Impax Asset Management, an investment management company, released its “Impax US Sustainable Economy Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. In Q3 2025, the portfolio lagged behind the Russell 1000. Similar to the second quarter, the US equity markets favored a risk-on approach, benefiting high-risk, high-momentum, and lower-quality factors. Although the portfolio’s focus on relatively modest, lower-risk, and high-quality factors contributed to the underperformance, the fund (Institutional Class) returned 7.33% in Q3 compared to 7.99% for the Index. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2025.

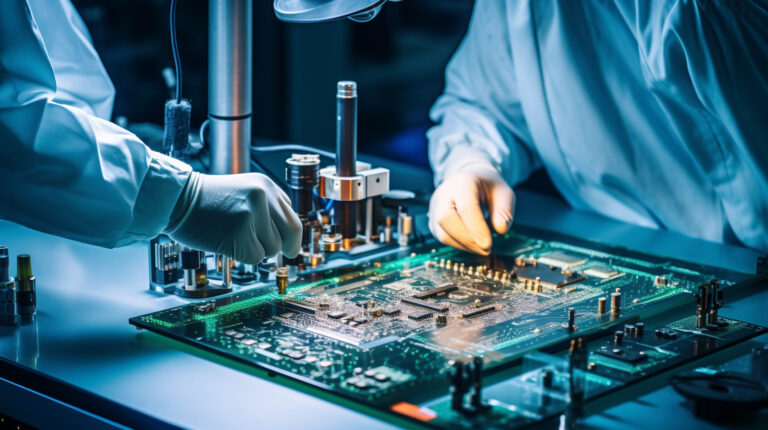

In its third-quarter 2025 investor letter, Impax US Sustainable Economy Fund highlighted stocks such as Intel Corporation (NASDAQ:INTC). Intel Corporation (NASDAQ:INTC) designs, develops, manufactures, markets, and sells computing and related products and services. The one-month return of Intel Corporation (NASDAQ:INTC) was -1.81%, and its shares gained 101.41% of their value over the last 52 weeks. On January 6, 2026, Intel Corporation (NASDAQ:INTC) stock closed at $40.04 per share with a market capitalization of $190.99 billion.

Impax US Sustainable Economy Fund stated the following regarding Intel Corporation (NASDAQ:INTC) in its third quarter 2025 investor letter:

“Intel Corporation (NASDAQ:INTC) (Information Technology, Semiconductors) rallied strongly in September as the company announced a partnership with Nvidia on integrating Intel’s x86 central processing units (CPUs) with Nvidia graphics processing units (GPUs) in AI server systems. Investors cheered the multi-billion-dollar investments from Softbank and the US government. The stock is in an attractive industry from a secular growth perspective and exhibits strong corporate resilience, according to the team’s analysis, primarily through its management of environmental and social risks.”

Intel Corporation (NASDAQ:INTC) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 81 hedge fund portfolios held Intel Corporation (NASDAQ:INTC) at the end of the second quarter, compared to 82 in the previous quarter. In the third quarter of 2025, Intel Corporation (NASDAQ:INTC) reported $13.7 billion in revenue, marking an increase of 6% sequentially. While we acknowledge the potential of Intel Corporation (NASDAQ:INTC) as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.