The Federal Reserve kicked off 2026 by keeping interest rates unchanged at 3.50-3.75%, breaking a three-meeting cutting streak as policymakers signaled growing confidence that monetary policy is now close to neutral.

Despite two dovish dissents from Governors Stephen Miran and Christopher Waller—both favoring an additional quarter-point cut—the majority of the committee upgraded their assessment of economic growth and removed previous warnings about rising employment risks.

Key Takeaways

- The Fed kept interest rates unchanged at 3.50-3.75%, pausing after three consecutive cuts in the final months of 2025

- Split vote: The decision passed 10-2, with Governors Stephen Miran and Christopher Waller both dissenting in favor of a 25bp cut, marking the third straight meeting with multiple dissents

- Economic upgrade: The statement upgraded growth language to “solid pace” from “moderate pace” and noted the unemployment rate has “shown some signs of stabilization”

- Labor market shift: The Fed removed language about “downside risks to employment” rising, signaling reduced concern about the job market

- Inflation remains elevated: The statement acknowledged that inflation “remains somewhat elevated,” though policymakers appear confident tariff effects will be temporary

The decision reflects a Fed that’s shifting from actively easing policy to a more cautious wait-and-see approach, with Chair Jerome Powell emphasizing that further rate cuts are no longer automatic and will depend heavily on incoming data.

Link to FOMC Monetary Policy Statement (January 2026)

In his press conference, Chairman Powell struck a careful but slightly dovish tone that ended up weighing on the dollar even as the Fed held rates steady.

JPow said the economy remains on a firm footing with improving growth and easing risks, while describing policy as around neutral to mildly restrictive rather than meaningfully tight based on recent data. At the same time, he emphasized flexibility, saying the Fed is well-positioned after three cuts to let the data speak, with decisions made meeting by meeting and no preset path.

On inflation, Powell said core PCE likely ran near 3.0% in December and framed the recent pickup as largely tariff-related, arguing those effects amount to a one-time price shift rather than lasting inflation pressure.

He also pointed to labor market stabilization, suggesting higher unemployment reflects slower labor force growth from reduced immigration rather than outright job losses, which helped justify the pause.

Powell avoided political landmines but defended his Supreme Court appearance as one of the most important legal cases in the Fed’s 113-year history.

Link to Fed Chairperson Powell’s Press Conference (January 2026)

Market Reactions

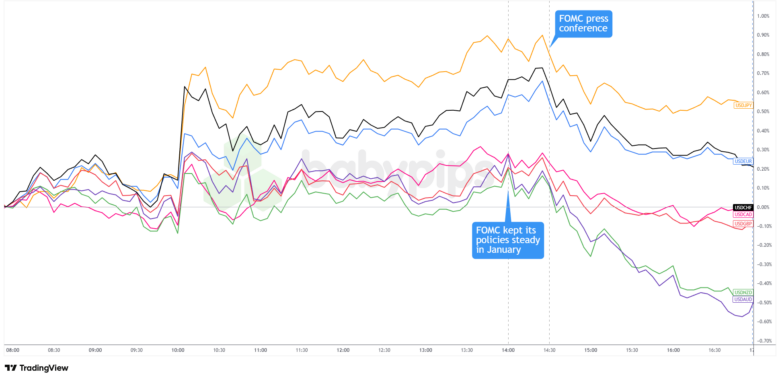

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart Faster with TradingView

It looks like the bar for additional cuts has risen as the data improves, but the Fed is still open to easing further. That likely explains why the dollar briefly popped on the FOMC statement after trading near U.S. session highs, then slid once Powell stepped up to speak.

The initial lift probably came from the upgraded growth outlook and the removal of language flagging employment risks. But Powell’s emphasis on watching incoming data, the evolving outlook, and the balance of risks when weighing the timing and extent of future adjustments kept markets from reading the pause as a clean end to the easing cycle.

Dovish dissents from Waller and Miran may have also weighed on the dollar, underscoring lingering concern among some policymakers about labor market conditions and where the neutral rate really sits. Waller’s dissent stood out given his status as a leading candidate to replace Powell in May, with his vote signaling that he still sees policy as somewhat restrictive despite recent cuts.

By the end of the New York session, the dollar was down about 0.20% to 0.55% against most major currencies compared to pre-FOMC levels.

Markets continue to price in roughly two quarter-point cuts by year-end (approximately 46 basis points of easing), suggesting traders view the Fed’s pause as temporary rather than signaling the end of the cycle.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top rated journaling app! ($120 in savings)! Click here for more info!