Summary

-

Treasury Secretary Bessent flagged possible changes to the Fed’s inflation framework and communications.

-

Said Kevin Miran could return to the White House by February or March, aligning with a likely Fed chair decision.

-

Bessent indicated support for an inflation target range, but only once inflation is back at 2%.

-

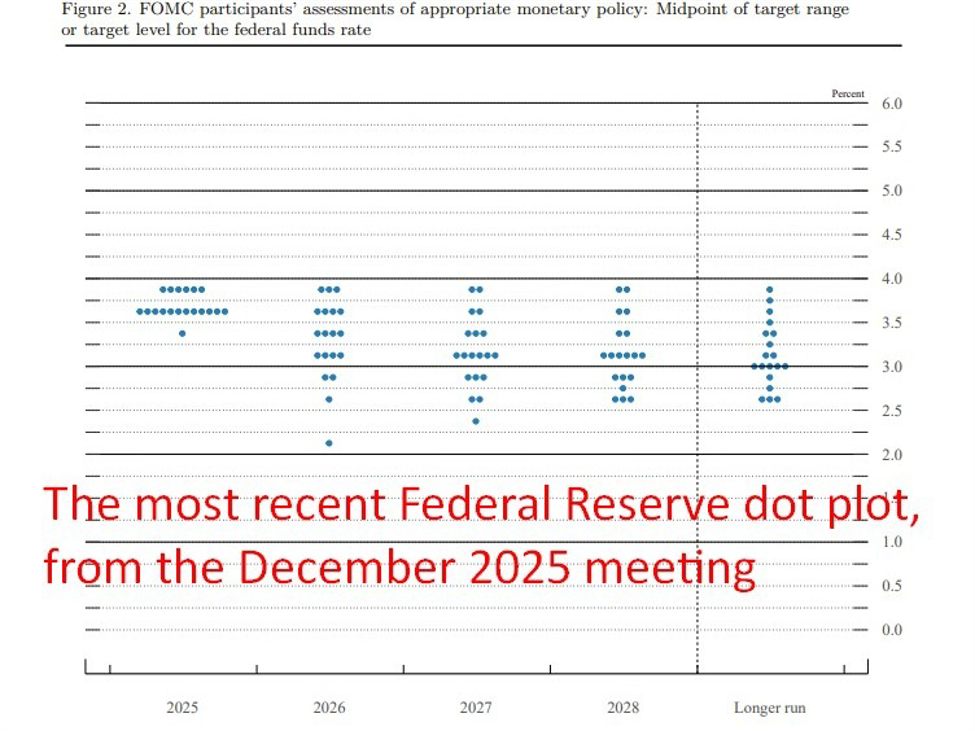

He floated the idea that a new Fed chair could scrap the dot plot.

-

Comments add to market debate around Fed communication and perceived independence.

US Treasury Secretary Scott Bessent has signalled potential changes to the Federal Reserve’s policy framework and communications as the White House moves closer to naming its next Fed chair.

Speaking on a podcast, Bessent said current fill-in Fed governor Kevin Miran is likely to return to the White House in February or March, a timeline that markets interpreted as aligning with a formal decision on the next Federal Reserve chair.

Bessent also appeared to open the door to a rethink of the Fed’s inflation framework, suggesting he favours the idea of an inflation “range” rather than a fixed point target. However, he was careful to stress that such a change would not be appropriate while inflation remains above 2%, signalling that any review would be conditional on inflation being firmly under control.

In a further hint at potential reform, Bessent suggested a new Fed chair could consider scrapping the dot plot — the quarterly projection of policymakers’ rate expectations — a move that would mark a significant shift in how the central bank communicates its policy outlook.

The remarks stop short of signalling imminent change, but they add to growing market sensitivity around Federal Reserve independence, communication tools and long-term policy credibility. With rate cuts already priced for later in 2026, investors are increasingly focused on whether a change in leadership could alter how policy intentions are signalled, even if the near-term rate path remains data-dependent.