The Reserve Bank of Australia (RBA) delivered its first interest rate hike since November 2023, raising the cash rate by 25 basis points to 3.85% in a unanimous decision that reflected mounting concern over persistent inflation pressures.

The decision marked a dramatic reversal from its August 2025 rate cut, with the Board concluding that “the rate was no longer at the right level to get inflation back to target in a reasonable time frame.”

The central bank highlighted that inflationary pressures accelerated through the second half of 2025, driven by stronger-than-expected private demand in both consumption and investment, alongside tighter capacity constraints.

Key Takeaways

- The RBA raised its cash rate to 3.85%, reversing one of three cuts delivered in 2025 and marking the first major central bank globally to shift from easing back to tightening

- Inflation picked up materially in the second half of 2025, with private demand growing faster than expected and capacity pressures greater than previously assessed

- Governor Michele Bullock emphasized the economy is supply-constrained and inflation will remain above the 2-3% target for some time, though she stopped short of pre-committing to further hikes

- Updated forecasts assume the cash rate rising to 3.9% by June and 4.2% by December, implying roughly two additional hikes in 2026

Link to Reserve Bank of Australia Monetary Policy Statement (January 2026)

In her press conference, RBA Governor Bullock acknowledged borrowers would be “disappointed” but warned that allowing inflation to remain elevated would be worse. She defended the August rate cut, noting circumstances had changed substantially since mid-2025 when demand was weak and inflation appeared on track to target.

Bullock emphasized the RBA’s strategy hasn’t fundamentally shifted—the Board still aims to bring inflation down while preserving labor market gains—but stressed the economy is “even a little bit more constrained than we thought.”

Link to RBA Gov. Bullock’s Press Conference (January 2026)

The updated Statement on Monetary Policy revealed significantly higher inflation forecasts, with core inflation now expected to reach 3.2% by end-2026, up from November’s 2.7% projection, and not returning to the 2.5% midpoint until mid-2028.

This upward revision occurred despite the forecast path assuming additional rate hikes, underscoring the Board’s concern about inflation momentum.

Market Reactions

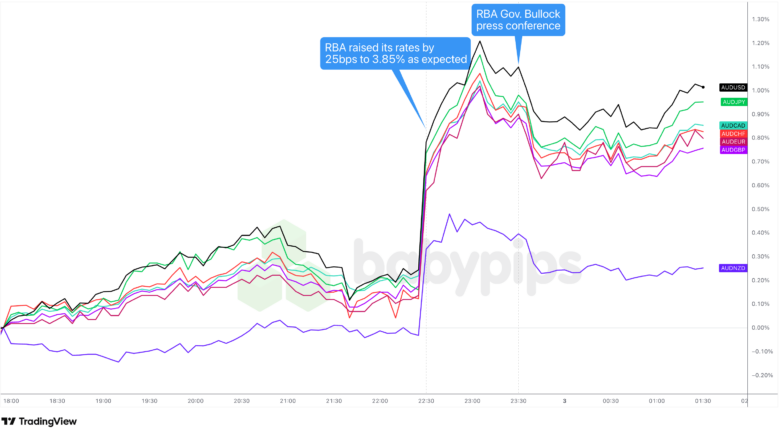

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart Faster with TradingView

The Australian dollar had been easing back from its early Asian session gains before snapping sharply higher on the RBA rate hike. AUD/USD led the move, jumping about 1% and pushing firmly above the .7000 psychological level.

The unanimous nature of the decision, with no dissenting votes, reinforced the view that the RBA is serious about bringing inflation under control, even if that means higher borrowing costs for households.

Swaps markets wasted no time repricing the outlook, moving away from expectations of further easing and toward a roughly two-thirds chance of another rate hike by June, with a possible follow-up move in August.

The Aussie gave back a portion of its post-statement gains around 30 minutes after the announcement and briefly dipped following Governor Bullock’s press conference. Still, the comdoll quickly found its footing and stayed comfortably above pre-event levels as trading moved into the London session.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high-quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top-rated journaling app! ($120 in savings)! Click here for more info!