Trade

Republic closed a €1.2 billion secondary transaction valuing the company at

€12.5 billion, cementing its position as Germany’s most valuable startup.

Existing

investors, led by Peter Thiel’s Founders Fund, bought shares from early backers, while new long-term investors, including Wellington Management, Singapore’s GIC, and Fidelity Management & Research Company, joined the shareholder base.

Trade Republic’s Valuation

Jumps From €5 Billion in Three Years

The deal

doesn’t inject fresh capital into the company, which has been profitable for

three consecutive years. Trade Republic had revenue of €340 million in the year

to September 2024. The Berlin-based neobroker reported earlier this month

it generated

€34.8 million in profit after securing its full ECB banking license, with equity climbing

to €566.5 million.

The

secondary round more than doubles Trade Republic’s 2022 valuation of roughly €5

billion. Other existing investors participating in the share purchase include

Sequoia, Accel, TCV, and Thrive Capital, alongside new investors Khosla

Ventures, Lingotto Innovation, and Aglaé, the technology investment arm of

France’s Arnault family.

Trade

Republic has

doubled its customer base to more than 10 million users in the past 18

months, with clients now managing €150 billion in assets across the platform.

Co-founder Christian Hecker said 70% of Trade Republic customers are first-time

investors, adding that the “cultural shift to retail investing in Europe

is only starting”.

“We launched in 2019 with a mission to help close

Europe’s pension gap,” he added.

Expansion Follows Banking

License and Product Rollout

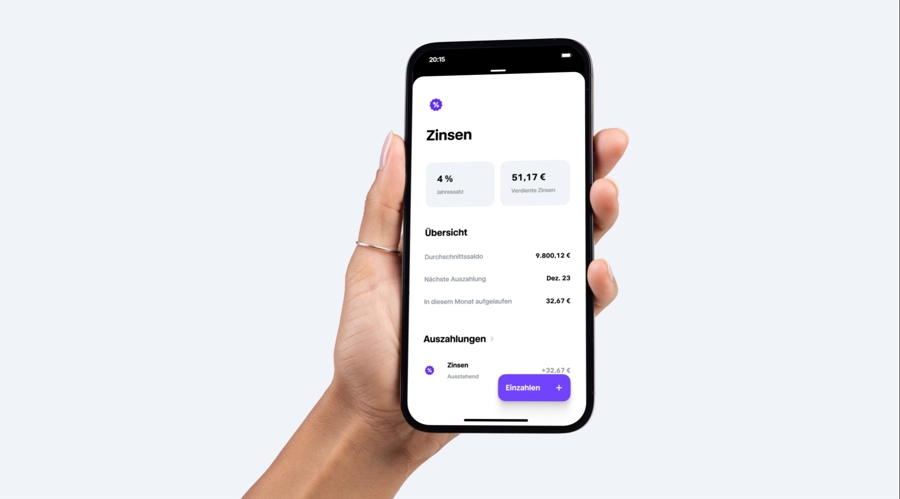

The company

obtained a full banking license from the European Central Bank in 2023,

allowing it to expand beyond its original brokerage model. Trade Republic now

offers current accounts with local IBANs, passes ECB interest rates directly to

customers, and has distributed €2.5 billion in interest payments since January

2023.

This year

the neobroker localized its offering in France, Italy, Spain, the Netherlands,

and Austria, while launching in

Poland in

September. The company also introduced child savings accounts and expanded into

new asset classes, recently giving retail

investors access to private markets, fixed income, and a crypto wallet.

Pension Gap Drives Retail

Investing Surge

Hecker

pointed to Europe’s

widening pension gap as a driver for private wealth accumulation.

“This

is more important than ever as the public pension system is under growing

pressure to fulfill its promises,” he said.

Recent

surveys show 41% of Europeans still don’t contribute to supplementary pension

schemes, while state pensions across the EU are expected to decline from 46.2%

of retirement income in 2019 to around 37.5% by 2070.

Germany and

other European governments have started implementing pension reforms to

encourage private stock ownership, a trend Trade Republic expects to

accelerate. The company, which launched in 2019, operates across 18 European

countries and holds a full banking license supervised by Germany’s Federal

Financial Supervisory Authority (BaFin) and the Deutsche Bundesbank.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link