-

Unity posted Q3 adjusted earnings of $0.20 per share versus a $0.24 loss expected.

-

The stock tripled from its $15 early 2024 low after the CEO canceled unpopular runtime fees.

-

IPO investors remain down 4.9% after five years despite the recent 110% one-year gain.

-

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

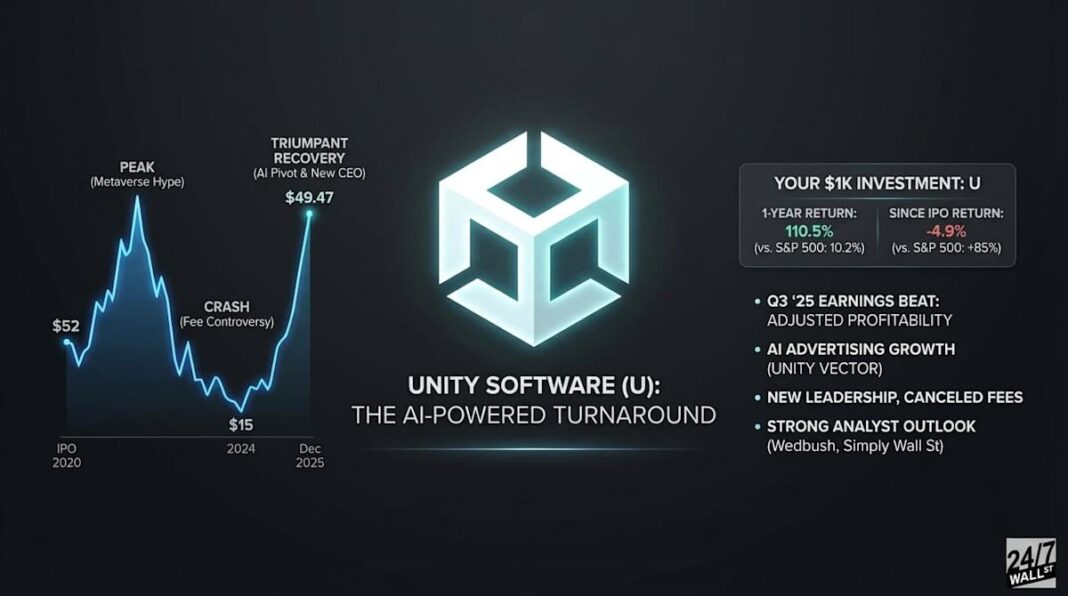

Unity Software (NYSE: U) went public in September 2020 at $52 per share during the pandemic gaming boom. The company provides the engine behind thousands of mobile games and interactive 3D experiences. Its business splits into Create Solutions (development tools) and Grow Solutions (advertising and monetization platform).

The stock peaked above $200 in late 2021 during metaverse hype, then crashed over 80% by 2024. Unity burned cash, posted widening losses, and alienated developers with a controversial runtime fee structure threatening to charge per game install. New CEO Matthew Bromberg canceled the unpopular fees in early 2024, raised subscription prices, and pivoted into AI-powered advertising with Unity Vector.

The stock bottomed around $15 in early 2024 and has since tripled.

Here’s what $1,000 invested at different points would be worth today at $49.47 per share:

1-Year Return (December 2024 to December 2025)

A $1,000 investment in Unity Software (U) at its September 2020 IPO experienced significant ups and downs, resulting in a projected -4.9% return by December 2025, despite a recent rebound.

-

Initial Investment: $1,000

-

Current Value: $2,105

-

Total Return: 110.5%

-

S&P 500 (same period): $1,102 (10.2%)

Since IPO (September 2020 to December 2025)

-

Initial Investment: $1,000 at $52 IPO price

-

Current Value: $951

-

Total Return: -4.9%

-

S&P 500 (same period): Approximately $1,850 (85%)

IPO investors remain underwater after five years. But 2024 buyers doubled their money in 12 months, crushing the S&P 500 by 100 percentage points.

Unity’s Q3 2025 earnings on November 5 delivered a massive surprise. The company posted adjusted earnings of $0.20 per share against expectations of a $0.24 loss. Revenue of $471 million beat estimates, and management credited Unity Vector AI for driving 6% growth in the advertising segment. Free cash flow hit $151 million. Analysts expect $0.89 in earnings for fiscal 2025, turning the corner to profitability.

Wedbush added Unity to its Best Ideas List in early December, citing undervaluation in the game engine and mobile ad markets. Simply Wall St estimated fair value at $55.77, suggesting 20% upside at current prices near $49.