China’s central bank signalled sustained policy support into 2026, reinforcing expectations of further easing to stabilise growth.

Summary:

-

PBOC confirms moderately loose policy stance for 2026

-

Further RRR and interest rate cuts remain on the table

-

Policy framework to shift toward expectation-driven indicators

-

Structural tools to support innovation and SMEs

-

Commitment to currency flexibility and RMB internationalisation

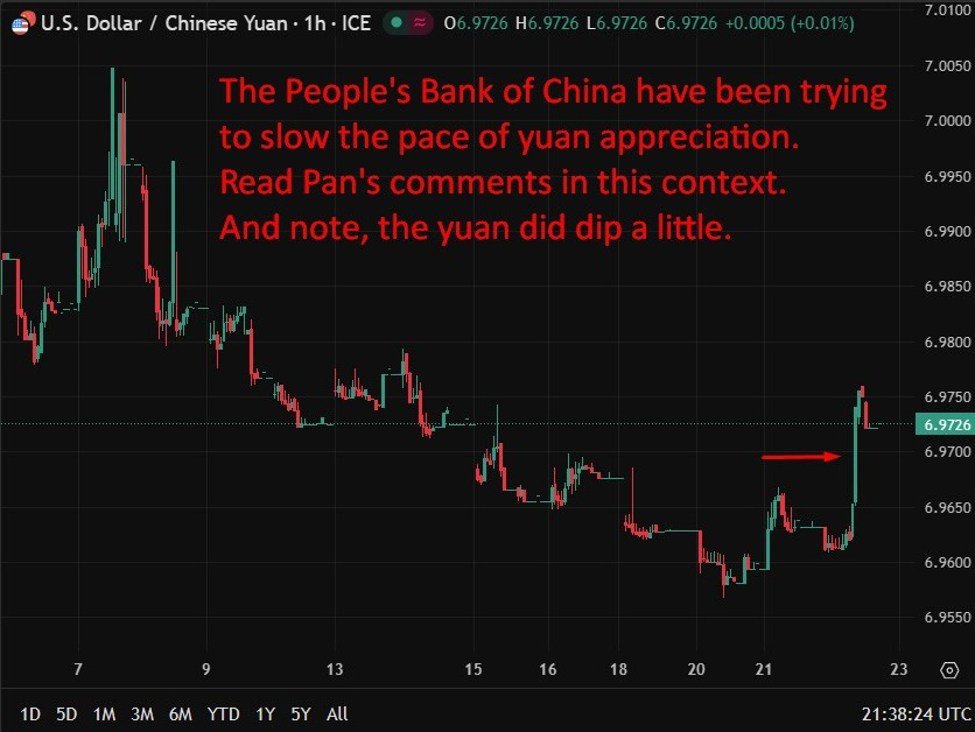

China’s central bank has reaffirmed a clear easing bias for monetary policy in 2026, signalling further scope for both reserve requirement ratio (RRR) cuts and interest rate reductions as it seeks to stabilise growth and support a gradual recovery in prices. Speaking to Xinhua on Thursday, PBOC Governor Pan Gongsheng said policy would remain “moderately loose,” with authorities committed to keeping liquidity ample and financing costs low across the economy.

Pan said monetary policy would prioritise stable economic growth and a “reasonable” recovery in prices, deploying both new stimulus measures and existing policy tools to create a supportive financial environment. He explicitly noted there is still room for further RRR and rate cuts this year, reinforcing expectations that policy support will remain in place even as global central banks move more cautiously.

The governor also highlighted structural changes underway in China’s financial system. In 2025, new bank loans accounted for less than half of total social financing, underscoring a shift toward market-based financing channels. In response, the PBOC plans to refine its policy framework to better reflect these changes and improve regulatory effectiveness.

A key theme was flexibility. Pan said the central bank will move away from rigid quantitative targets toward a more observation-based and expectations-driven framework. Liquidity management will increasingly rely on government bond transactions to ensure sufficient funding within the banking system, while efforts will be made to improve the transmission of policy rates to market rates.

The PBOC also plans to enhance its structural policy tools, guiding banks to allocate credit more effectively toward priority areas such as innovation, technological upgrading and support for small and medium-sized enterprises. On the currency front, Pan reaffirmed a commitment to a market-driven exchange rate, while guarding against excessive volatility in the yuan.

Internationally, the central bank will continue pushing for deeper financial opening, supporting RMB internationalisation and strengthening Shanghai and Hong Kong as global financial hubs. Enhanced cross-border RMB payment systems and broader international financial cooperation were also flagged as priorities for 2026.