The UK’s

fintech sector posted a 29% year-on-year increase in professional job vacancies

during 2025, substantially outperforming the broader financial services market

as companies compete aggressively for scarce technology talent.

The sector

created roughly 16,200 professional positions last year, accounting for 24% of

all finance industry vacancies in the UK, according

to a new report from Morgan McKinley and Vacancysoft. Banking vacancies grew

just 8% to around 41,100 roles, while accountancy firms increased hiring 15% to

approximately 10,000 positions.

For

example, CMC

Markets spent nine months searching for a CFO, ultimately opting for an

internal appointment in November 2025 after an unsuccessful external search.

“The UK professional jobs market in 2025 marked a clear inflection point,” said Victoria Walmsley, Managing Director at Morgan McKinley UK. “Following several years of disruption, rapid change and post-pandemic recalibration, hiring activity moved into a more selective and disciplined phase.”

Technology Hiring

Accelerates Sharply

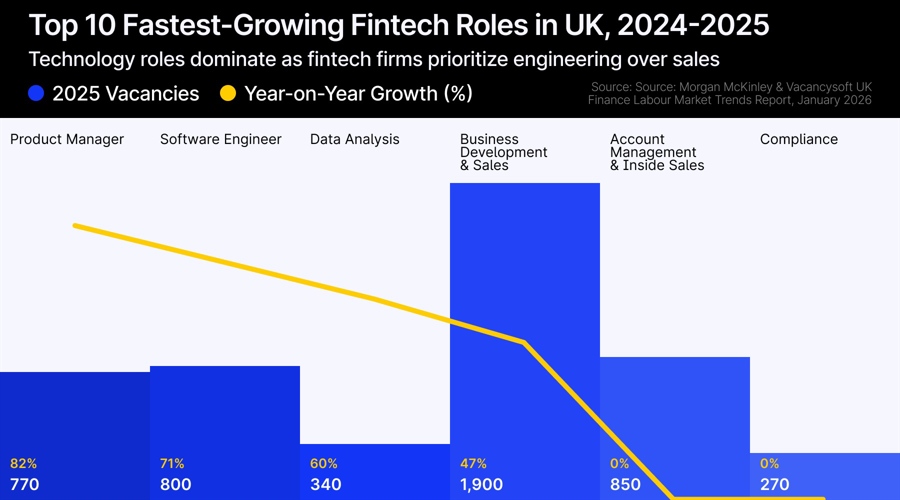

Software

engineering vacancies climbed 71% to nearly 800 roles in 2025, while product

management IT positions surged 82% to approximately 770 vacancies. Data

analysis roles expanded 60% to around 340 positions, underscoring the sector’s

focus on technical capability over front-office expansion.

Business

development and sales remained the largest single category at close to 1,900

vacancies, up 47% year-on-year. Account management and inside sales roles

reached around 850 vacancies but saw their share of total hiring slip from 6%

to 5%, suggesting a strategic rebalancing toward product-led growth.

UK fintech

hiring was projected to rise 32% earlier in 2025 as compliance and cybersecurity demands

intensified across the industry. Fintech,

compliance, and risk roles emerged as top career paths in London’s finance sector

during Q2 2025, with financial crime specialists and regulatory experts

becoming increasingly sought after.

Compliance

positions held steady at approximately 270 roles despite explosive growth in

other technology functions, raising questions about whether firms are

adequately staffing risk management teams as they scale operations.

Compliance

heads in CFD-heavy Cyprus now earn six-figure salaries, with heads of compliance receiving

up to €120,000 as regulatory demands intensify.

The IT Crowd

IT emerged

as the most in-demand profession across regional markets, exceeding 10,000

vacancies nationwide in 2025 and growing 23% year-on-year.

Retail

trading platforms and fintech companies today are no longer driven mainly by

salespeople, but by engineers and software experts. For example, XTB reported

as early as 2023 that out of more than 1,000 employees, nearly

half were working in IT.

Moreover,

the compensation landscape reflects intensifying competition for specialized

talent. IG Group’s CEO

earned $4.5 million in FY25, though this figure remained below Plus500’s top executives, who each

pocketed $4.97 million as retail trading platforms battle for leadership

expertise.

The

cross-sector technology hiring boom is creating direct competition between

fintechs, banks, and traditional accountancy firms for the same engineering

talent. Dubai’s FX

sales heads now earn twice the pay of Cyprus roles, with compliance head salaries jumping 250% in

Dubai as regional hubs compete for specialized expertise.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link