As expected, the Swiss National Bank (SNB) kept interest rates on hold at 0.00% during their December meeting, despite inflation hitting the bottom of its target range.

SNB policymakers emphasized their commitment to avoiding negative interest rates and signaled that monetary policy could remain at its current state for an extended period.

Key Takeaways

- SNB maintained the policy rate at 0%, in line with unanimous market expectations

- Swiss inflation registered 0% in November, sitting at the lower bound of the SNB’s 0-2% target range

- The central bank revised down near-term inflation forecasts but maintained its medium-term outlook

- Officials reaffirmed their reluctance to move rates into negative territory, citing “undesirable effects”

SNB Governor Martin Schlegel and the Governing Board unanimously voted to leave the policy rate at 0%, maintaining the discount for banks’ sight deposits above certain thresholds at 0.25 percentage points.

The central bank also reiterated its willingness to intervene in foreign exchange markets “as necessary,” though officials at the press conference emphasized that interest rates remain their primary monetary policy tool, marking a notable evolution from the pre-pandemic period when FX interventions were used more extensively.

Link to SNB official statement (December 2025)

Still, the central bank significantly revised down its quarterly inflation outlook, now expecting just 0.1% in Q1 2026, 0.2% in Q2, and 0.3% in Q3, down from 0.5%, 0.5%, and 0.6% respectively in the September projections.

At the subsequent press conference, Governor Martin Schlegel, joined by Vice Chairman Antoine Martin and Governing Board Member Petra Tschudin, reiterated their strong aversion to negative interest rates. The central bank has been explicit in recent months about the “undesirable effects” of negative rates, which include distortions to financial markets, pressure on bank profitability, and unintended consequences for savers.

Link to SNB Press Conference (December 2025)

Market Reactions

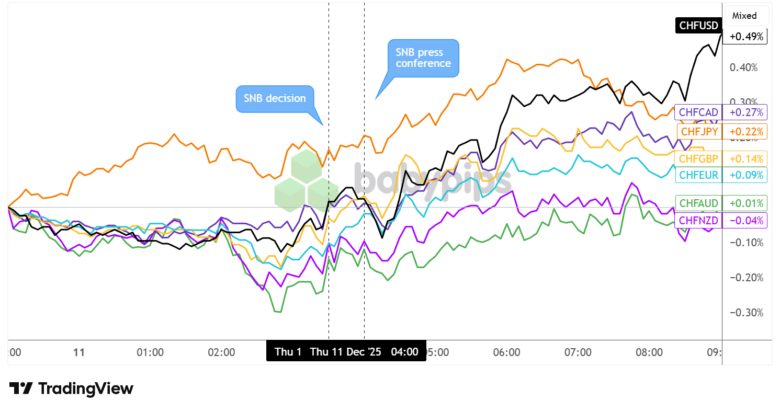

Swiss Franc vs. Major Currencies: 5-min

Overlay of CHF vs. Major Currencies Chart by TradingView

The Swiss franc, which had started to pull higher leading up to the actual SNB announcement, had an initial bullish reaction to the official decision since policymakers refrained from cutting rates to negative territory.

CHF briefly pulled back during the press conference, as traders likely weighed the implications of avoiding further easing amid a weaker inflation outlook, while also assessing the central bank’s willingness to intervene in the currency market “as necessary.”

Still, the Swiss currency managed to regain footing and sustain its rally as the London session went on, likely buoyed by dampened interest rate cut expectations until early 2026. CHF chalked up its strongest gains versus USD (+0.49%) followed by CAD (+0.27%) and JPY (+0.22%) while barely landing in positive territory versus AUD (+0.01%) and NZD (-0.04%) around the U.S. session open.