Intel Corporation (NASDAQ:INTC) is one of the best high volume stocks to buy right now. On December 16, Bank of America raised the firm’s price target on Intel to $40 from $34, while keeping an Underperform rating on the shares. The firm highlighted a growing opportunity for Intel Foundry to secure external wins in advanced packaging and wafer design. However, BofA also noted that manufacturing uncertainties continue to weigh on the outlook, requiring a more cautious stance until production consistency improves.

On December 3, Intel announced its decision to retain its Networking and Communications unit/NEX following a comprehensive strategic review. This move marks a pivot from earlier considerations of divestiture intended to stabilize the company’s balance sheet. The decision was made possible by a considerably improved financial position, according to CFO Dave Zinsner, which follows a series of massive capital injections earlier in the year, including $8.9 billion in US government funding, $5 billion from Nvidia, and $2 billion from SoftBank.

Earlier on November 18, Intel’s John Pitzer outlined the company’s roadmap for margin recovery and market share growth. While Intel faces supply constraints expected to peak in Q1 2026, it is prioritizing cost-efficiency to counteract currently depressed data center margins. A centerpiece of this strategy is the previously mentioned $5 billion partnership with Nvidia, where Intel will produce a custom Xeon processor for data centers that Nvidia will integrate and bring to market.

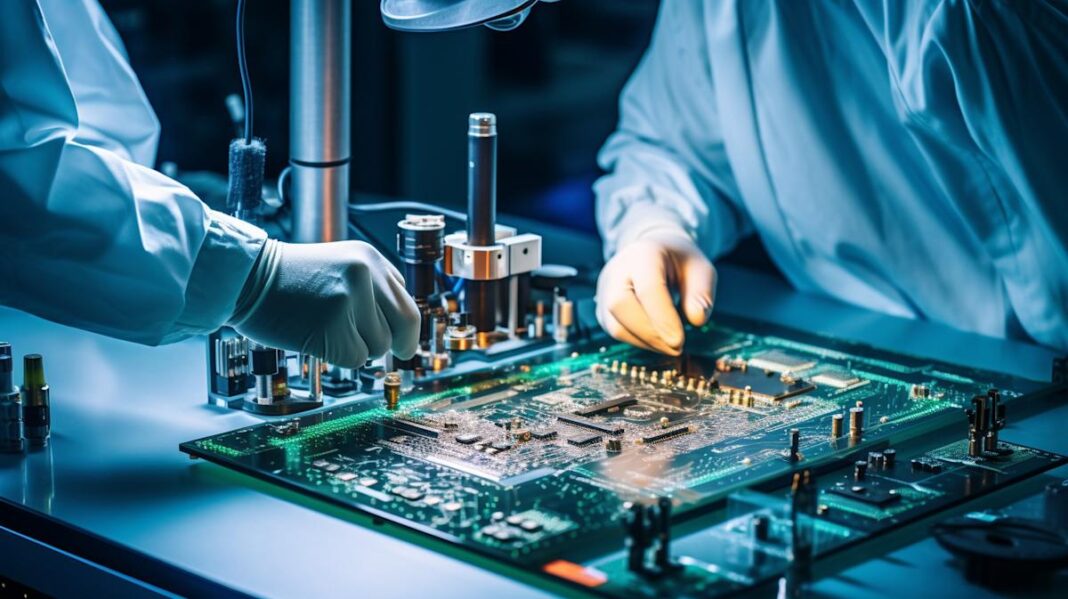

Intel Corporation (NASDAQ:INTC) designs, develops, manufactures, markets, and sells computing and related products and services worldwide. It operates through Intel Products, Intel Foundry, and All Other segments.

While we acknowledge the potential of INTC as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.