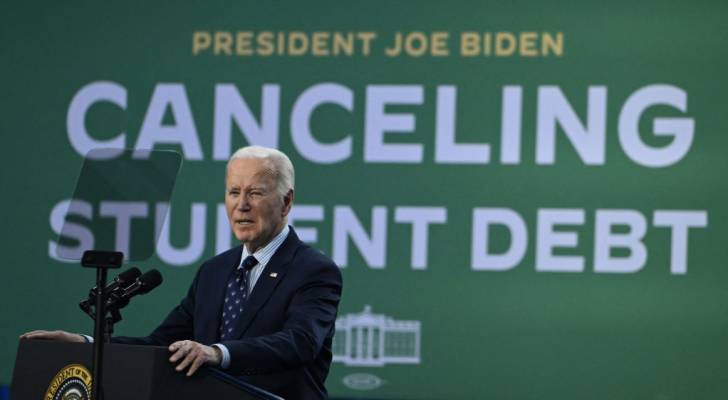

After being paused for 7.6 million borrowers under President Biden’s SAVE plan (Saving on A Valuable Education), the Trump administration announced a settlement that will — if it gets approved in court — kill the program.

SAVE, which promised ultra-low payments and faster forgiveness, is now being called “illegal” by the White House, with critics arguing it unfairly shifted costs to taxpayers who never borrowed.

For millions of Americans, that could mean student loan payments are back.

The total U.S. student loan debt is about $1.75 trillion, but student debt isn’t just numbers on a statement. It’s a real source of stress for a lot of people.

The average borrower owes about $39,000 (1). Over half of student loan borrowers say they don’t feel financially secure according to Pew (2), and about three-quarters worry if they can even repay their loans, a Harris poll says (3).

With grocery bills, housing, and health care already draining household budgets, the return of student loan payments could have a massive impact. Roughly 1 in 5 borrowers are already in delinquency or default, and restarting payments could push many deeper into financial stress (4).

The SAVE plan would have cost taxpayers $342 billion over a decade and was delayed by the courts multiple times. Many borrowers benefited from 0% interest forbearance, freezing both payments and interest for months, but that cushion could be gone. Full repayment is back on the table.

If the settlement is approved, the SAVE era will officially come to an end. No new SAVE enrollments will be allowed, and all pending applications will be denied. Current SAVE borrowers will be automatically moved into legally valid repayment plans.

The Department of Education will contact affected borrowers to give instructions and deadlines. Borrowers will have a limited window to choose a new repayment plan (5).

Read More: Vanguard reveals what could be coming for U.S. stocks, and it’s raising alarm bells for retirees. Here’s why and how to protect yourself

Borrowers need to move fast to make a plan for the coming changes.