-

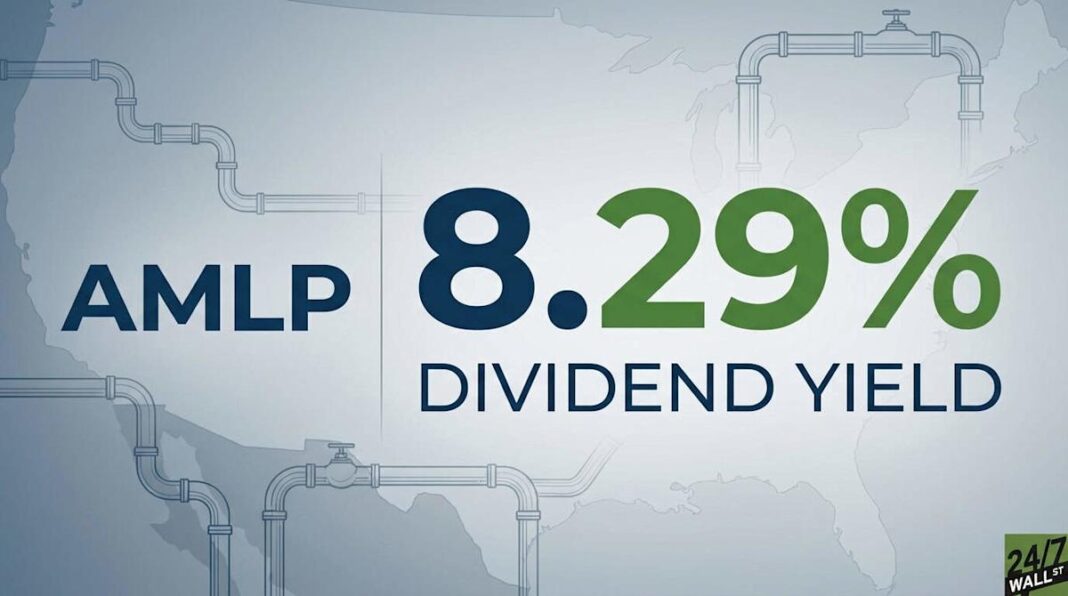

AMLP delivers an 8.29% yield through MLPs that avoid corporate taxes and distribute most cash flow to unitholders.

-

Top holdings like MPLX and EPD show strong distribution coverage ratios between 1.22x and 1.8x.

-

AMLP returned 4.4% total return over the past year despite a 3.87% price decline.

-

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

The Alerian MLP ETF (NYSEARCA:AMLP) offers an 8.29% dividend yield when traditional dividend stocks struggle to reach 4% and the S&P 500 barely tops 1%. For income-focused investors, AMLP provides access to master limited partnerships operating critical energy infrastructure across the United States.

AMLP generates income by holding equity stakes in MLPs, which are pass-through entities that distribute the majority of their cash flow to unitholders. These partnerships operate pipelines, storage facilities, and processing plants for crude oil, natural gas, and refined products. Because MLPs don’t pay corporate income taxes, they can distribute higher yields than traditional corporations. The ETF’s top six holdings represent 77% of the portfolio, providing concentrated exposure to industry leaders.

This infographic details the Alerian MLP ETF (AMLP), highlighting its 8.29% dividend yield, MLP investment strategy, top holdings, and performance metrics. It also provides a comparison with an alternative, the Global X MLP ETF (MLPA).

AMLP’s yield sustainability depends directly on the distribution strength of its largest positions. Each operates fee-based business models that generate stable cash flows regardless of commodity price fluctuations.

MPLX (NYSE:MPLX), the largest holding at 13.57%, recently increased its quarterly distribution by 12.5% to $1.0765 per unit. The partnership maintains distribution coverage of 1.3x, generating 30% more cash than it pays out. With Q3 adjusted EBITDA of $669 million and a 41.4% profit margin, MPLX demonstrates exceptional financial strength. The partnership has grown distributions consistently since 2016 without cuts during the 2020 crisis.

Enterprise Products Partners (NYSE:EPD) at 12.66% exemplifies dividend aristocrat quality with 25 consecutive years of distribution increases. Its 1.22x coverage ratio and $69.7 billion market cap provide stability. Energy Transfer (NYSE:ET) has increased distributions nine consecutive quarters, reaching $0.3325 after recovering from 2020 cuts.