Electrovaya Inc. (NASDAQ:ELVA) is one of the most promising small-cap industrial stocks under $50.

On December 18, Oppenheimer analyst Colin Rusch initiated coverage of Electrovaya Inc. (NASDAQ:ELVA). The analyst assigned a bullish rating to the stock with a price target of $14, which gives an upside of almost 87% from the current level.

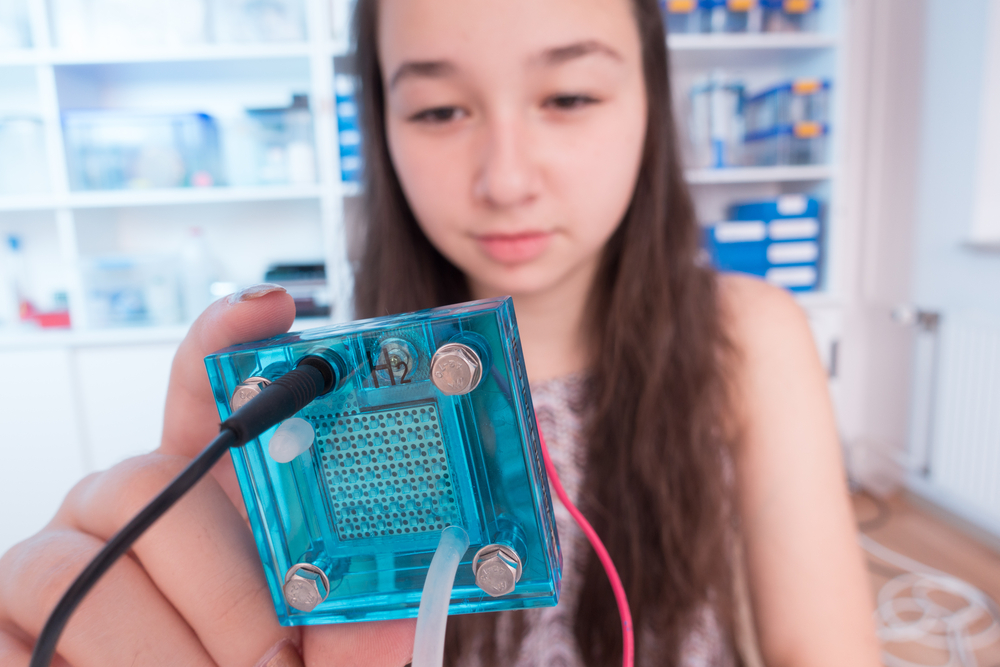

science photo/Shutterstock.com

Rusch based his outperform rating on the market position of Electrovaya Inc. (NASDAQ:ELVA). As a leading platform for battery technologies and systems, he highlighted the company’s intellectual property in design, manufacturing, and handling, centered on its proprietary Infinity Battery Platform. Not only does it create a powerful moat, but it also offers a solid foundation to the business for becoming a critical supplier of long-life lithium-ion battery systems for autonomous mobile robots. Rusch believes the company is in a strong position to scale its presence within an expanding electric materials handling space. These factors make him hold a highly optimistic view of the stock.

As of the December 22 closing, consensus ratings remain favorable toward Electrovaya Inc. (NASDAQ:ELVA). All 5 analysts covering the company assigned Buy ratings, resulting in a consensus 1-year average price target of $9.90. This results in an upside potential of 32% from the current level.

Electrovaya Inc. (NASDAQ:ELVA) is a manufacturer of lithium-ion batteries and battery management systems. Their offerings focus on preventing climate change and have various applications, including electric transportation, energy storage, warehousing, and heavy-duty electric vehicles. They leverage solid-state battery technology covering both low and high voltage systems.

While we acknowledge the potential of ELVA as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: Cathie Wood’s Stock Portfolio: Top 10 Stocks to Buy and 30 Most Fantastic Stocks Every Investor Should Pay Attention To.

Disclosure: None. This article is originally published at Insider Monkey.