The U.S. manufacturing sector capped off a turbulent 2025 with continued weakness in December, as the ISM Manufacturing PMI slipped to 47.9%, marking the lowest reading of the year and the tenth consecutive month of contraction.

Key Takeaways

- Manufacturing PMI declined to 47.9% from 48.2%, the lowest level since October 2024

- New orders remained in contraction territory for the fourth consecutive month at 47.7%, though marginally improved from 47.4%

- Production barely expanded at 51.0%, down from 51.4%, while employment contracted for the eleventh straight month at 44.9%

- Prices remained elevated at 58.5%, unchanged from November, suggesting persistent inflationary pressures from tariffs and commodity costs

- Only two industries reported growth: Electrical Equipment, Appliances & Components, and Computer & Electronic Products

Production, while technically still in expansion territory at 51.0%, lost momentum with a 0.4 percentage point decline. More troublingly, new orders have now remained below the critical 50-mark for four consecutive months, suggesting that the demand weakness may persist into early 2026.

Employment conditions remained particularly challenging, with the index at 44.9% marking the eleventh consecutive month of workforce contraction. Survey respondents indicated that managing headcounts through attrition and layoffs remained the prevailing strategy, with companies showing little appetite for hiring amid ongoing uncertainty.

Link to official ISM Manufacturing PMI Report (December 2025)

The Prices Index remained elevated at 58.5% for the second consecutive month, indicating that cost pressures continue to challenge manufacturers. The report highlighted that steel and aluminum price increases, combined with tariffs on imported goods, continue to drive prices throughout the value chain.

Meanwhile the Customers’ Inventories Index remained in “too low” territory at 43.3%, accelerating from 44.7% in November. While this is typically considered a positive signal for future production, the context of weak new orders suggests customers may be keeping inventories lean due to economic uncertainty rather than anticipating stronger demand.

Market Reactions

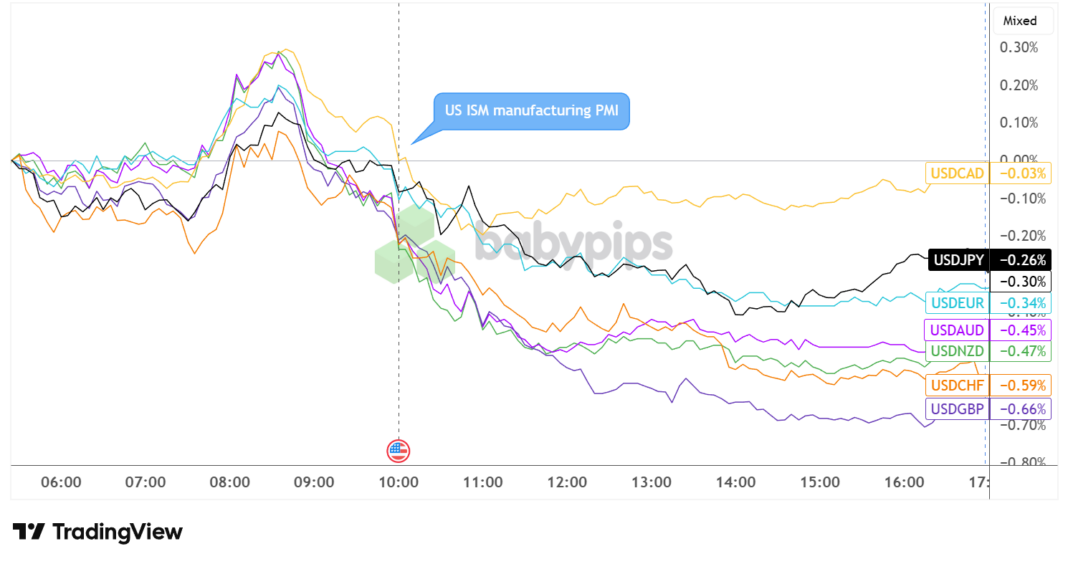

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The disappointing ISM report triggered broad-based weakness in the US dollar, with all major currency pairs showing dollar depreciation following the release.

USD declined against all major currencies over the first hour of trading, with the most significant moves against the British pound (-0.66%), Swiss franc (-0.59%), and New Zealand dollar (-0.47%), suggesting investors interpreted the data as increasing the likelihood of Federal Reserve rate cuts in early 2026.

The euro (-0.34%) and yen (-0.26%) showed more modest but still notable weakness against the dollar. Even the Canadian dollar (-0.03%) strengthened slightly despite its own economic challenges closely tied to U.S. manufacturing demand.