A $100,000 home sale gain unraveled into financial chaos after a couple used the cash on cars instead of obligations.

Logan, calling from Lexington, Kentucky, contacted “The Ramsey Show” seeking clarity on the tax impact of a recent home sale. He said he and his wife bought the house for $315,000 and later sold it for $415,000.

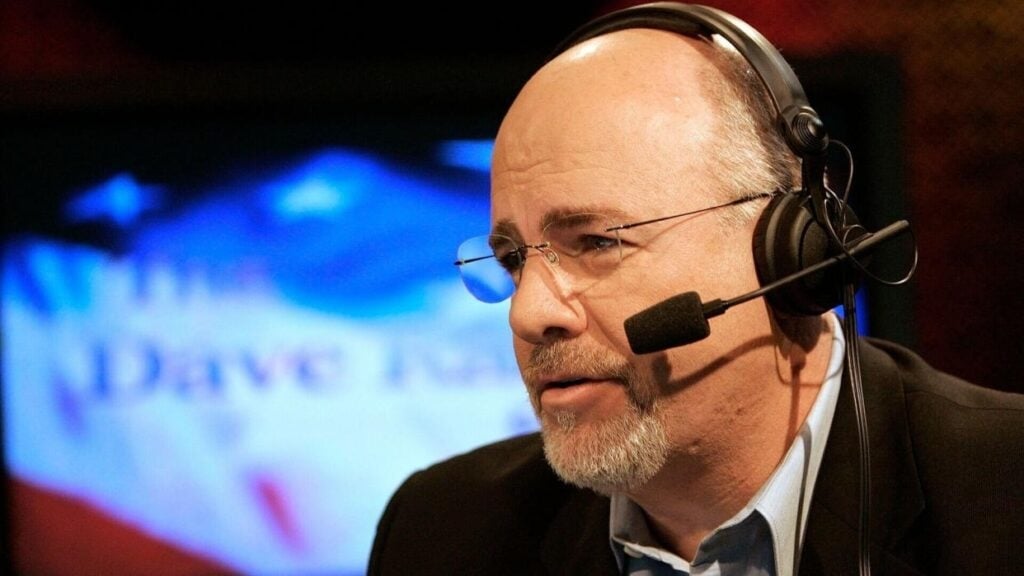

He said the couple walked away with about $77,000 after fees, but tensions rose when $22,000 of the proceeds went toward a car for his wife while he still owed $37,500 on his truck — prompting a blunt response from personal finance expert Dave Ramsey.

“What are you smoking?” Ramsey asked, interrupting as Logan outlined how the money was spent.

Don’t Miss:

Logan said he and his wife married in April 2022 after paying off her student loan and starting with roughly $30,000 in savings. They rented for a year before buying a 4,200-square-foot home from a family friend at a discounted price, even though they knew it stretched their budget.

With no down payment and a 6.25% interest rate, Logan said they lived paycheck to paycheck in 2024. That November, they decided to sell.

The house went under contract in seven days. After fees, they walked away with about $77,000 but also carried roughly $10,000 in credit-card debt from updates made to prepare the home for sale.

Trending: Americans With a Financial Plan Can 4X Their Wealth — Get Your Personalized Plan from a CFP Pro

The conversation then turned to taxes. Logan said he did not know how much he owed from the sale. Ramsey replied that the profit would not qualify for capital gains treatment because the home was not held long enough.

“It’s ordinary income,” Ramsey said, adding that after sales expenses and allowable improvements, the tax bill would likely be close to $20,000.

He urged Logan to stop making major financial moves and meet with a tax professional to calculate the exact amount.

“You went and bought another car,” Ramsey said. “And you haven’t even settled with the IRS yet.”

See Also: $100k+ in investable assets? Match with a fiduciary advisor for free to learn how you can maximize your retirement and save on taxes – no cost, no obligation.

As Ramsey pressed Logan on selling vehicles, co-host John Delony joined the discussion. “You got a ticket, dude, and you blew your nose in it,” he said, reacting to the use of the home-sale proceeds.