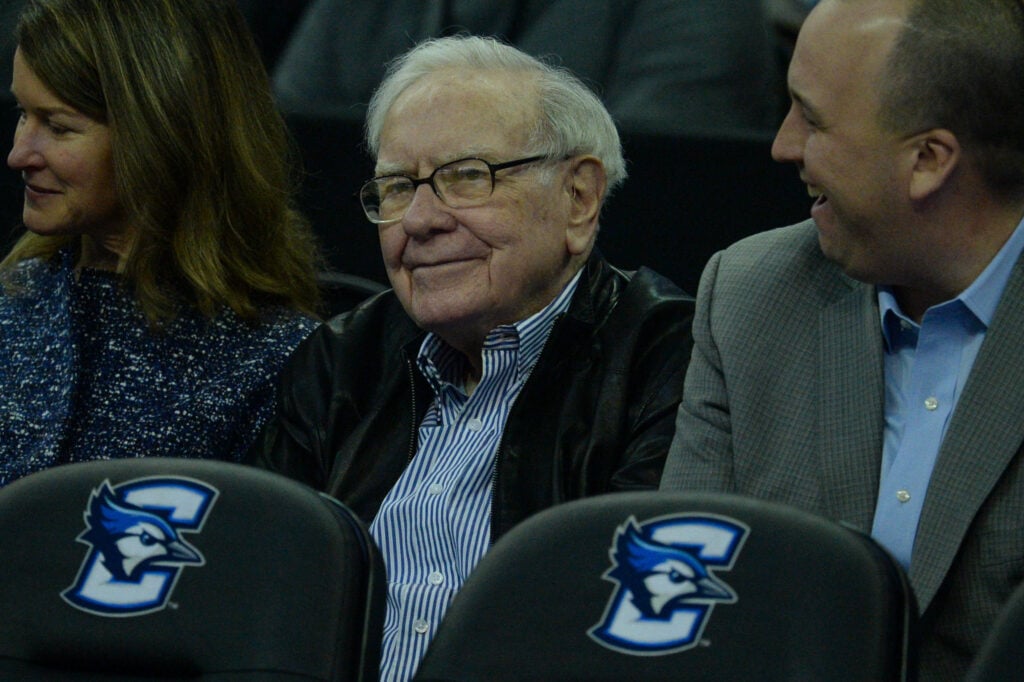

Despite beating the market for decades and turning a failing textile mill into one of the world’s most admired business empires, Warren Buffett is known for his humility. He often speaks frankly about the mistakes he has made during his career and shares the lessons he learned with the public.

In his letter to Berkshire Hathaway Inc. (NYSE:BRK, BRK.B)) shareholders earlier this year, Buffett said many large public companies treat admitting mistakes as a “taboo” and called delaying the correction of errors a “cardinal sin.” He said he has made mistakes in evaluating companies for acquisitions and in judging the people he hired.

Don’t Miss:

Buffett made some “dumb” mistakes in acquiring businesses that later turned out to be bad investments, he said in his 2016 letter to Berkshire shareholders.

The billionaire, who will step down as Berkshire CEO at the end of this month, said in that letter that he and then-Vice Chair Charlie Munger were “stewards” of their capital with a job to deliver strong returns despite market headwinds.

“Charlie and I have no magic plan to add earnings except to dream big and to be prepared mentally and financially to act fast when opportunities present themselves,” Buffett wrote. “Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do.”

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Buffett in 2016 talked about the transition Berkshire made in the early 1990s to focus more on acquiring businesses and the mistakes he made during the process. He said buying Dexter Shoe for $434 million was a “particularly egregious error” as the business later became worthless. Another “error” he made was “foolishly” using Berkshire shares to buy General Reinsurance in late 1998, a decision that caused shareholders to give far more than they received, Buffett wrote.

“As is the case in marriage, business acquisitions often deliver surprises after the ‘I do’s,'” Buffett said. “I’ve made some dumb purchases, paying far too much for the economic goodwill of companies we acquired.”