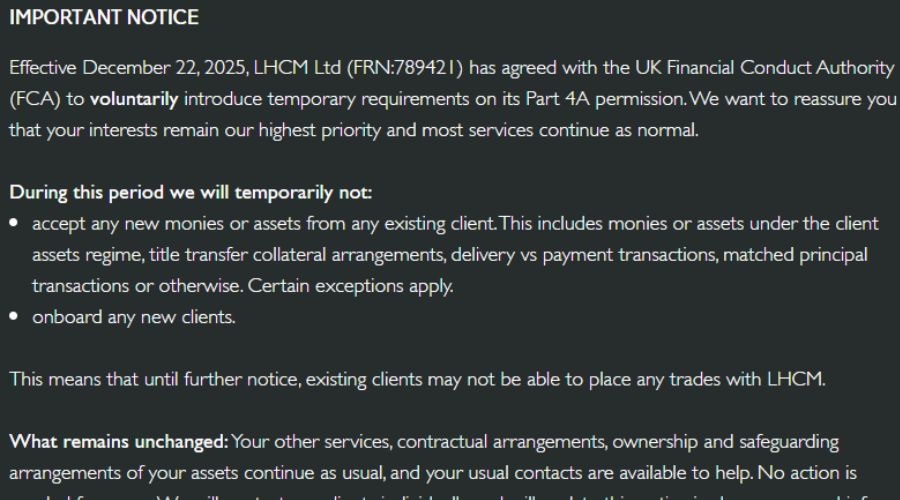

LHCM, the UK-regulated brand of the Exante Group, has suspended the onboarding of new clients and has also stopped accepting deposits from existing clients. According to a notice on LHCM’s website, the move is “voluntary” and in agreement with the Financial Conduct Authority.

Another Broker Limiting Its UK Presence?

The company explained that the suspension includes restrictions relating to “monies or assets under the client assets regime, title transfer collateral arrangements, delivery versus payment transactions, matched principal transactions or otherwise”.

Furthermore, the broker said that the service suspension may affect the opening of new trades.

It should be noted that the UK unit was not accepting retail clients even before the latest suspension of client onboarding.

The suspension took effect on 22 December 2025, but the company did not mention any plans for the resumption of full services.

“We want to reassure you that your interests remain our highest priority and most services continue as normal,” the notice added.

FinanceMagnates.com reached out to Exante to understand its plans in the UK, but did not receive a response as of press time.

Shifting Focus in Other Markets

Apart from the UK, Exante is also regulated in Cyprus and is onboarding clients under that unit. It also has a presence in Malta and Hong Kong.

Last year, the brokerage group also expanded by opening a new office in Dubai.

Meanwhile, Exante is not the only broker to suspend client onboarding. Admirals, a retail contracts for differences (CFDs) broker brand, halted onboarding in the European Union in early 2024, but resumed the service about a year later.

However, several established brands are also leaving the UK market. Recently, FinanceMagnates.com reported that Gain Capital, which operates Forex.com, plans to surrender its FCA licence after shifting services to its Dubai base.

Hirose and AETOS are two other brands that have stopped offering retail services in the UK and some other markets. Both brokers now have a limited presence only in their core markets — Japan for Hirose and Australia for AETOS. While AETOS surrendered its FCA licence, Hirose is now only offering services to institutions under it.

This article was written by Arnab Shome at www.financemagnates.com.

Source link