By Hyunjoo Jin

SEOUL, Jan 6 (Reuters) – Samsung Electronics (005930.KS) is expected to flag a 160% jump in its fourth-quarter operating profit spurred by a severe chip shortage that has sharply driven up memory prices as customers scramble to meet booming demand for artificial intelligence.

Semiconductor prices have rocketed in recent months, as the industry’s shift to AI-related chips has curbed production for traditional memory, while demand has been surging for both conventional and advanced chips to train and run AI models.

Samsung is likely to estimate an operating profit of 16.9 trillion won ($11.7 billion) for the October to December period, according to LSEG SmartEstimate from 31 analysts, which is weighted toward those who are more consistently accurate.

This compares with 6.49 trillion won from a year earlier and would mark the highest quarterly profit since the third quarter of 2018, which was a record high of 17.6 trillion won.

Some analysts have in recent weeks raised their estimates for Samsung’s fourth-quarter operating profit to more than 20 trillion won on the back of stronger-than-expected prices of traditional chips.

The world’s top memory chip maker is set to release its estimates for revenue and operating profit on Thursday.

SOARING MEMORY CHIP PRICES

Prices for a type of DDR5 DRAM chip jumped 314% in the fourth quarter from a year earlier, according to data from market researcher TrendForce.

It expects conventional DRAM contract prices to rise 55% to 60% in the current quarter, from the October to December period.

“As conventional DRAM prices continue to surge, Samsung – whose production capacity is largely concentrated in this segment – stands to gain relatively more from the current price upcycle,” TrendForce analyst Avril Wu said.

DRAM chips are used in servers, computers and smartphones to temporarily store data and help run programs and applications smoothly and swiftly. DDR5 DRAM, a conventional chip, is faster and more efficient than its predecessor.

In December, Micron Technology forecast second-quarter adjusted profit at nearly double Wall Street estimates. Micron CEO Sanjay Mehrotra said he expects memory markets to remain tight past 2026 and that in the medium term, it expects to meet only half to two-thirds of demand from several key customers.

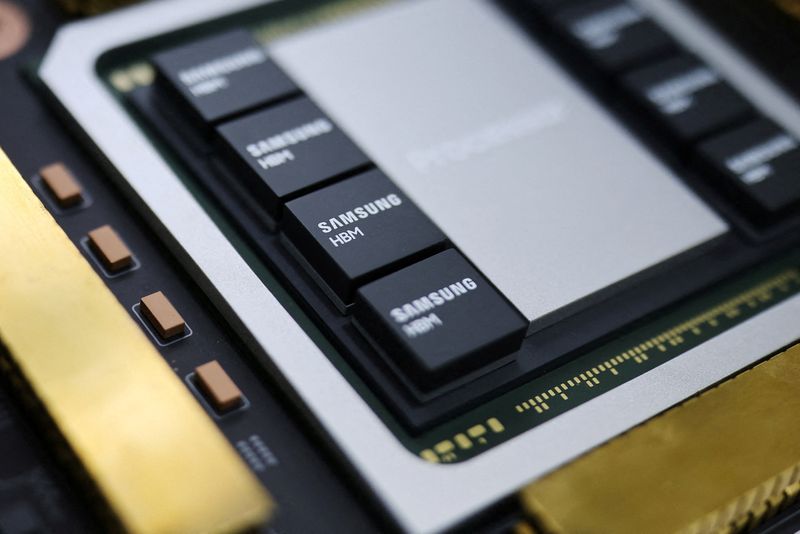

NVIDIA, HBM, MOBILE

Samsung’s booming profit marks a dramatic turnaround, just over a year after CEO Jun Young-hyun apologised for the company’s disappointing earnings and performance as it lagged its cross-town rival SK Hynix in supplying high-end chips to Nvidia, the dominant maker of AI processors.