Oil markets are ignoring Trump’s Greenland drama as a fire at Kazakhstan’s giant Tengiz field tightens supply, lifting Brent back to $65.

China Embraces Dominant Power-Producer Role

– With China’s National Bureau of Statistics finally publishing data for December 2025, Beijing can now officially declare that 2025 saw the first annual drop in fossil-fuel power generation since 2015.

– Thermal electricity generation amounted to 6.29 trillion kWh last year, down 1% from a year ago, even though coal output soared to another all-time high of 4.83 billion metric tonnes.

– China’s power demand growth seems to be slowing down in line with slackening GDP growth rates, with 2025 posting an annual rate of 5% after a 6.8% year-over-year jump in 2024.

– Even so, China now consumes more electricity than the European Union, Russia, India and Japan combined.

– Renewables accounted for more than 60% of new installed generation capacity in 2025, with total installed capacity soaring to 1,760 GW by the end of the year.

Market Movers

– Japanese conglomerate Mitsubishi (TYO:8058) has agreed to purchase Aethon Energy Management’s Haynesville basin assets for $7.53 billion, doubling the size of its current LNG equity production.

– UK-based energy major Shell (LON:SHEL) has reportedly asked Syrian authorities to withdraw from the al-Omar oilfield, the country’s largest producing asset, before the onset of the 2011 Civil War prompted a full closure.

– Norwegian state oil firm Equinor (NYSE:EQNR) has made a gas and condensate discovery with its Sissel exploration well, right on the border with the UK continental shelf, with recoverable reserves up to 28 million boe.

– The Carlos Slim-controlled Mexican conglomerate Grupo Carso has agreed to purchase Lukoil’s (MCX:LKOH) two main assets offshore Mexico, the shallow-water Ichalkil and Pokoch fields, for $270 million.

Tuesday, January 20, 2026

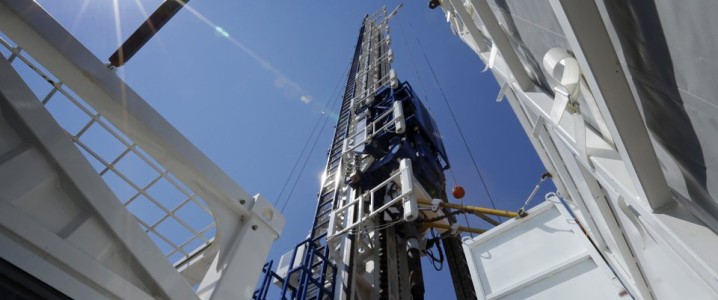

Supply disruptions have overshadowed Trump’s Greenland antics this week in the oil markets, with a fire debilitating Kazakhstan’s largest oil field, to the extent that ICE Brent has strengthened to $65 per barrel again. Macroeconomics could dampen that bullish sentiment soon, particularly with the IEA report coming out later this week, however if Tengiz fails to return by the end of January, curbed Kazakh supply could prompt further pricing upside.

US Crude Differentials Are Booming. According to S&P Global, a mid-February cargo of light sweet WTI lifted by Gunvor was sold at a record premium of $3.60 per barrel over Dated Brent, the highest price for a US cargo since the inclusion of the grade in the Brent basket more than two years ago.

China’s Refinery Runs Hit Record Highs. China’s refinery throughput climbed to an all-time high in 2025, averaging 14.8 million b/d across the year (equivalent to a 4% year-over-year increase), driven by the ramp-up of giant private refiner Yulong and better margins for state-owned refiners.

Syria’s New Rulers Take Back Occupied Fields. Syria’s new government under President al-Sharaa is set to regain full control over oil and gas fields in the Kurdish-controlled northeastern provinces, consolidating some 100,000 b/d of crude output from the Deir ez-Zor, Raqqa and Hasakah fields.

Fire Halts Output at Top Kazakh Site. The Chevron-operated (NYSE:CVX) TCO joint venture operating the supergiant 700,000 b/d Tengiz field onshore Kazakhstan stated that it had suspended production as a ‘precautionary measure’ after a fire broke out at the field’s power distribution systems.

Trump Cabinet Seeks to Expand Chevron’s License. US Energy Secretary Chris Wright has announced that the Trump administration is moving ‘as fast as it can’ to expand the production license of US major Chevron (NYSE:CVX) in Venezuela, currently producing some 240,000 b/d.

LNG Canada Disappoints Main Stakeholders. Key stakeholders of Canada’s $29 billion LNG Canada project, UK-based major Shell (LON:SHEL) and Japanese conglomerate Mitsubishi (TYO:8058), are reportedly considering sale options for their respective stakes – 40% and 15% – in the project.