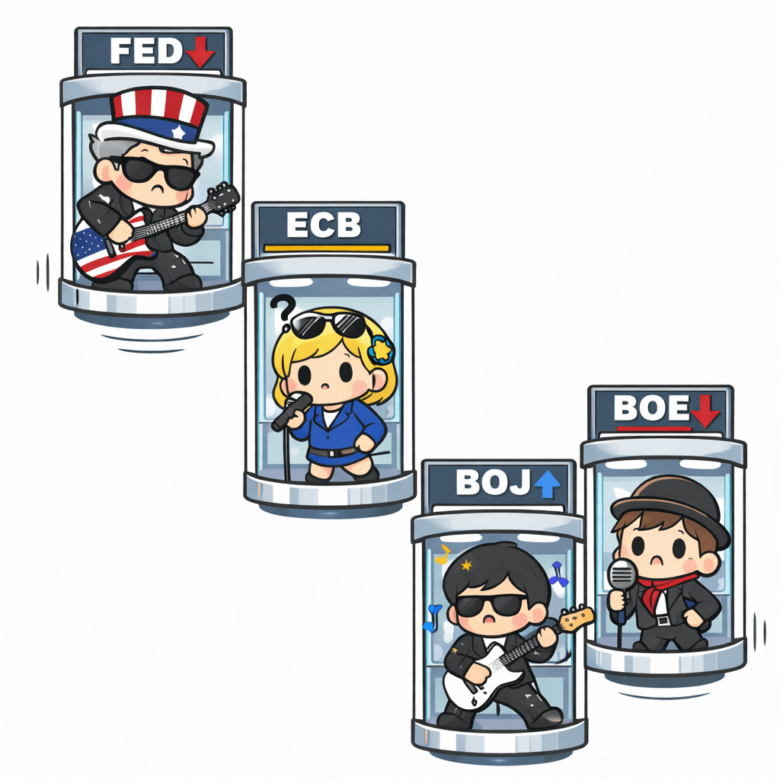

For the past few years, central banks were basically peak One Direction. Wherever one went, the rest followed. Everyone was hiking rates together to fight the same monster: inflation.

But as January 2026 gets underway, the playlist has changed.

Just like Harry Styles is gearing up for his Together Together tour, and Zayn Malik and Louis Tomlinson are working on a Netflix project, major central banks are no longer moving in sync.

Today, the U.S. Federal Reserve looks set to cut interest rates in the coming months. The RBA and the BOJ may still be leaning toward hikes. Meanwhile, the ECB is taking a chill pill and sticking with its current policy stance.

In other words, the band broke up, and everyone is doing their own thing now.

Luckily for forex traders, this split isn’t a problem. It’s the setup.

Carry trades – a strategy that takes advantage of monetary policy divergences – are one of the most reliable ways to make money in FX, because it creates clear strength versus weakness between currencies.

Interest Rate Differentials Drive Currency Flows

First, remember that in forex, you’re not just trading random price swings of imaginary assets. You’re trading fiat currencies backed by countries and their central banks.

Because different central banks offer different interest rates, money naturally flows toward higher returns.

If the Reserve Bank of Australia offers a 5% return while the Federal Reserve offers 3%, global investors, from pension funds to hedge funds, will dump their US dollars and buy Australian dollars to earn that higher yield.

That demand pushes the Australian dollar higher.

This is why a currency often rallies when a central bank hints at an interest rate hike. Traders want to get positioned before the interest rate party officially starts.

This is also why, when every central bank is cutting rates together in a synchronized cycle, those yield differences disappear. With no clear advantage between currencies, price action tends to be muted and boring.

But when one bank is hiking (RBA), one is pausing (Fed), and another is threatening to cut (ECB), you get increased capital flows and volatility.

And that tension is exactly what creates the price swings that carry traders rely on to make money.

So, What Is a Carry Trade?

A carry trade is like taking out a low-interest loan to put the money into a high-yield savings account.

Making a carry trade means you:

- Borrow Low: You “sell” a currency with a tiny interest rate (like the Japanese Yen).

- Invest High: You “buy” a currency with a higher rate (like the Australian Dollar).

- Collect the Spread: You keep the difference between the two rates.

