Proposed US tariffs could raise costs for UK car exporters and motor finance providers, adding pressure to manufacturers and lenders already operating in a subdued domestic economy, according to reporting in the financial press.

The measures, outlined by President Donald Trump, would impose a 10% tariff on goods shipped to the US from the UK and several European countries from 1 February, with the rate set to rise to 25% from June unless a wider agreement is reached. Finance sector analysts cited by the Financial Times said the move could affect pricing, demand and investment decisions across the automotive supply chain.

Although tariffs are formally levied on imports, economists said the burden is typically shared between consumers, manufacturers and finance providers. Higher vehicle prices risk dampening US demand, while attempts to absorb some of the cost could weigh on profitability and cash generation, particularly for exporters reliant on premium models.

For motor finance firms, the uncertainty is centred on residual values and volume assumptions. UK-built vehicles sold into the US underpin a range of leasing and personal contract purchase products, where future resale values are critical to pricing. Any sustained fall in US demand could weaken used car prices and force lenders to reassess risk.

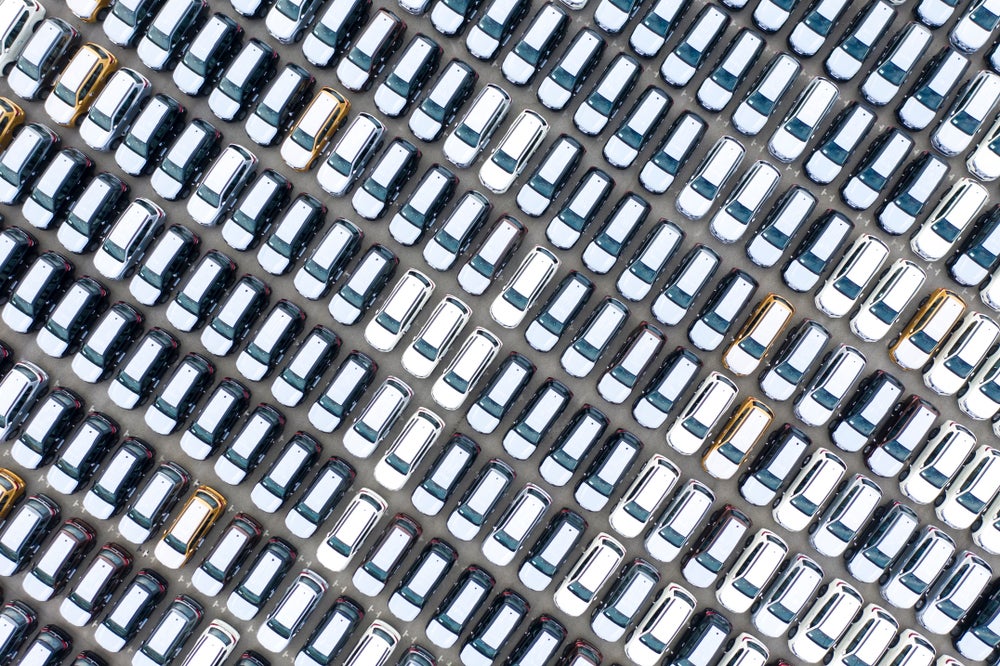

UK automotive exports are heavily concentrated in manufacturing. The US is Britain’s second-largest overseas market for cars, accounting for just under a fifth of exports last year, with the bulk made up of premium and luxury vehicles. Finance providers supporting those sales said they were monitoring the situation closely, given the sector’s exposure to transatlantic trade flows.

Bentley said in a recent press release that it was “evaluating the announcements in detail” and reiterated its support for “open markets and stable trade relations”. Earlier this month, the company’s chief financial officer, Jan-Henrik Lafrentz, said that if tariffs were imposed they would “ultimately be passed on to the consumer”, though different scenarios were under review.

Other UK manufacturers with significant US exposure include Aston Martin, Rolls-Royce and McLaren, all of which rely heavily on North American sales. Jaguar Land Rover has previously said US tariffs had a “direct and material impact” on profitability and cashflow during earlier trade disputes.

By contrast, high-volume manufacturers such as Nissan and Toyota, which build cars in the UK primarily for European markets, have limited direct exposure. However, analysts noted that suppliers, logistics firms and captive finance arms could still be affected by any slowdown in production or investment.