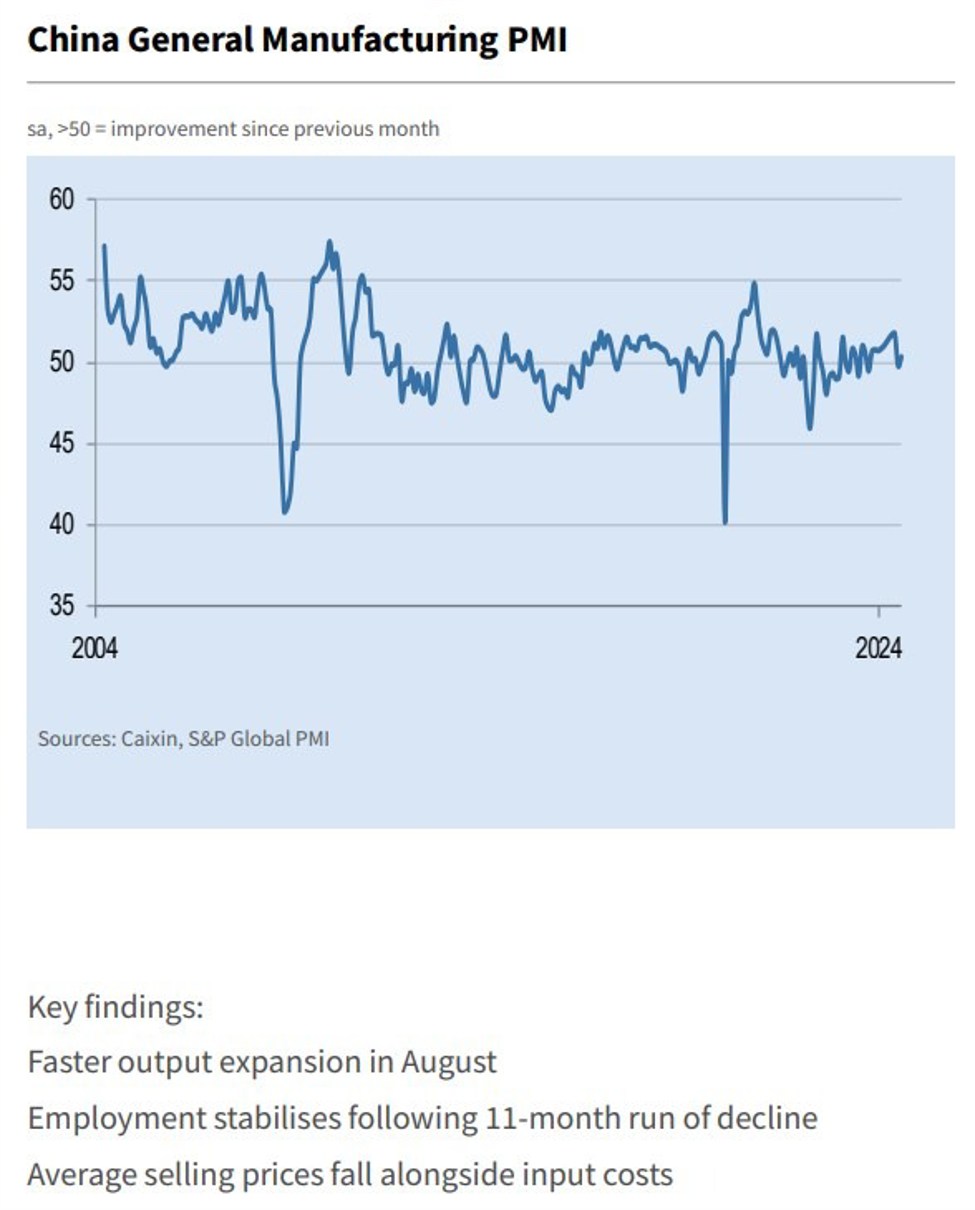

The private, Caixin S&P Global manufacturing PMI is much better, coming in at 50.4.

From the report, in summary:

- Demand picked up as total new orders resumed growth, with stronger

demand for intermediate goods - Exports declined for the first time in eight

months - Employment remained steady after an 11-month contraction

- Both input and output prices decreased

- Lower prices for raw materials such as industrial metals brought down input

costs - Output prices decreased amid sales pressure, with the corresponding

indicator reaching the lowest level in four months

—

China has two primary Purchasing Managers’ Index (PMI) surveys – the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by the media company Caixin and research firm Markit / S&P Global.

- The official PMI survey covers large and state-owned companies, while the Caixin PMI survey covers small and medium-sized enterprises. As a result, the Caixin PMI is considered to be a more reliable indicator of the performance of China’s private sector.

- Another difference between the two surveys is their methodology. The Caixin PMI survey uses a broader sample of companies than the official survey.

- Despite these differences, the two surveys often provide similar readings on China’s manufacturing sector.

- The Caixin services PMI will follow on Wednesday