Qualcomm Inc. (NASDAQ:QCOM) is one of the most undervalued quality stocks to buy right now. On February 2, Cantor Fitzgerald lowered its price target for Qualcomm to $160 from $185 while keeping a Neutral rating.

Although the firm anticipates that Qualcomm will exceed expectations for the December quarter, it expects the company to issue conservative guidance for the upcoming periods, modestly below consensus for March and significantly below for June. This outlook is attributed to factors like Apple’s reduced modem share, Samsung’s transition to moving some modems in-house, and a decline in the Chinese handset market.

On January 25, Mizuho analyst Vijay Rakesh reduced the price target for Qualcomm Inc. (NASDAQ:QCOM) to $160 from $175 with a Neutral rating following an industry call regarding handsets. Rakesh informed investors that global handset estimates for 2026 are down 4% year-over-year, with further downside expected in H2 of the year due to memory shortages and pricing issues. Consequently, the firm lowered price targets across the sector.

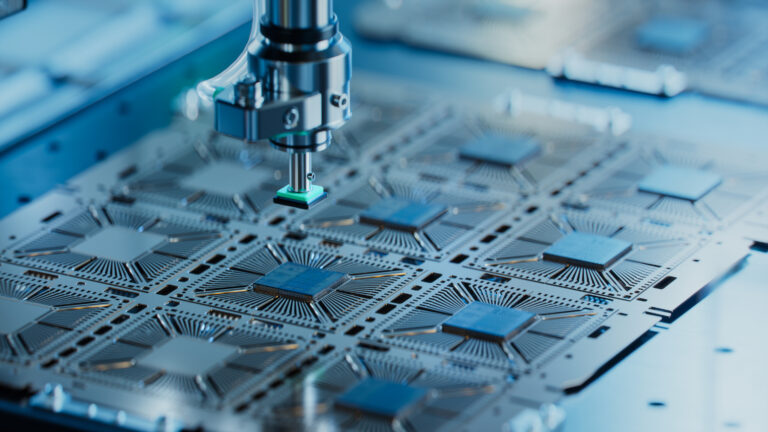

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

Qualcomm Inc. (NASDAQ:QCOM) develops and commercializes foundational technologies for the wireless industry worldwide. It operates through three segments: Qualcomm CDMA Technologies/QCT, Qualcomm Technology Licensing/QTL, and Qualcomm Strategic Initiatives/QSI.

While we acknowledge the potential of QCOM as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.