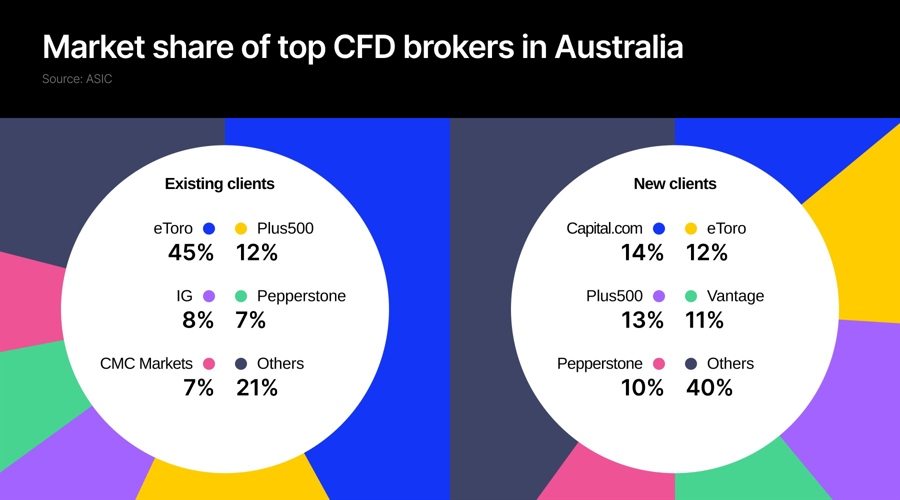

eToro holds 45 per cent of existing Australian contracts for differences (CFD) traders, while Capital.com onboarded 14 per cent of new traders, the highest among brokers, according to a report by the Australian Securities and Investments Commission (ASIC).

Five to Six CFD Brokers Dominate Australia

The Aussie CFD industry appears highly concentrated, with only five brokers capturing most of the market share. After eToro, the Australian unit of Plus500 holds 12 per cent, IG holds 8 per cent, and Pepperstone and CMC Markets hold 7 per cent each.

Interestingly, 67 per cent of new retail clients who placed their first CFD

trade in the first quarter of FY 24 stopped trading by

the end of that year, ASIC found.

When it comes to new client acquisition, Plus500, with 13 per cent, follows Capital.com. The shares of eToro, Vantage, and Pepperstone stand at 12 per cent, 11 per cent, and 10 per cent, respectively.

Read more: ASIC Makes “Reporting Misconduct” a Priority – An Alarm for CFD Brokers?

The Aussie regulator revealed that 119,300 clients traded CFDs per quarter in fiscal year 2024, which marked a 76 per cent drop from the average of 515,000 clients in the two months before ASIC imposed industry restrictions in March 2021.

“This decline could be due to several factors, including the impact of ASIC’s product intervention order, the subsequent reduction in foreign retail clients, and high client attrition rates,” ASIC noted.

The report followed ASIC’s review of 52 locally licensed CFD brokers between October 2024 and December 2025.

The regulator found “widespread weaknesses” in CFD brokers’ design and distribution obligations (DDO), the CFD product intervention order (PIO), and regulatory reporting requirements. As a result, ASIC secured about AU$40 million in refunds for more than 38,000 retail CFD clients.

Wholesale CFD Traders Lost More Money Than Retail Traders

According to regulatory data, 94 per cent of CFD traders in Australia are retail clients, while the remaining 6 per cent are wholesale clients. However, wholesale clients lost more money than retail clients in FY24. Seventy per cent of wholesale clients made net losses totalling AU$738 million, including AU$63 million in fees.

Among retail clients, 68 per cent lost money, amounting to AU$458 million, including AU$73 million in fees.

The Aussie regulator has started a target market review of the classification of retail and wholesale clients and will conduct risk-based testing to assess whether retail clients are misclassified as wholesale clients.

Aussie CFD brokers acquired 45 per cent of new retail clients through paid online ads, while 20 per cent came from paid referrals, including introducing brokers, affiliates, and client referrals. Notably, 74 per cent of new retail clients acquired through paid online ads lost money.

Options CFDs: A Loss-Making Product for Retail Traders

Another product with high losses was options CFDs, as 85 per cent of retail clients trading these products lost money. However, ASIC is not yet clear who is suitable to trade options CFDs. “We will consider this when determining the way forward in relation to the upcoming expiry of ASIC’s product intervention order in 2027,” the regulator added.

The Aussie watchdog also raised concerns about growing demand for copy trading. A total of 26,243 retail clients, mainly concentrated among a few brokers, used copy trading services.

“We have identified potential concerns relating to CFD issuers’ supervision and oversight of lead trader conduct, fee transparency, and lead trader conflicts of interest,” the regulator noted. “We will engage with issuers and other related providers regarding their copy trading services and our proposed regulatory response.”

Exotic CFD products, which some brokers sold from November 2020 for three years to retail and wholesale clients, also raised concerns. Seventy-two per cent of retail traders using these instruments lost money, while costs reduced profits and increased losses. ASIC is also unsure about the appropriate clients for these products.

The regulator noted that although brokers have stopped offering these instruments, they refunded more than AU$1.3 million to 250 affected retail clients for losses, fees, and costs after its intervention.

ASIC has already imposed strict restrictions on retail CFD offerings, including leverage caps and marketing limits, in line with rules in Europe and the UK.

Effective from March 2021, ASIC’s intervention order will expire in May 2027. The regulator stated that in the 2025–26 fiscal year, it will engage with the industry on its proposed next steps.

The Aussie watchdog also found that two CFD brokers breached leverage limits and refunded more than AU$1.3 million to affected retail clients.

This article was written by Arnab Shome at www.financemagnates.com.

Source link