The first U.S. CPI report of 2025 came in hotter than expected, with headline inflation rising 0.5% in January after December’s 0.4% increase. This pushed the year-over-year rate up to 3.0% from 2.9%.

Core CPI, which strips out volatile food and energy prices, climbed 0.4% for the month and 3.3% annually, suggesting underlying price pressures remain stubborn.

Link to the official U.S. CPI Report (January 2025)

Details from the report gave clues on what may have driven January’s increase:

- Shelter costs rose 0.4%, accounting for nearly a third of the monthly gain

- Energy jumped 1.1% as gasoline prices increased 1.8%

- Food prices ticked up 0.4%, with a notable 15.2% surge in egg prices

- Auto insurance saw a sharp 2.0% rise

- Medical care and airline fares also contributed to the upside

Speaking before lawmakers, Fed Chair Powell acknowledged “great progress” on inflation but made it clear: “We’re not quite there yet.” That reinforced the view that policy needs to stay restrictive for now.

The hotter-than-expected report caught markets off guard, as it marked the biggest monthly increase since August 2023. Economists had expected a milder 0.3% gain, so the upside surprise forced traders to rethink their rate expectations.

The CME FedWatch tool even showed the odds of a rate cut this year falling sharply, with markets now pricing in just one cut instead of two.

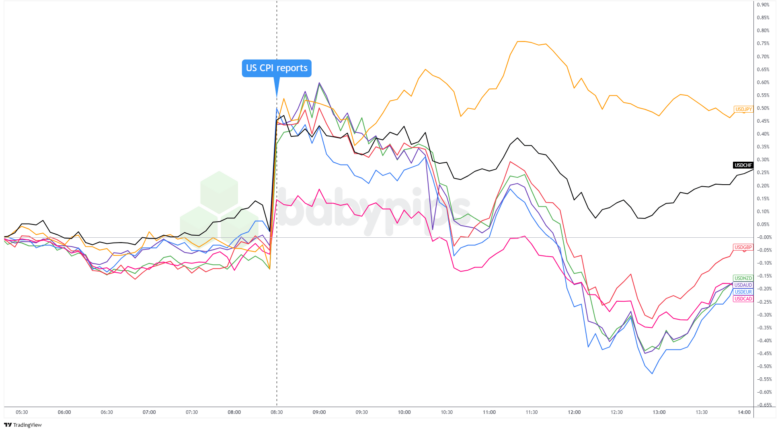

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The stronger inflation print added another hurdle for the Fed as it considers when and how aggressively it could ease policy, and kept investors on edge about the timing of the first interest rate reduction.

This is likely why the U.S. dollar, which had been trading in ranges and with mixed results, shot broadly higher at the hotter-than-expected CPI report. The report triggered what’s probably the sharpest dollar rally in months, with USD/JPY leading the charge and potentially marking its biggest daily gain since December.

However, the dollar’s strength didn’t last long.

As analysts pointed out that January often sees seasonal price increases, markets started questioning whether the inflation spike was more noise than trend. That set the stage for what looked like a classic round of profit-taking and position squaring, particularly in EUR/USD, which likely clawed back some of its early losses as these flows kicked in.

USD/JPY was the clear outlier, holding onto most of its gains. Yield differentials may have continued to support the pair, even as other dollar crosses reversed amid growing skepticism about just how much weight to give January’s hotter inflation print.