Another decline in the benchmark price of diesel has sent that number down by the biggest amount in a five-week period in two years.

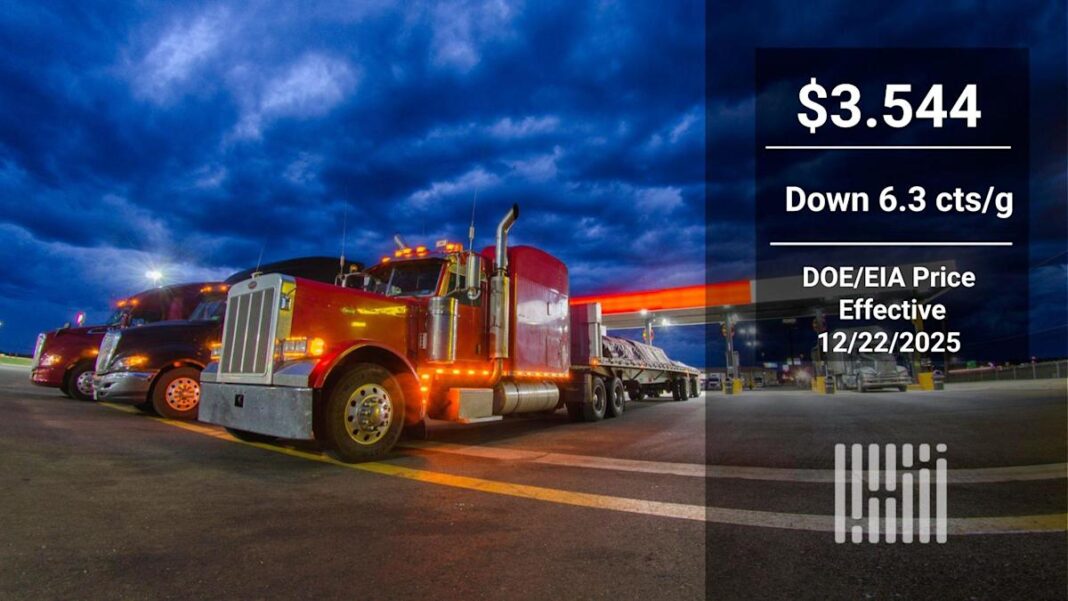

The Department of Energy/Energy Information Administration average weekly retail diesel price fell 6.3 cents/gallon go $3.544/g. It stood at $3.868 before this five-week run of falling numbers.

The decline of 32.4 cts/g during that period is the most over a 5-week span since it fell 37.9 cts/g over the five weeks ended December 11, 2023.

The latest price, effective Monday and published Tuesday, is the lowest for the benchmark used for most fuel surcharges since it was $3.471 on June 11.

Retail prices lag declines in the futures market. The price of ultra low sulfur diesel (ULSD) on the CME commodity exchange has stabilized over the past few trading sessions after a decline that began November 18 with a ULSD settlement of $2.7011/g.

And while the ULSD price on CME settled November 12 at $2.1980/g, it fell to as low as $2.1219/g Friday before rising to a Monday settlement of $2.1581/g.

Ironically, some of the market stability is coming from uncertainty. The uncertainty is whether recent developments between the U.S. and Venezuela will slow Venezuelan oil output.

Long-term, the end of the Maduro regime in Venezuela would almost certainly be bearish. It would give the oil industry an opportunity to rebound from years of mismanagement.

The most recent Argus Media estimate of Venezuelan production is about 1 million barrels/day. Prior to Hugo Chavez taking over the country in 1998, Venezuelan output was close to 3.5 million b/d.

The other uncertainty in the market is the precise amount of oil coming out of Russia.

The uncertainty surrounding oil supplies given those two large geopolitical factors has meant that even as ULSD has declined slightly in the last week, Brent on the CME settled Monday at $62.07/barrel, up from $60.56/b a week ago.

There is still plenty of talk about a glut. It is the forecasts of that weakness that has been the primary driver of lower oil prices for the last six weeks.

But geopolitics, at least for a short period of time, can outpace the impact of supply and demand.

More articles by John Kingston

New York City bill that targeted Amazon won’t get taken up in 2025

State of Freight: a depressed trucking market suddenly comes to life

Benesch panelists: Why 2026 could be a strong year for logistics M&A

The post Benchmark diesel down yet again, five straight weeks of declines appeared first on FreightWaves.