(Bloomberg) — Bond traders are on guard for an especially volatile Friday as a pivotal US jobs report and a potential Supreme Court ruling on President Donald Trump’s tariffs threaten to jolt the Treasuries market out of its doldrums.

First up is the 8:30 a.m. Washington time release of December employment figures, a highly anticipated report seen as finally giving a reliable reading on the economy after weeks of data affected by the government shutdown. The figures will either cement expectations that the Federal Reserve will hold steady this month, or boost the view that a fourth straight interest-rate cut is possible.

Most Read from Bloomberg

As the dust settles from that, traders will be on high alert for the possible release as soon as mid-morning Friday of a ruling on the legality of the president’s levies. An opinion against the tariffs, which have generated hundreds of billions of dollars in revenue and eased pressure on the US budget deficit, may weigh on Treasuries.

“Over the past couple of months, the lack of economic data has allowed for more complacency in markets,” said Zach Griffiths, head of investment-grade and macro strategy at research firm CreditSights. “We are likely to see volatility pick up.”

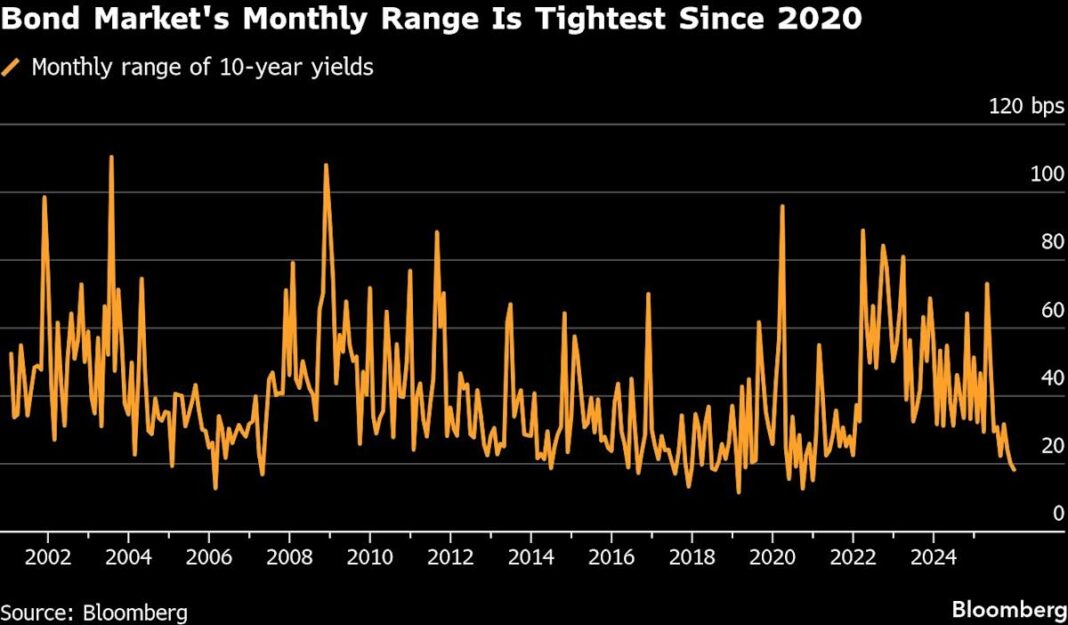

The tariff decision is “a big wild card,” he said. But the stage is set Friday for a one-two punch that could roil the $30 trillion US government-debt market. The benchmark 10-year yield, which has been fluctuating in a narrow range of 4.1% to 4.2%, was two basis points higher at 4.19% at 4:45 a.m. in New York.

Fed Focus

Treasuries gained more than 6% last year, their best performance since 2020, as a cooling labor market led the Fed to lower rates in three straight quarter-point steps.

Investors anticipate the employment data will show a stabilizing labor market, giving the central bank room to pause at its Jan. 27-28 meeting. Economists surveyed by Bloomberg forecast that December payrolls rose by 70,000, after a gain of 64,000 in November. The unemployment rate is projected to fall to 4.5% from 4.6%.

Investors now see about a 10% chance of a Fed cut this month. They’re pricing in the next reduction coming in June, the month after Fed Chair Jerome Powell’s tenure ends, with another easing to follow in the fourth quarter.