The Bank of England (BOE) cut its Bank Rate by 25 basis points to 3.75% at its December meeting, delivering the sixth rate reduction since August 2024.

However, the decision proved far more contentious than markets anticipated, with the Monetary Policy Committee voting 5-4 in favor of the cut, revealing deep divisions about the path ahead for UK monetary policy.

Governor Andrew Bailey, who cast the deciding vote after sitting on the fence in November, emphasized that “we still think rates are on a gradual path downward, but with every cut we make, how much further we go becomes a closer call.”

Key Takeaways from the BOE Decision

- Narrow 5-4 vote split: Five MPC members voted to cut, while four preferred to hold at 4%, highlighting persistent disagreement about inflation risks versus growth concerns.

- Inflation falling faster than expected: CPI dropped to 3.2% in November and is now projected to fall “closer to 2%” by April—roughly a year earlier than the BOE forecast just last month.

- Budget measures provide relief: Chancellor Rachel Reeves’ autumn budget, including energy bill cuts and fuel duty freezes, is expected to reduce inflation by around 0.5 percentage points in early 2026.

- Economy stagnating: The BOE now expects zero GDP growth in Q4 2025, down from a 0.3% forecast in November, as businesses remain cautious following budget uncertainty.

- Labour market weakening: Unemployment rose to 5.1%—the highest since January 2021—while wage growth continued to moderate, with private sector pay growth falling to 3.9%.

- Hawks remain concerned: The four dissenters warned that forward-looking wage indicators remain “elevated” at 3.5-4%, suggesting pay growth may not fall much further.

- Cautious easing ahead: Bailey signaled the BOE is approaching neutral rates (estimated at 3-3.5%), making future cuts increasingly dependent on incoming data.

Link to official BOE Monetary Policy Statement (December 2025)

The five members voting for a cut – Bailey, Sarah Breeden, Dave Ramsden, Swati Dhingra, and Alan Taylor – judged that “the disinflation process was on track” and upside risks to inflation had continued to recede. Bailey noted rising unemployment and flows from employment to unemployment, warning the committee should be “vigilant” about potential sharper labour market deterioration, though he saw no “conclusive evidence” of this yet.

The four dissenters – Megan Greene, Clare Lombardelli, Catherine Mann, and Huw Pill – placed “greater weight on prolonged inflation persistence, including from structural factors.” They argued the current and forward-looking evidence on services inflation, wage growth, and inflation expectations remained above target-consistent levels, potentially signaling “lasting changes in wage and price-setting behaviour.”

Notably, both camps referenced the same wage survey data showing expectations had “levelled out in the 3.5-4% range,” but drew opposite conclusions. Hawks saw this plateau as evidence that wage disinflation might stall, while doves viewed it alongside falling actual wage growth and rising unemployment as confirmation that restrictive policy was working.

The minutes emphasized that “judgements around further policy easing will become a closer call” as Bank Rate approaches the neutral level, with members holding “different views on how, and with what degree of precision, an equilibrium, or neutral, level of Bank Rate could be identified.”

Bailey’s remarks that future decisions would be a “closer call” resonated with currency traders, who interpreted this as the BOE approaching the end of its easing cycle. The central bank’s projection that inflation would reach 2% by spring 2026—much sooner than previously forecast—gave the MPC room to cut now while signaling less urgency for aggressive easing ahead.

Link to BOE MPC meeting minutes and Monetary Policy Summary

Market Reactions

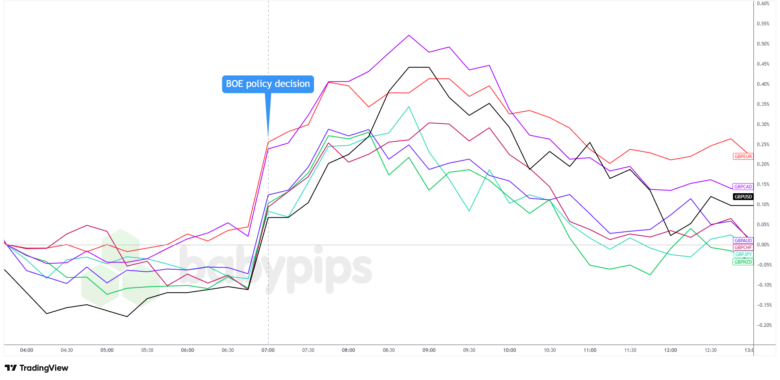

British Pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

Two-year gilt yields jumped 5-6 basis points following the announcement as bond markets repriced expectations for the 2026 easing cycle. Interest rate swaps now reflect approximately 50-75 basis points of additional cuts through end-2026, down from the 75-100 basis points priced before the meeting.

The British pound, which saw a bearish lean in early London trading, strengthened modestly following the BOE’s rate decision despite the widely expected 25bp cut. The initial market reaction suggested traders were caught off-guard by the hawkish undertones in both the vote split and forward guidance.

However, Sterling’s strength was short-lived, as the currency pulled back during the U.S. trading session. The pullback coincided with the ECB’s policy decision and press conference, where officials kept the door open for potential future rate cuts while holding rates steady at 2%. The ECB’s relatively balanced messaging may have supported the euro during the session, while traders also digested the U.S.’s weaker-than-expected inflation print.

GBP lost most of its post-BOE gains against several major currencies, though it managed to hold modest gains against USD, NZD, and EUR while closing lower against other majors like AUD, CAD, JPY, and CHF.

Looking ahead, market focus will shift to the BOE’s next decision on February 5, 2026. Economists remain divided on whether the central bank will cut again in February or wait until March, with incoming wage and inflation data through January likely to prove decisive.