If you can’t beat them, join them. That might be the attitude investors soon adopt when it comes to the wave of Chinese electric vehicle (EV) automakers that are rapidly expanding around the globe. After years of development, government subsidies, and incentives, the Chinese automakers are highly advanced with EV technology and can undercut the world on prices. If you’re looking for a Chinese EV maker with upside, Nio (NYSE: NIO) should be high on your list. Here’s why.

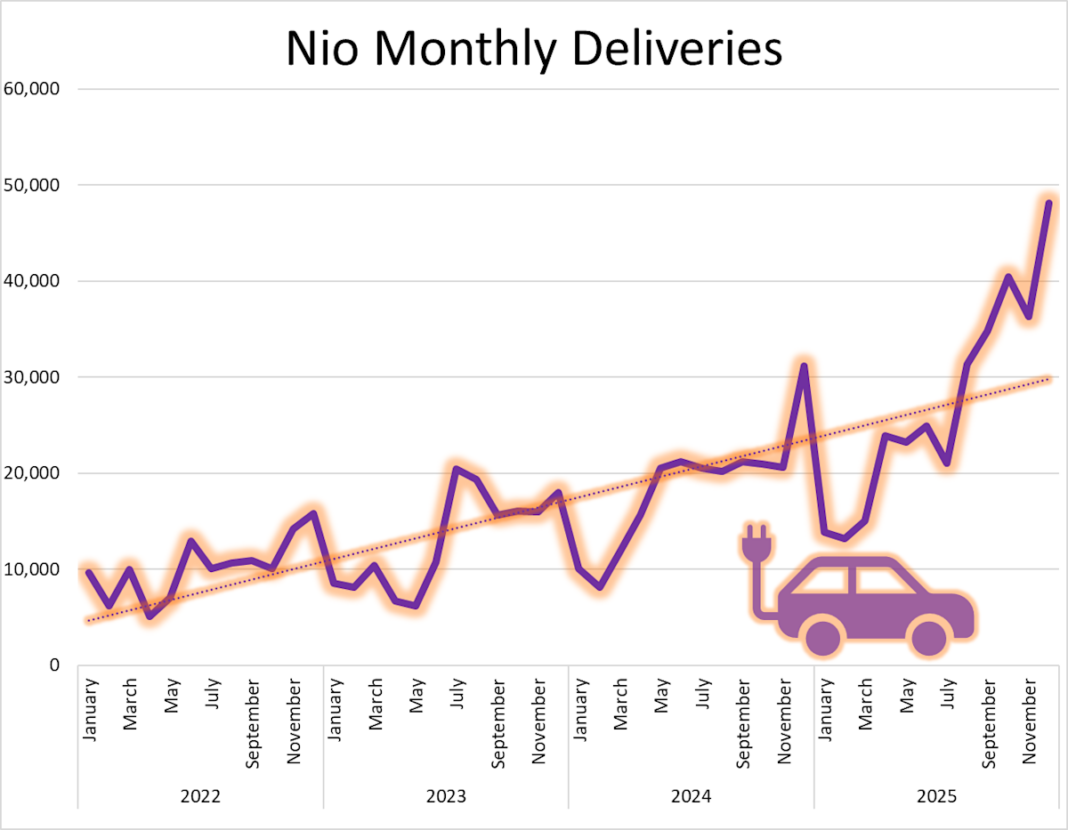

Nio could be a hidden gem for investors interested in the electric vehicle industry, especially with its recent sales growth driven by two newer brands, Onvo and Firefly. In fact, Nio delivered over 48,000 vehicles in December 2025, which was a new monthly record and a 54.6% increase compared to the prior year. The good news is that there’s still room for growth, as its two newer brands are still expanding and haven’t reached their full potential. December deliveries broke down to 31,897 vehicles from the company’s premium namesake Nio brand, 9,154 vehicles from its Onvo brand, and 7,084 vehicles from Firefly.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

As you can see in the graphic above, Nio’s delivery growth has exploded over the past few months, with fourth-quarter deliveries increasing by a staggering 71.7% over the prior year. In fact, Nio’s 326,028 deliveries in 2025 accounted for nearly one third of the company’s cumulative deliveries.

The potential drawback, however, was that if Nio expanded its segment coverage into more affordable vehicles, it might negatively affect the company’s margins.

Nio has done a solid job of cutting costs and improving scale, and investors can see the fruits of labor in vehicle and gross margins. Vehicle margin checked in at 14.7% during the third quarter of 2025, which was a noticeable improvement over the prior year’s 13.1% and far better than the second quarter’s 10.3%. Nio’s Q3 gross profit jumped a robust 50.7% compared to the prior year, and the automaker has shown consistent progress, driving gross margins higher over time.

This is a potential turning point for Nio and its investors. The company is driving explosive growth by expanding its brands, and it’s more profitable growth with consistently improving margins. Nio still faces increasing competition, tariff barriers to entry in some foreign markets, and a brutal price war in its domestic Chinese market.