GMG Prime, the institutional division of Global

Markets Group Limited, has enabled a direct institutional liquidity feed into

MetaTrader 5 using MetaQuotes’ Ultency Matching Engine.

The integration allows brokers to tap GMG Prime’s

liquidity pool natively from MT5, reducing dependence on external bridges and

middleware layers. The move targets execution quality for brokers and

institutional clients that route high volumes through MetaTrader 5.

GMG Prime highlights lower jitter, improved fill

ratios, and high-throughput performance across a wide set of instruments,

including during volatile trading conditions.

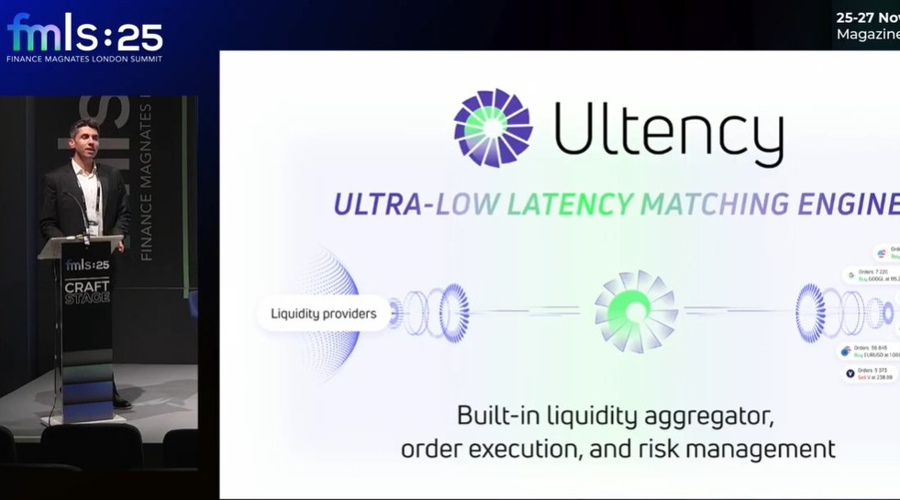

Ultency Built into MetaTrader 5

Ultency operates as a matching and aggregation engine

that MetaQuotes has built directly into the MetaTrader 5 stack. It handles

liquidity aggregation, order execution, and risk management from inside the

platform to support fast order processing and stable system performance.

Brokers can connect to the Ultency-based setup and

access extensive liquidity while avoiding fixed maintenance fees, paying

instead on actual traded volume. GMG Prime frames the integration as an upgrade for

institutional workflows rather than a cosmetic platform change.

“Ultency, it’s a game changing solution for MetaTrader

5 brokers and liquidity providers seeking for the best in-class ultra-low

latency solution for their liquidity connectivity, aggregation, distribution,

and also for their execution and risk management,” commented Christoforos

Theodoulou, the Head of Global Business and Sales at MetaQuotes, during the

FMLS:25.

By combining Ultency’s proprietary aggregation and

matching logic with GMG Prime’s liquidity network, the firm says brokers can

access tighter spreads, faster execution, and more control over routing and

risk parameters.

The new setup gives institutional clients direct

access to multi-source liquidity with increased operational transparency,

according to GMG Prime. Brokers that connect through Ultency can deploy

advanced risk controls while using infrastructure that scales horizontally as

client flow and product coverage expand.

GMG Prime and Its Client Base

Global Markets Group Limited launched in March 2015

and has held authorization from the UK Financial Conduct Authority since

September 2016, operating as a liquidity provider to financial institutions and

brokerages.

GMG Prime serves start-up and small-to-medium

brokerages, as well as family offices, hedge funds and asset and wealth

managers.

It offers institutional pricing and deep liquidity

through a scalable execution environment, with streamlined onboarding and

flexible account setups to help clients go live quickly while keeping control

over how their trades execute.

This article was written by Jared Kirui at www.financemagnates.com.

Source link