-

Verizon reported $33.82B revenue with 2.1% wireless service growth but missed estimates.

-

AT&T’s fiber broadband revenue surged 16.8% to $2.2B with 41% of fiber customers bundling mobile.

-

AT&T acquired $23B in spectrum from EchoStar to expand 5G capacity.

-

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

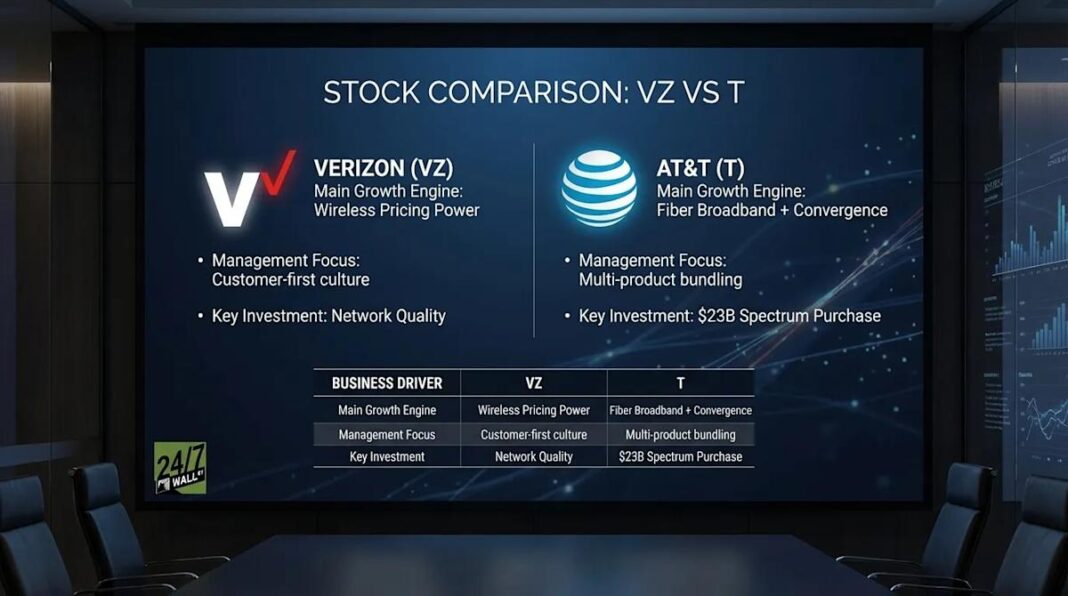

Verizon (NYSE: VZ) and AT&T (NYSE: T) just reported Q3 results revealing two telecom giants chasing different growth paths. Verizon leaned on wireless pricing discipline and a new CEO’s customer-first mandate. AT&T bet on fiber broadband convergence and a massive spectrum purchase to fuel its 5G future.

Verizon posted $33.82B in revenue, missing estimates of $35.31B but growing 1.5% year-over-year. Wireless service revenue climbed 2.1% to $21.0B, driven by pricing power. Equipment revenue jumped 5.2% to $5.6B as device upgrade cycles accelerated. Net income surged to $5.06B from $3.41B a year earlier. New CEO Dan Schulman emphasized a culture shift toward customer retention, signaling Verizon will prioritize quality over aggressive acquisition.

AT&T delivered $30.70B in revenue, slightly below the $30.89B estimate, with 1.6% growth. Mobility service revenue rose 2.3% to $16.9B, but fiber broadband surged 16.8% to $2.2B. CEO John Stankey highlighted convergence success: 41% of fiber households now bundle AT&T Mobility service, underscoring the strategy to lock customers into multi-product ecosystems. Net income hit $9.7B, though $9.3B came from the DIRECTV sale. Free cash flow reached $4.9B, and AT&T repurchased $1.5B in shares while announcing a $23B spectrum acquisition from EchoStar to bolster 5G capacity.

|

Business Driver |

Verizon |

AT&T |

|

Main Growth Engine |

Wireless pricing power |

Fiber broadband + convergence |

|

Management Focus |

Customer-first culture |

Multi-product bundling |

|

Key Investment |

Network quality |

$23B spectrum purchase |

Verizon’s strategy centers on protecting its premium network positioning. The company raised its dividend for the 19th consecutive year, reinforcing its appeal to income investors with a 6.77% yield. Guidance projects wireless service revenue growth of 2.0% to 2.8% and adjusted EBITDA growth of 2.5% to 3.5%, with free cash flow expected between $19.5B and $20.5B. Operating margins stand at 23.9%, the highest among peers, but profit margins lag AT&T at 14.4% versus 17.9%. High debt limits flexibility for aggressive expansion.