Synaptics Incorporated (NASDAQ:SYNA) is included in our list of the best rising tech stocks to buy now.

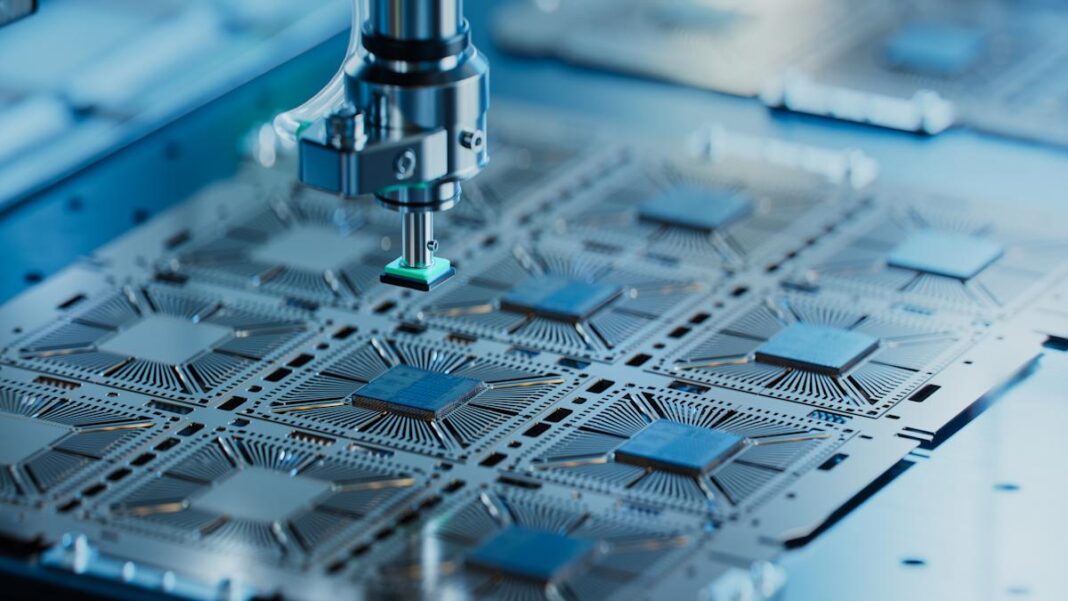

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

On December 19, 2025, TheFly reported that Wells Fargo initiated coverage of Synaptics Incorporated (NASDAQ:SYNA) with an “Overweight” rating and a $95 price target. The firm believes the stock offers an attractive risk/reward profile into 2026. Furthermore, the analyst cited the company’s acceleration of its transition to an Internet of Things (IoT) chip supplier. Meanwhile, the company’s Astra pipeline updates are seen as potentially positive catalysts by the analyst. The firm notes that the company will experience a valuation re-rating over time.

The company’s increasing focus on the Internet of Things is reflected by its October launch of the Astra SL2600 Series of multimodal Edge AI processors. These processors are purpose-built for a diverse range of intelligent IoT applications. Meanwhile, the SL2610 product line focuses on high-growth end markets, including smart appliances, industrial and factory automation, healthcare devices, retail point-of-sale systems, robotics, and autonomous platforms. With these launches, Synaptics Incorporated (NASDAQ:SYNA) deliberately shifts away from legacy interface-centric silicon toward embedded edge compute and connectivity.

At the same time, Synaptics Incorporated (NASDAQ:SYNA) announced a collaboration with Qualcomm Technologies in November, highlighting its evolution from a traditional human-interface supplier to intelligence- and AI-enabled edge solutions. While the collaboration is rooted in touch and fingerprint sensing for mobile, wearables, and AI PCs, it emphasizes tighter integration of sensing, compute, and security. These features reflect key building blocks for edge intelligence.

Looking ahead, Synaptics Incorporated (NASDAQ:SYNA) appears well-positioned to further its transition into embedded edge and IoT markets, thanks to strong product momentum and strategic partnerships.

Synaptics Incorporated (NASDAQ:SYNA), a developer and fabless supplier of mixed-signal semiconductor solutions, enables intelligent interactions with connected devices across consumer, automotive, and enterprise environments.

While we acknowledge the potential of SYNA as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.