- The GBP/USD price analysis remains mildly subdued following the US dollar’s gain in traction after the CPI data release.

- The US PPI and retail sales data due on the day could impact the direction of GBP/USD.

- A patient and dovish BoE could keep the outlook for the pound from struggling.

The GBP/USD pair is trading lower around 1.3430 on Wednesday morning ahead of the London session, as renewed demand for USD weighs on the pair. The move shows that the US dollar is gradually recovering, thanks to recent US CPI data and cautious positioning ahead of key US data later in the day. Overall, the US Dollar Index is mildly weaker but supported by the idea that the Fed will stay on hold for a while.

–Are you interested in learning more about forex tools? Check our detailed guide-

US CPI data shows inflation under control, but not weak enough to expedite expectations for rate cuts. In December, the headline CPI rose by 2.7% YoY, the same as in November and in line with expectations. The core CPI, on the other hand, fell to 2.6% YoY, which was slightly softer than the previous 2.7%. The cooler core reading initially hurt the USD, but markets absorbed the impact soon. The first move in Fed funds futures is still priced in for around the middle of the year, which keeps short-term US yields high.

The direction of the GBP/USD in the near future will depend on the release of US Retail Sales and PPI later today. Retail sales are expected to go up by 0.4% from the previous month, while both headline and core PPI are expected to be around 2.7% YoY. Data that shows strong demand and stable producer prices would likely support the USD and keep the GBP/USD under pressure. On the other hand, clear downside surprises could give the pair some relief.

Political chaos and the independence of central banks are risks for the dollar. Subpoenas from the White House and the Justice Department aimed at Fed Chair Powell have raised concerns about the Fed’s independence, which could hurt the USD if investors think that policy credibility is at risk.

However, for GBP/USD, the relative policy outlook is more important. The Bank of England has already cut rates to 3.75% and is expected to ease further in 2026, with another 0.25% cut likely by March or April. The fact that the BoE is more dovish than the Fed suggests that GBP/USD will be sold on rallies, unless upcoming US data is much softer.

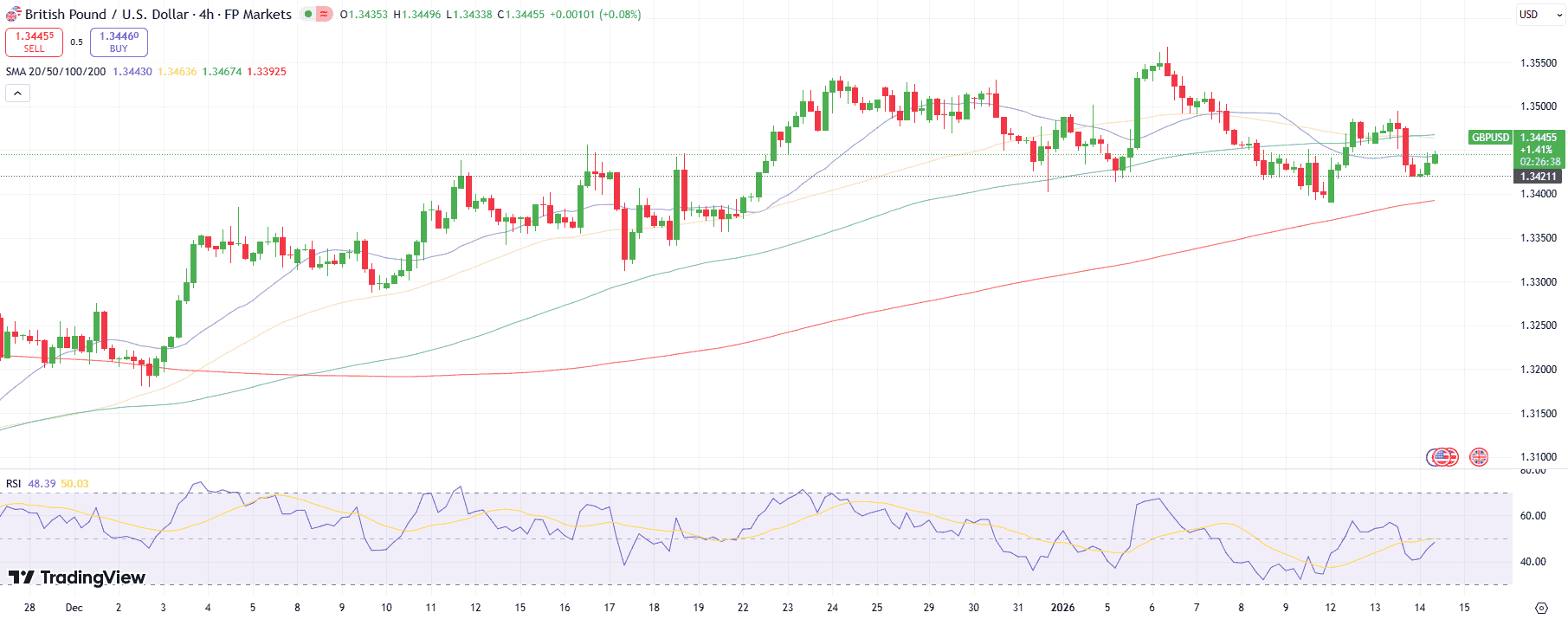

GBP/USD Technical Price Analysis: Lacking Momentum Around 20/50 MA

The 4-hour chart shows that GBP/USD is just above the 200-period MA at 1.3390, with immediate support at 1.3420. If the price falls below 1.3400, it could reach the January 12 low at 1.3375. The pair has trouble getting past the 20-period MA near 1.3445 and the 50-period MA at 1.3460. A secondary supply zone exists at the 100-period MA at 1.3467.

–Are you interested in learning more about the best crypto exchange? Check our detailed guide-

On breaking through 1.3480, the pair could aim for the January 7 peak around 1.3500. The RSI is at 48, indicating a neutral position and a lack of directional momentum. Until the 20/50 MAs are clearly broken, the price will stay between 1.3420 and 1.3480. A sustained move beyond those levels will confirm the trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.