- Business activity in the US rose, supported by the service sector.

- The economy expanded by 3.1% in the fourth quarter.

- The Fed cut rates but projected only 50 bps of cuts in 2025.

The AUD/USD weekly forecast suggests renewed downward pressure as the dollar rallies on the outlook of fewer Fed rate cuts in 2025.

Ups and downs of AUD/USD

The AUD/USD pair had a bearish week as the dollar soared on upbeat economic data and a drop in Fed rate cut bets. Data during the week revealed that business activity in the US rose, supported by the service sector. At the same time, retail sales jumped more than expected in November. Meanwhile, the economy expanded by 3.1% in the fourth quarter compared to forecasts of 2.8%.

However, the primary catalyst came when the Fed cut rates but projected only 50 bps of cuts in 2025. This boosted the greenback and sunk the Aussie.

Next week’s key events for AUD/USD

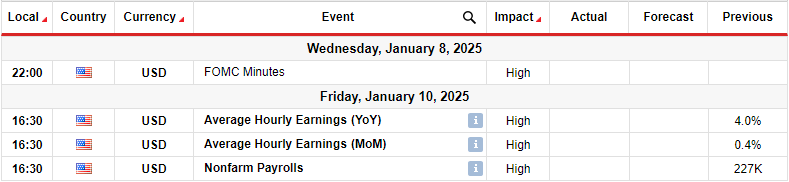

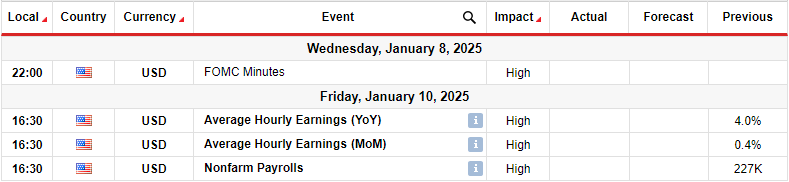

The next important week will come in 2025 when the US will release its first major report on monthly employment. At the same time, investors will focus on the FOMC meeting minutes.

The US nonfarm payroll report for December will show the state of the labor market going into the new year. A robust report will support the Fed’s new outlook for a gradual easing pace in 2025. On the other hand, a downbeat report will show cracks in the labor market, increasing Fed rate cut expectations.

Meanwhile, the FOMC minutes will show what went into the December meeting. Moreover, it might contain clues about the future.

AUD/USD weekly technical forecast: Bears prepare to breach the 0.6202 support

On the technical side, the AUD/USD price has made a new low near the 0.6202 support level. This move has pushed the price well below the 22-SMA, a sign that bears have a strong lead. At the same time, the RSI trades in the oversold region, showing solid bearish momentum.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

After a corrective bullish move, bears took control by breaking below the 22-SMA and the 0.6675 level to make a lower low. Since then, the price has maintained a downward trajectory, making lower lows. The RSI has also maintained its position in bearish territory. Moreover, it has not made a bullish divergence, indicating that bears are still enthusiastic about lower prices. Therefore, the price will likely breach the 0.6202 support in the new year to make new lows.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.