Micron Technology, Inc. (NASDAQ:MU) is among the stocks with the best earnings growth for the next 5 years. On January 15, Citi lifted the price target on Micron Technology, Inc. (NASDAQ:MU) to $385 from $330 and maintained a Buy rating, while removing the stock from its US Focus List. According to an analyst note, the company’s DRAM pricing momentum may decline in Q2 relative to Q1, noting that the stock usually moves in line with its quarter-over-quarter pricing momentum.

A day before, RBC Capital began coverage on Micron Technology, Inc. (NASDAQ:MU) with an ‘Outperform’ rating and $425 price target. The bank believes rising demand for generative AI, coupled with better supply discipline, has created “extreme tightness” in the memory space. This could extend the current upcycle into 2027.

Srini Pajjuri, an analyst at RBC, noted the company’s robust roadmap, stating that High Bandwidth Memory (HBM) content is accelerating at a rate higher than 50%, with the HBM4 shift reflecting a significant tailwind for the company. That said, the firm anticipates record earnings of $50 or more per share for Micron Technology, Inc. (NASDAQ:MU).

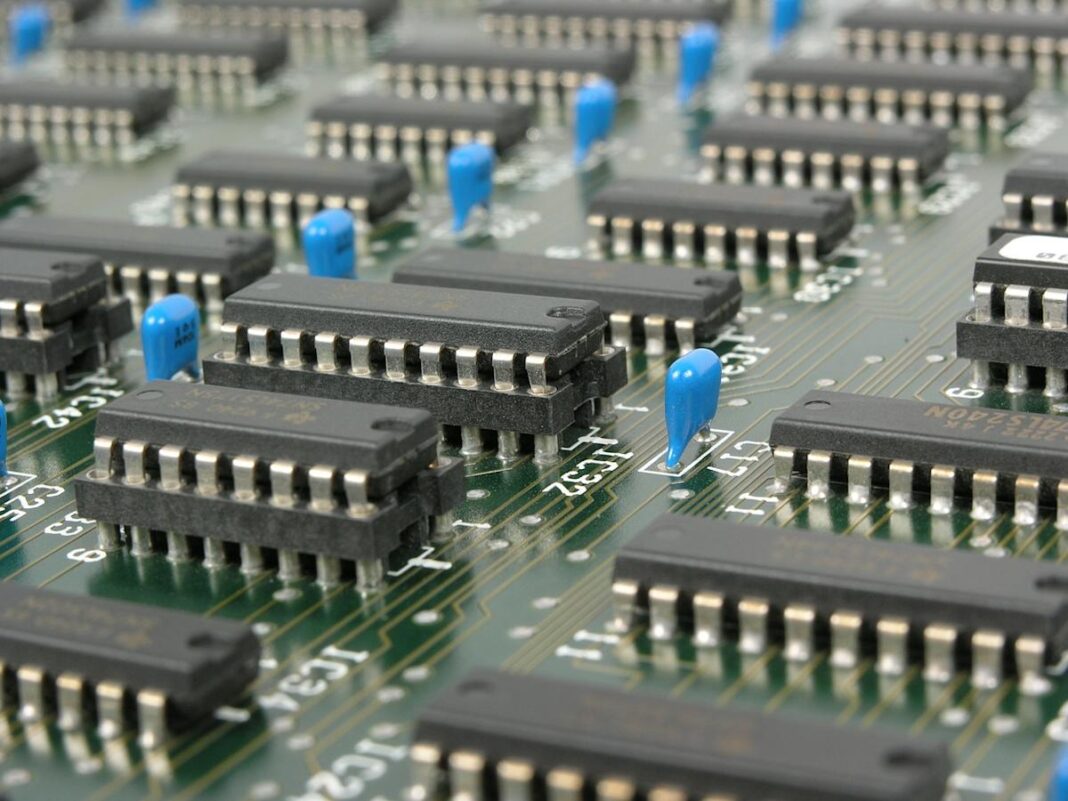

Micron Technology, Inc. (NASDAQ:MU) is an Idaho-based company specializing in memory and storage products. Incorporated in 1978, the company operates through four segments, including the Cloud Memory Business Unit and Core Data Center Business Unit.

While we acknowledge the potential of MU as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None.