The S&P 500 (SNPINDEX: ^GSPC) is on course for a solid 2025. With just a couple of trading days left in the year, the index is up almost 17%. That’s not bad considering the average annual total return for the S&P 500 (including dividends) is about 10%.

But five components in the large-cap index have blown that average away, posting gains of more than 200%.

The top S&P 500 performer for 2025 is Sandisk (NASDAQ: SNDK). The stock is up a whopping 587% since it went public in February at $38.50 a share. It currently trades at about $232.

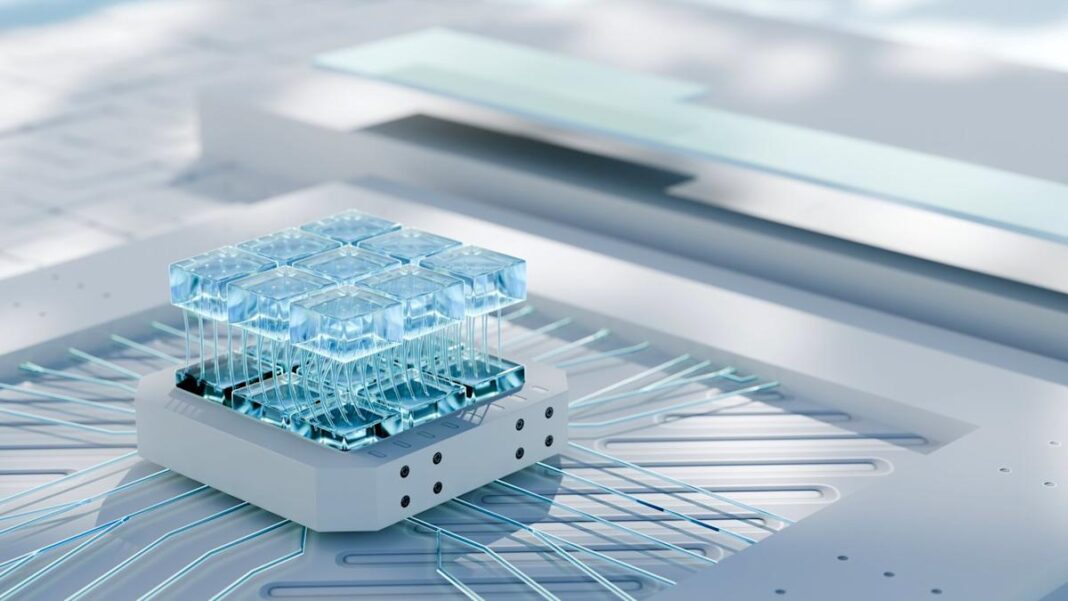

Headquartered in Milpitas, California, in the heart of Silicon Valley, Sandisk makes data storage devices based on NAND flash technology, which is a type of nonvolatile storage technology that can retain data without a power source. “NAND” combines the words “not” and “and,” referring to the logic gates that are central to the devices. And there’s currently a shortage of such devices.

No. 2 on our list is Western Digital (NASDAQ: WDC). It’s up 283% for the year. Based in San Jose, California, it also makes data storage products, but it’s focused on hard drives rather than flash memory. Interestingly, Western Digital and Sandisk used to be one company, but Western Digital spun off Sandisk early this year.

Next up: Seagate Technology Holdings (NASDAQ: STX), which is up 226% so far in 2025. The Fremont, California, company also makes data storage products. (Are you sensing a trend here?) These include personal storage devices, gaming hard drives, network storage, and similar products.

Fourth on the list is Robinhood Markets (NASDAQ: HOOD), which is up about 225% as of this writing. Based out of Menlo Park, California, Robinhood operates an online discount brokerage platform that offers retail investors commission-free trading of stocks, ETFs, options, and cryptocurrencies.

The company makes money via something called “payment for order flow,” wherein market makers pay Robinhood for routing customer orders to them. Other income comes from investing users’ cash deposits. The company has been benefiting from a surge in retail investing and crypto trading.

Finally, last on the S&P 500’s top five list this year is Micron Technology (NASDAQ: MU), up 222% year to date. Based in Boise, Idaho, it also makes memory and storage solutions – specifically, the high-performance memory (DRAM) and storage devices (NAND) used in data centers and other computing devices. Like three other stocks in the top five, Micron is also benefiting from a rising wave of demand tied to artificial intelligence (AI) workloads.