Since currencies never really stop moving, brokers use 5:00 PM EST as the cutoff.

If you hold your position past this time, the broker “rolls over” the trade. They charge you the low interest you owe and pay you the high interest you earned.

The leftover profit – the swap – is deposited into your account daily.

Carry Trade in Action

Let’s take a look at some of the more popular carry trade pairs in action:

AUD/JPY (The “Classic” Carry)

- Japan (JPY) Rate: 0.25%

- Australia (AUD) Rate: 4.35%

- Differential: 4.10%

The Play: You borrow 10 million yen (about $65,000), convert it to Aussie dollars, and just sit on it. Assuming the exchange rate doesn’t move (extremely unlikely) and rates don’t move, there’s a potential to collect roughly $2,665 per year just for holding that position. Free money while you sleep!

NZD/CHF (The “Yield Hunter”)

- Switzerland (CHF) Rate: 1.00%

- New Zealand (NZD) Rate: 4.75%

- Differential: 3.75%

The Play: You borrow 100,000 Swiss francs (about $115,000), convert them to Kiwi dollars, and let it ride. As long as the exchange rate & central bank rates holds steady, the potential yield is roughly $4,310 per year in pure interest spread. That’s one whole Labubu to add to a collection!

Take note that these examples assume the exchange rate stays put. But currencies don’t just sit there—they move. A lot.

The big risk is that you may potentially earn 4% on your carry, but if the yen suddenly strengthens 10% against the Aussie dollar (like it did during the August 2024 meltdown), you just lost 6% overall.

That’s why traders call carry trades “picking up pennies in front of a steamroller.” When it works, it’s potentially easy money. When it doesn’t… ouch!

Why Carry Trade May Be Coming Back Stronger Than a 90’s Trend

In 2024, everyone was cutting rates together. If everyone has a 2% rate, the spread is 0%, and the carry trade is boring.

Today, the “sync” is broken, and investors are paying attention:

- Fed hit pause on rate cuts. They’re sitting tight, watching the labor market like a hawk.

- RBA might actually hike rates because Aussie inflation won’t quit.

- ECB is warning that if the euro gets too strong, it will cut rates just to weaken it.

- BOC has been cutting more aggressively than most, making the Loonie less attractive.

- RBNZ is holding steady, but New Zealand’s economy looks shakier than Australia’s.

- BOE is stuck between awful growth and stubborn inflation. Nobody knows what they’ll do next.

- SNB and BOJ are still at rock-bottom rates, making the franc and yen perfect for borrowing cheap money to fund carry trades, regardless of their members’ biases

With central bank policies diverging, those interest rate differentials are widening and look more durable. Carry trades are back on the menu.

Tips for Building Carry Positions

The Exchange Rate is Boss: A 3% interest payout won’t save you if the currency price drops 5% in a day. Only consider carry trade strategies that align with the technical trend.

Watch for the “Unwind”: Carry trades thrive in “happy” markets. If a crisis hits, everyone panics and “unwinds”—selling their AUD to pay back the JPY they borrowed. This typically causes the Yen and Swiss Franc to rocket higher instantly.

Central Banks Can Sabotage You: When the ECB says the euro is “too strong,” believe them. They might cut rates just to ruin your “long” party.

Watch Government Bond Yields, especially the 10-year notes: Yield spreads are the difference between what bonds in two countries pay. Bond markets are forward-looking—they move before central banks do. If you see Australian 10-year yields pulling away from Japanese yields, that’s the “smart money” may be moving in before the RBA even announces a rate hike.

Bottom Line

We are entering the most interesting carry trade environment in years.

By pairing the “Strongest Hawk” (hello, RBA at 4.35% and potentially hiking) with the “Weakest Dove” (BOJ at 0.25%, or SNB at 0.50%), you may find the path of least resistance, all else being equal.

The opportunities are there. Just don’t confuse opportunity with certainty, and never forget that in forex, price action is king and the carry is just the loyal servant. And with any potential risk exposure, risk and trade management are everything!

Want to combine fundamental and technical analysis to spot high-probability trades that fit your style? Our Premium Babypips membership delivers weekly market analysis, event breakdowns, short-term strategies, and actionable trade ideas.