-

David Tepper sold his entire Intel (INTC) stake worth $205M despite recent government backing and Nvidia partnership.

-

UnitedHealth (UNH) was Tepper’s largest sale at $780M after buying a similar amount the prior quarter.

-

He sold many other stocks, including AI ones, to buy this 1 recovery bet.

-

A recent study identified one single habit that doubled Americans’ retirement savings and moved retirement from dream, to reality. Read more here.

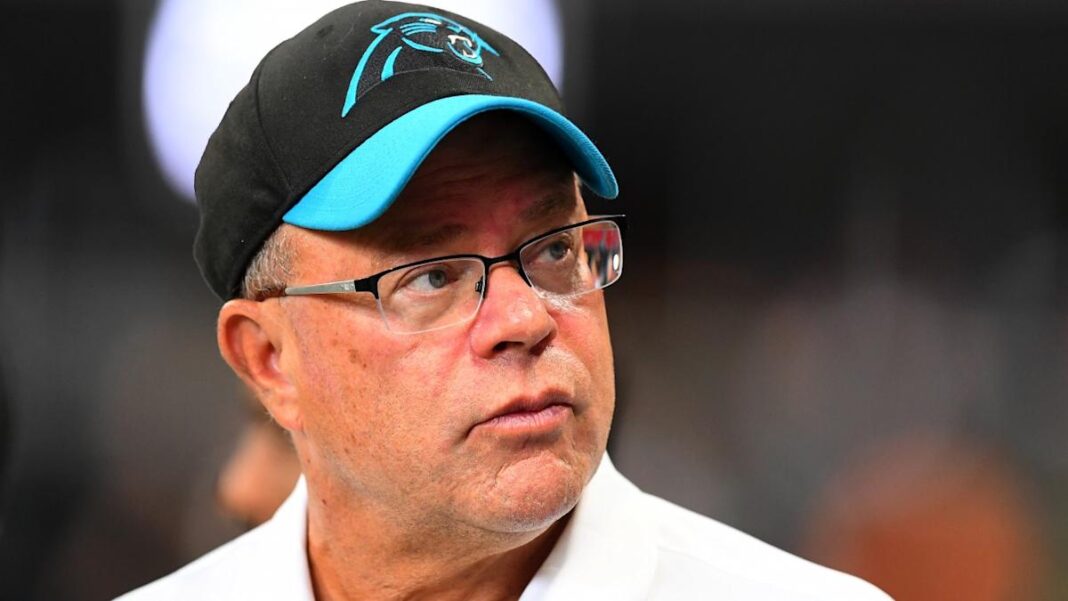

David Tepper is one of the most successful hedge fund managers in history, with a net worth of ~$23.7 billion. He’s been selling UnitedHealth (NYSE:UNH), Intel (NASDAQ:INTC), Alibaba (NYSE:BABA), Vistra (NYSE:VST), and Micron (NASDAQ:MU). He’s piling into a lesser-known stock instead called Whirlpool (NYSE:WHR), and we’ll look into why in a bit.

Tepper is the founder of Appaloosa Management and is also the proprietor of the NFL’s Carolina Panthers and Charlotte FC in Major League Soccer.

Tepper is credited with playing a major role in the survival of Goldman Sachs after the 1987 stock market crash. After being passed over for a partner at Goldman Sachs twice, Tepper quit in December 1992 and created Appaloosa Management in early 1993. This hedge fund has been raking it in. It has returned roughly 25% a year since its founding.

One of his hallmark strategies is to buy up distressed stocks, especially those of companies with debt-laden balance sheets. He has successfully invested in many such stocks, and the contrarian approach paid off as the companies recovered. This is exactly what he did in 2009 and earned $7 billion by buying distressed financial stocks in February and March.

He’s now selling many AI holdings and popular stocks, a very contrarian move. Let’s take a look.

Tepper’s largest sale for Q3 2025 was UNH. He shaved off 92% of his position, or about $780 million worth of the stock. UNH turned into a fan-favorite for hedge funds after it halved in value. After all, how can you pass on America’s largest insurance business at a 50% discount?

Tepper is doing just that after buying a similar amount of shares in Q2 2025. It’s unknown when he bought in Q2 2025, but if he bought at the peak, he may be just cutting his losses. If he bought the dip, the ongoing “recovery” may be too slow for his liking, and he’s fine with the tidy profits.

Wall Street’s hopes were dashed for Intel as it failed to make use of the AI headwinds… right up until the company’s new CEO, Lip-Bu Tan, cozied up with the Trump administration. He’s been able to secure U.S. government + SoftBank investments. Even Nvidia (NASDAQ:NVDA), a “competitor,” partnered up with Intel with a $5 billion deal this September. This led to Intel’s “best day since 1987”.