Loomis Sayles, an investment management company, released its “Small Cap Value Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. US equities delivered strong results in the third quarter, mainly driven by easing tariff concerns, a pro-growth budget passed by the U.S. Congress, and anticipation of the Federal Reserve’s further rate cuts. The fund returned 6.21% in the quarter compared to 12.60% for the Russell 2000 Value Index. In addition, please check the fund’s top five holdings to know its best picks in 2025.

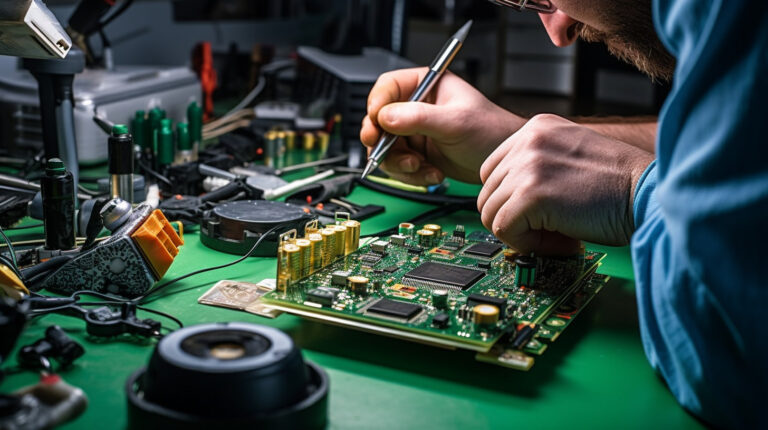

In its third-quarter 2025 investor letter, Loomis Sayles Small Cap Value Fund highlighted stocks such as Bel Fuse Inc. (NASDAQ:BELFB). Bel Fuse Inc. (NASDAQ:BELFB) designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits. The one-month return of Bel Fuse Inc. (NASDAQ:BELFB) was 15.38%, and its shares gained 110.53% of their value over the last 52 weeks. On December 24, 2025, Bel Fuse Inc. (NASDAQ:BELFB) stock closed at $176.17 per share, with a market capitalization of $2.23 billion.

Loomis Sayles Small Cap Value Fund stated the following regarding Bel Fuse Inc. (NASDAQ:BELFB) in its third quarter 2025 investor letter:

“Bel Fuse Inc. (NASDAQ:BELFB) is a global industrial company that supplies electronic components that power, protect, and connect industrial and technology products, with aerospace/defense and computer networking as its largest markets. Over the course of the past few years, the company has simplified operations, improved pricing, and optimized capital allocation over the past several years. The stock price outperformance has been driven by a savvy aerospace acquisition and a rebound in the computer networking segment. The investment is maintained in the Fund.”

Bel Fuse Inc. (NASDAQ:BELFB) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 24 hedge fund portfolios held Bel Fuse Inc. (NASDAQ:BELFB) at the end of the second quarter, which was 15 in the previous quarter. In the third quarter of 2025, Bel Fuse Inc. (NASDAQ:BELFB) announced sales of $179 million, marking a 44.8% rise compared to the same quarter in the previous year. While we acknowledge the potential of Bel Fuse Inc. (NASDAQ:BELFB) as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.