-

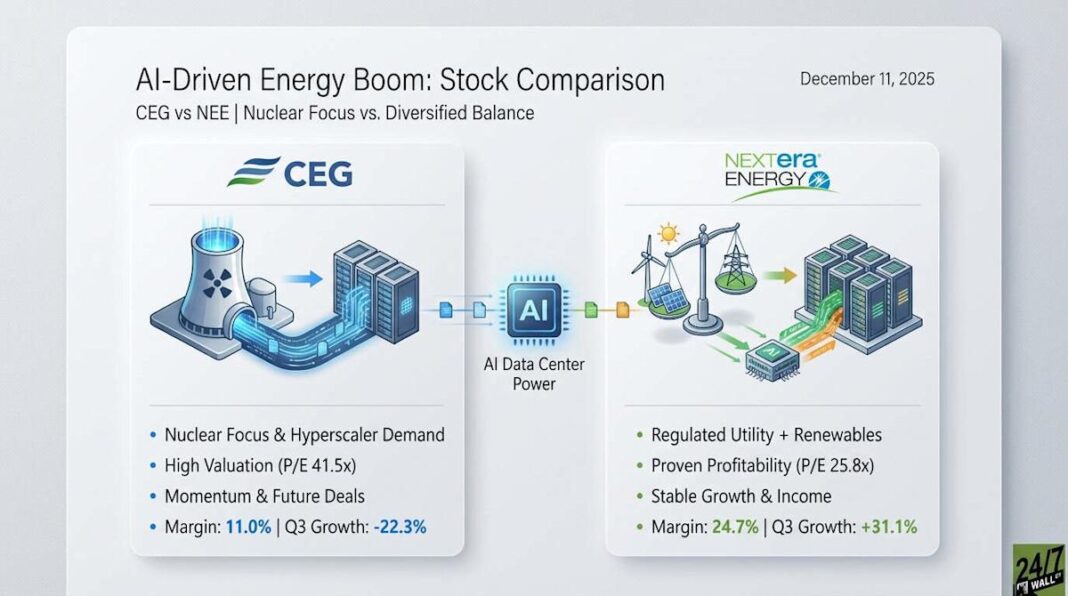

Constellation trades at 41.5x earnings despite a 22% YoY earnings decline while NextEra trades at 25.8x with 31% earnings growth.

-

NextEra’s 24.7% profit margin doubles Constellation’s 11.0% due to its regulated Florida utility base funding renewable expansion.

-

Constellation’s Three Mile Island restart won’t deliver power until 2028 despite the $1B government loan and Microsoft agreement.

-

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

Constellation Energy (Nasdaq: CEG) and NextEra Energy (NYSE: NEE) both missed Q3 2025 revenue expectations, but the stories reveal fundamentally different business models competing for the AI-driven energy boom.

Constellation posted $6.57 billion in revenue and $3.04 per share in adjusted earnings, both below Wall Street targets. CEO Joe Dominguez called it “outstanding performance” from the nuclear fleet, which generated 46,477 gigawatt-hours in Q3, up from 45,510 a year earlier. Renewable capture rates improved to 96.8%. The company secured a $1 billion government loan to restart the Three Mile Island reactor, backed by a Microsoft power purchase agreement.

NextEra delivered $7.97 billion in revenue but beat on earnings at $1.13 per share versus the $1.05 estimate. The company added 3 gigawatts to its renewables backlog and announced a 25-year nuclear supply deal with Google to power Iowa data centers. Florida Power & Light contributed $1.46 billion in net income, providing the stable regulated base that funds NextEra Energy Resources’ renewable expansion. Management maintained 2025 earnings guidance of $3.45 to $3.70 per share and projected roughly 10% annual dividend growth through 2026.

|

Business Driver |

CEG |

NEE |

|

Core Growth Engine |

Nuclear fleet performance |

FPL regulated base + renewables |

|

Q3 Earnings Growth |

-22.3% YoY |

+31.1% YoY |

|

Profit Margin |

11.0% |

24.7% |

|

Dividend Yield |

0.42% |

2.78% |

Constellation trades at 41.5x trailing earnings compared to NextEra’s 25.8x multiple, a 61% premium reflecting investor enthusiasm for nuclear exposure to hyperscaler demand. The stock climbed 49% year-to-date through early December versus NextEra’s 14% gain. That rally occurred despite a 22% earnings decline in Q3, while NextEra grew earnings 31%.

This infographic compares Constellation Energy (CEG) and NextEra Energy (NEE) across Q3 performance, valuation, and future strategies, highlighting their distinct business models in the AI-driven energy sector.