- Gold forecast tilts to the upside as US inflation data shows core CPI cooling.

- The dollar remains under pressure amid concerns about the Fed’s independence.

- Central bank buying remains a major factor, limiting the downside for gold.

Gold (XAU/USD) has surged to fresh record highs as markets lean harder into the view that the Federal Reserve will start cutting rates later this year. Spot gold jumped to around $4,634 before easing toward the $4,590 area. The move extends a solid 12-month rally, with bullion up roughly 70% over the period, supported by persistent geopolitical risks and a shift in global monetary conditions.

–Are you interested in learning more about forex tools? Check our detailed guide-

The immediate catalyst was softer US inflation data. Headline CPI rose 0.3% month?on?month and 2.7% year?on?year in December, in line with expectations, but core CPI slowed to 0.2% month?on?month and 2.6% year?on?year, below the 0.3% and 2.7% forecasts. This reinforced expectations that the Fed can pivot toward easing without reigniting inflation. Lower or expected lower policy rates reduce the opportunity cost of holding non-yielding gold, making the XAU/USD more attractive relative to bonds and cash.

Political pressure is amplifying that narrative. After the CPI release, US President Donald Trump reiterated calls for Fed Chair Jerome Powell to cut rates “meaningfully,” questioning his competence and integrity. Powell’s term ends in May, and the combination of looming leadership uncertainty and public attacks on the Fed adds to concerns over policy independence. That uncertainty tends to weaken confidence in the US dollar and bolster demand for safe-haven assets, such as gold.

Beyond the cyclical story, structural demand remains strong. Central banks have been large net buyers, diversifying away from dollar assets amid sanctions risk, rising fiscal deficits, and broader geopolitical fragmentation. Inflation is slowing down, but real yields are expected to fall, and political risk is high. This means that the background remains favorable for XAU/USD. As long as expectations for the Fed to ease in 2026 stay the same, dips are likely to attract more strategic and tactical buying.

