The Bank of Canada’s rate decision on Wednesday is shaping up to be a tight call, with RBC expecting policymakers to hold rates steady for the first time since April 2024.

While the base case assumes a pause in the current easing cycle, the risk of U.S. trade disruptions could still push the central bank toward a seventh consecutive rate cut.

With economic uncertainty lingering, markets will be watching for any signals on the future path of monetary policy. A decision to hold would mark a shift in strategy, suggesting policymakers see enough resilience in domestic conditions to pause further stimulus, despite external risks.

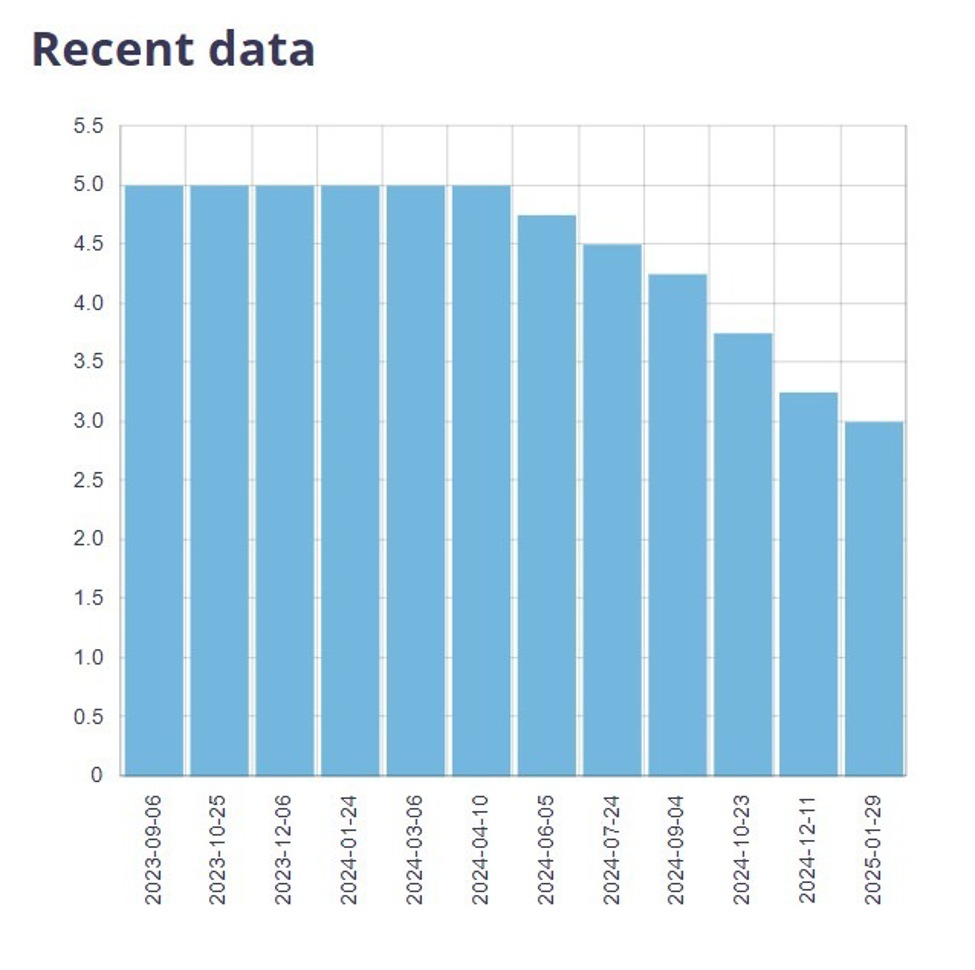

Bank of Canada stair step down in rates. The first cut of this cycle was in June of 2024.

The BoC statement is due at 0945 Eastern time (1345 GMT) on Wednesday, March 12, 2025.