Australia’s monthly inflation print came in at 2.4% year over year in February, a touch softer than January’s 2.5% growth and today’s expected reading. This marks continued progress in the Reserve Bank of Australia’s (RBA) efforts to bring inflation sustainably back within its 2-3% target band.

Trimmed mean inflation – the RBA’s preferred core gauge – also dipped to 2.7% from 2.8%, reinforcing the view that underlying price pressures are continuing to cool.

The largest contributors to annual inflation were:

- Food and non-alcoholic beverages (up 3.1%)

- Alcohol and tobacco (up 6.7%)

- Housing costs (up 1.8%)

- Rental prices rose 5.5% annually, down from 5.8% in January, showing the slowest growth since March 2023

- Electricity prices fell significantly (-13.2%) thanks to government energy rebates

- Automotive fuel prices declined 5.5% year-over-year, following a 1.9% drop in January

Link to ABS February 2025 CPI Report

February’s numbers strengthen the case for further monetary easing by the RBA.

While the central bank is expected to hold rates steady at its meeting next week, markets are now pricing in a roughly two-thirds chance of a rate cut in May, following the bank’s first reduction since 2020 earlier this year in February.

Market Reaction

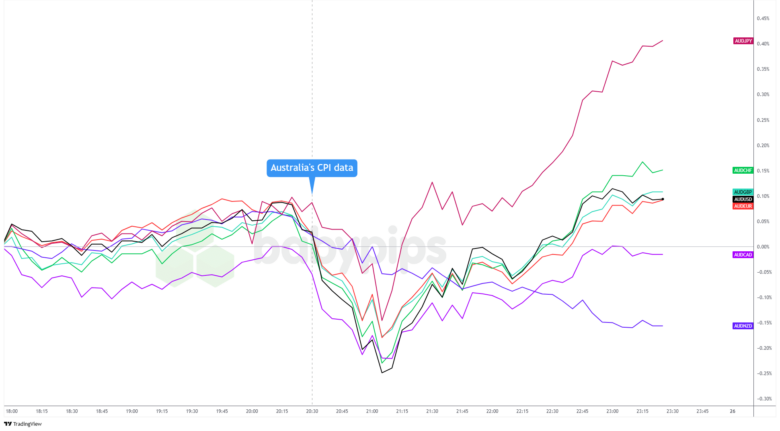

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

The Australian dollar, which had been edging higher ahead of the release, dipped about 0.1% to 0.2% lower before taking cues from a risk-friendly Asian session trading. This suggests traders had largely anticipated the continued cooling in price pressures.

AUD/JPY is showing the most gains as the Japanese yen extends its losses from Tuesday’s U.S. session trading, while AUD/CAD and AUD/NZD are seeing more limited gains compared to other major AUD pairs.

For now, the markets remain divided on the timing of the next cut. Some analysts suggest the weakness in underlying inflation supports a May rate cut, while others believe the RBA will likely wait for complete Q1 CPI data before deciding on rates.

The continued cooling of inflation, particularly with core measures now firmly within the RBA’s target band, provides promising signs that Australia’s battle against inflation is showing sustained progress, potentially opening the door for further monetary policy easing in the coming months.