Gold Technical Forecast: Buyers Looking at $4,700

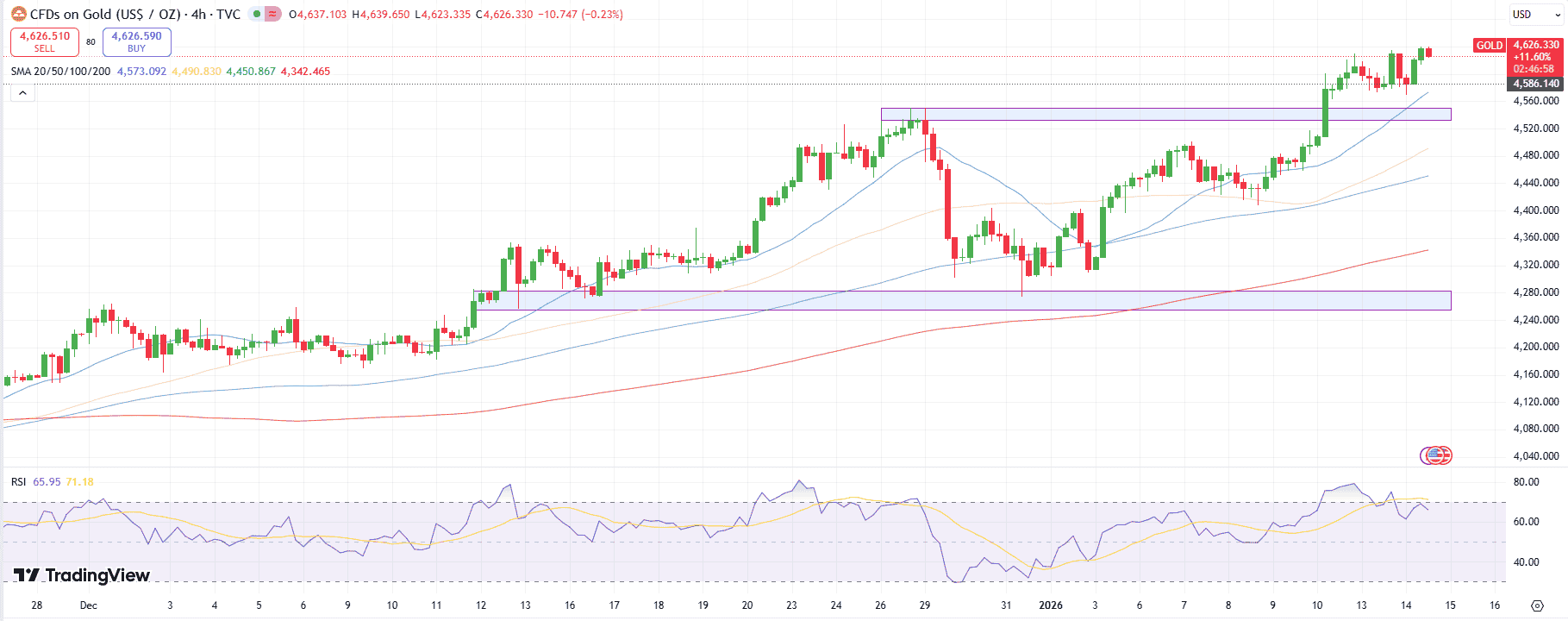

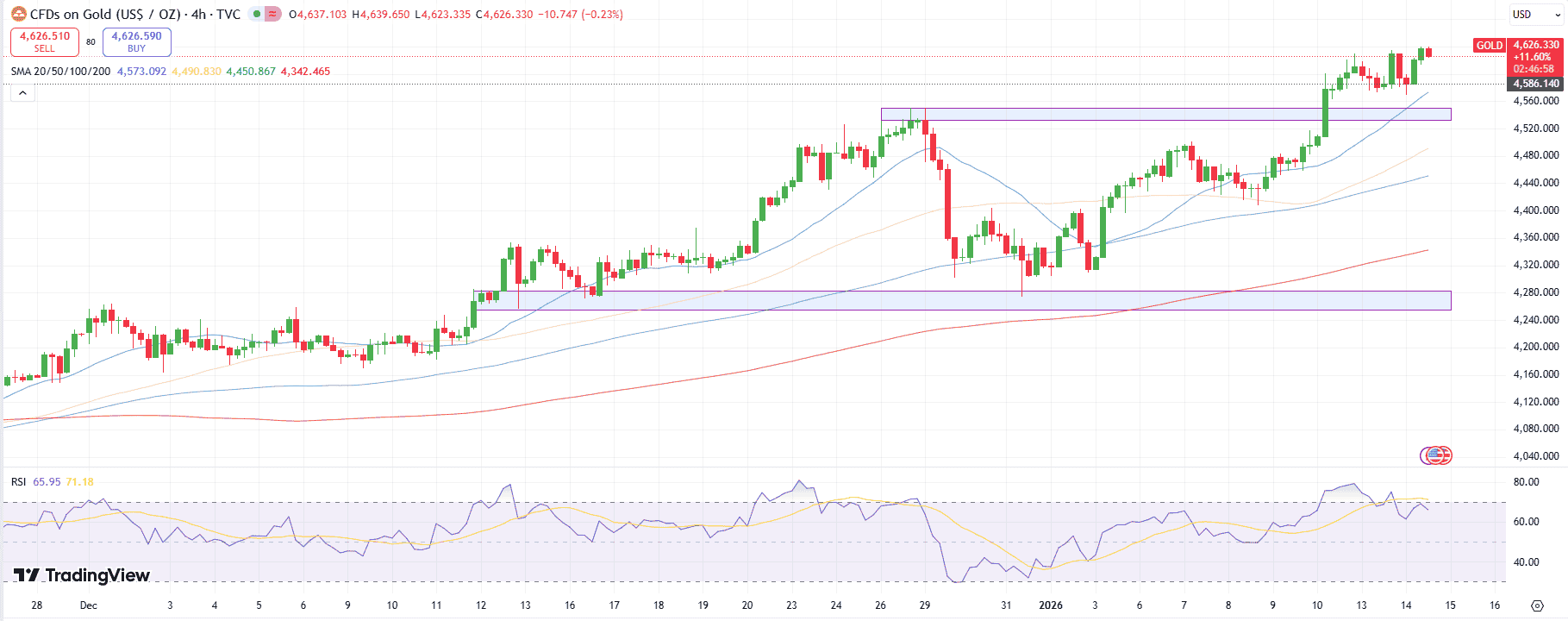

On the 4-hour chart, XAU/USD trades near $4,626, comfortably above the 20-period MA ($4,573) and 50-period MA ($4,491), confirming bullish momentum. Immediate resistance lies at $4 640-45. A decisive break would open a run toward $4,700. Key support sits at the 20-period MA zone around $4,560-70, followed by the 200-period MA at $4,342.

–Are you interested in learning more about the best crypto exchange? Check our detailed guide-

MAs stacked one on top of another reveal bullishness. RSI at 66 signals approaching overbought territory, but still leaves room to extend gains. Expect dips to $4,560 as buying opportunities; maintain a bullish bias above $4,560, with stops below $4,550.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.