It’s time to reflect on 2025 and prepare for the new year, potentially bringing new ideas for your portfolio. With that in mind, here’s a look at three investment themes that you might want to prepare for in the new year.

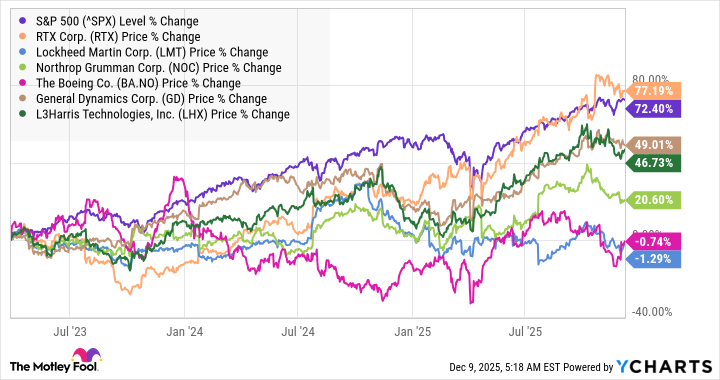

A quick look at the chart below shows that the major defense companies, including Lockheed Martin (NYSE: LMT), have underperformed the market in recent years. RTX has slightly outperformed, but that’s arguably due to its large commercial aerospace businesses enjoying a recovery in flight departures.

The general underperformance might surprise investors, given that wars and geopolitical conflict have encouraged military spending, NATO members have committed to raising spending to 5% of GDP by 2035 , and defense companies (including Lockheed) currently hold record backlogs.

The reason comes down to profit margin pressures at defense businesses, most notably on fixed-price development programs. For example, Boeing, Lockheed Martin, and RTX have reported multibillion-dollar losses and charges on assorted programs due to cost overruns. I’ve covered these issues in more detail elsewhere. However, the gist of the argument is that governments are using their monopsonistic power (the single buyer in a market with many sellers) over defense contracts to bargain more aggressively for contracts, while at the same time, defense technology is becoming increasingly complex and costly to develop.

It’s far from clear that these pincer-like pressures on margins aren’t long-term rather than temporary issues. In addition, a resolution to various conflicts in 2026, combined with the realization that government debt levels may curtail future defense spending, could turn sentiment negative toward defense stocks in 2026.

It’s no secret that artificial intelligence (AI) technology and infrastructure companies like Nvidia and Vertiv have delivered market-busting returns over the last year, but when even stocks like Caterpillar have surged higher to questionable valuations due to AI exposure (Caterpillar’s power generation equipment used to power and backup data centers), then it might be time to broaden exposure to the AI theme.

If you follow the argument that it’s more of a question of valuation than a bubble in AI spending, then it makes sense to look at software companies that are embedding AI into their solutions so as to increase their value to customers. PTC (NASDAQ: PTC) and its suite of software solutions are ideally positioned in this respect, not least because its existing solutions focus on enabling industrial companies to work smarter by adopting digital technology.