The TL;DR summary:

-

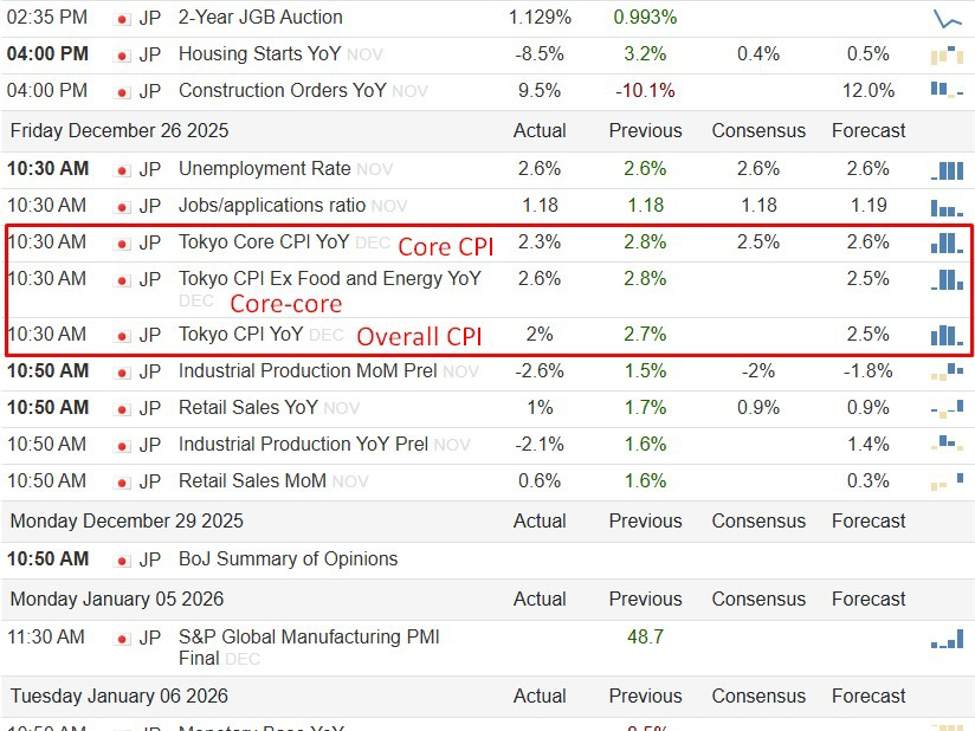

Tokyo core CPI slowed to 2.3% y/y in Dec (vs. prev 2.8%, exp 2.5%), driven by lower energy and utility costs.

-

Core-core CPI eased to 2.6% y/y (prev 2.8%), but remains above the BOJ’s 2% target, signalling persistent demand-side pressure.

-

Headline CPI cooled to 2.0% y/y (prev 2.7%), marking the first clear deceleration since August.

-

Data softens urgency, not direction, of BOJ policy; inflation remains consistent with gradual further tightening after last week’s hike to 0.75%.

-

Market read-through: modest yen softness near term, JGB front-end consolidation, Nikkei supported by reduced immediate tightening risk.

The screenshot above is via TradingEconomics.

—

Tokyo inflation cooled more than expected in December, but remained comfortably above the Bank of Japan’s 2% target, keeping the policy normalisation story intact even as near-term urgency eased.

Core consumer prices in the capital, excluding fresh food, rose 2.3% y/y, slowing from 2.8% in November and undershooting market expectations of 2.5%. The deceleration was driven largely by lower utility and energy costs, alongside a moderation in food price gains.

A closely watched “core-core” measure that strips out both fresh food and energy also softened, easing to 2.6% y/y from 2.8% previously, while headline CPI slowed to 2.0% from 2.7%. Together, the figures marked the first clear easing in Tokyo inflation momentum since August.

Despite the slowdown, all three gauges remain at or above the BOJ’s inflation target, reinforcing the view that underlying price pressures have become entrenched. Tokyo CPI is widely regarded as a leading indicator for nationwide trends, suggesting inflation is cooling gradually rather than collapsing.

The data follows last week’s Bank of Japan decision to raise its policy rate to 0.75%, the highest level in roughly three decades. Governor Kazuo Ueda has stressed that further tightening will follow if wages and prices evolve in line with the central bank’s outlook, while deliberately avoiding guidance on pace or terminal levels.

Markets now see the December data as consistent with the BOJ’s baseline scenario: inflation easing as energy effects fade, but remaining sufficiently firm to justify additional rate hikes over time. Analysts continue to expect a gradual hiking cycle, with rates rising roughly every six months and a terminal level near 1.25%, assuming wage growth remains solid.

BOJ policy implications

The softer-than-expected core print slightly reduces pressure for an imminent follow-up hike but does little to derail the broader tightening trajectory. With core inflation still above target and wage dynamics supportive, the BOJ is likely to proceed cautiously. A pause seems likely at the next meeting, on January 22–23, 2026.

Market impact: yen, JGBs, Nikkei:

-

Yen: The downside CPI surprise may cap near-term yen gains, especially if US yields remain elevated, but persistent above-target inflation limits scope for sustained depreciation.

-

JGBs: Front-end yields may consolidate after the recent sell-off, though the medium-term bias remains toward higher yields as policy normalisation continues.

-

Nikkei: Equities may welcome reduced near-term tightening pressure, particularly rate-sensitive sectors, while exporters remain sensitive to yen swings.