-

SPDR Mid Cap Value ETF (MDYV) returned 69% over five years versus Nasdaq-100’s 98%. NVIDIA trades at 46x earnings and Microsoft at 32x.

-

MDYV allocates 26% to financials and 19% to industrials. Interest rate trajectory is the biggest performance driver.

-

Vanguard Mid Cap Value ETF (VOE) charges 0.07% versus MDYV’s 0.15%. VOE yields 2.1% with 19% turnover versus 37%.

-

A recent study identified one single habit that doubled Americans’ retirement savings and moved retirement from dream, to reality. Read more here.

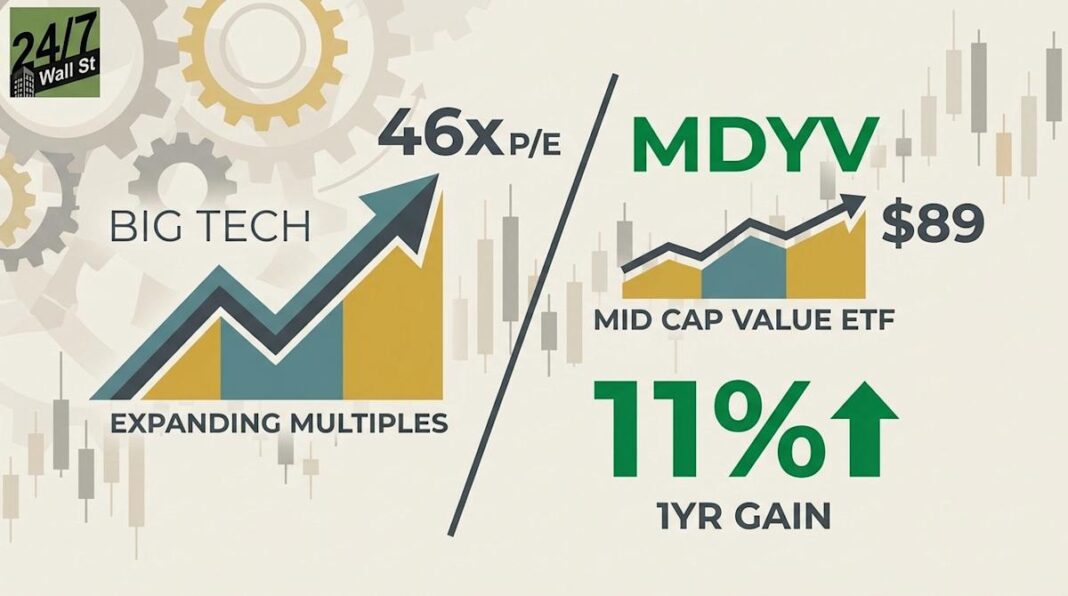

When mega-cap tech stocks trade at valuations that would make even the dot-com era blush, mid-cap value starts looking like a strategic alternative. NVIDIA’s 46x earnings multiple reflects investor enthusiasm for AI dominance, but also creates vulnerability if growth disappoints.

SPDR S&P 400 Mid-Cap Value ETF (NYSEARCA:MDYV) offers exposure to companies trading at much lower multiples, where the bar for positive surprises is considerably lower.

MDYV delivered an 11% gain over the past year, respectable in absolute terms but revealing how mid-cap value has been systematically overlooked. The fund’s 69% five-year return tells the story of a category left behind as investors chased mega-cap tech.

The Nasdaq-100’s 98% return over the same period shows where capital has been flowing, creating a valuation gap that could reverse if market leadership rotates.

At $89 per share with a 0.15% expense ratio, MDYV provides cost-efficient access to nearly 300 mid-cap companies. The fund’s valuation discount to big tech means these businesses don’t need flawless execution to deliver returns.

This infographic provides a detailed overview of the MDYVV Mid-Cap Value ETF, highlighting its sector focus, interest rate sensitivity, and value-oriented approach compared to high-multiple tech stocks.

The single biggest factor determining MDYV’s performance over the next 12 months is interest rate trajectory. The fund’s 26% allocation to financials means regional banks, mortgage REITs, and insurance companies dominate the portfolio. When rates rise, net interest margins expand and these companies print money. When rates fall, the opposite happens.

The Federal Reserve is navigating a delicate balance between controlling inflation and supporting economic growth. Watch the Fed’s quarterly Summary of Economic Projections for guidance on the terminal rate and pace of any future cuts. If the Fed signals rates staying higher for longer, MDYV’s financial holdings should benefit. If aggressive cuts materialize due to economic weakness, that sector concentration becomes a liability.