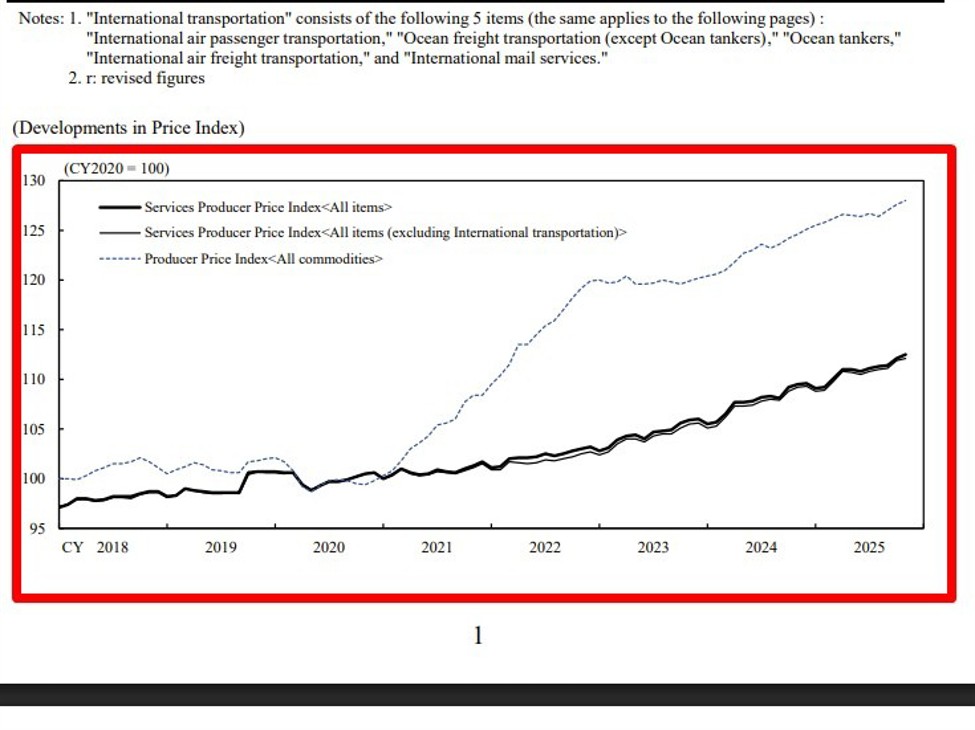

The Corporate Service Price Index (CSPI), more commonly referred to as Japan’s services producer price index, measures the change in prices charged between companies for services, such as transport, communications, advertising and other business-to-business services. Unlike traditional producer price indexes focused on goods, the CSPI captures service-sector price pressures that can be a leading signal for consumer inflation and broader cost dynamics in a service-driven economy.

The CSPI is closely watched by economists and the Bank of Japan as it tends to feed through to consumer services inflation with a lag. Because many services are labour-intensive, upward price momentum here can reflect wage pressure and firms passing on costs, which is pertinent at a time when Japan is trying to cement inflation above its 2% target sustainably.

In this November release, markets will dissect it looking for whether service price inflation remains firm or moderates, and how that fits into the broader inflation narrative that has seen Japan’s core CPI steady above target.

For context, the latest available CSPI year-on-year figures (BOJ data) show a generally elevated but stabilising trend through 2025:

CSPI YoY (total services)

-

May: +3.1%

-

June: +2.8%

-

July: +2.7%

-

August: +2.8%

-

September: +3.0%

-

October: +2.7%

These readings indicate persistent service price pressures, albeit with some ebb and flow. The slight deceleration from September to October suggested that while inflation in services remains solid, the pace of increases isn’t uniformly accelerating.

The November CSPI will therefore be interpreted not in isolation, but as part of the inflation story spanning goods prices, consumer services inflation and labour costs. A stronger-than-expected outcome could reinforce expectations of continued, and sooner than otherwise, monetary tightening by the BOJ, while a clear slowdown might bolster confidence that inflation is moderating without derailing the broader price trend.

In sum, the CSPI is a leading gauge of underlying inflation pressures in services that matters for both CPI forecasts and the central bank’s policy calculus in a period of evolving price dynamics.