Singapore is strengthening its position as a global payments

hub as digital wallets, real-time payment systems and regulated stablecoins

move closer to mainstream use, according to a new report by PwC Singapore and

the Singapore FinTech Association.

The report, Payments’ State of Play 2026, outlines how

Singapore’s payments

ecosystem has evolved from building domestic infrastructure to supporting

cross-border scale. Regulatory clarity and coordination between the public and

private sectors are identified as key factors in this shift.

Domestic Digital Payments Near Saturation

The

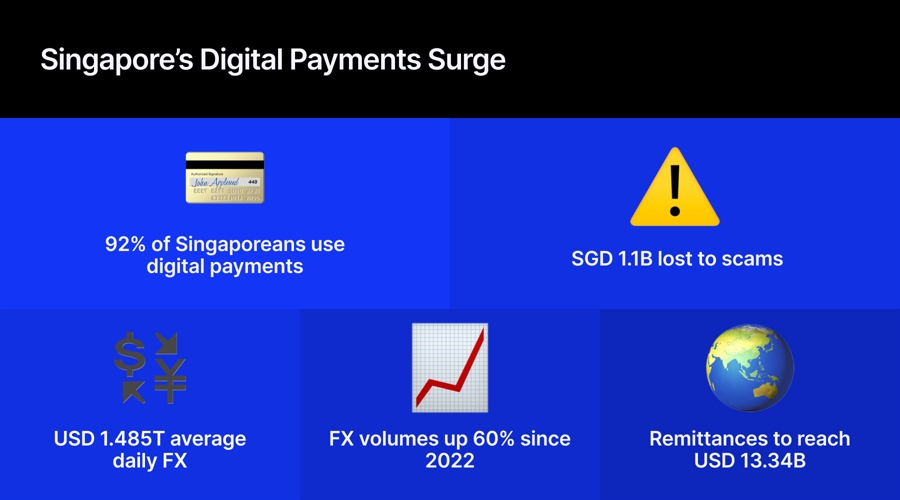

report shows that Singapore’s domestic payments market is already highly

digitised. About 92% of Singaporeans used a digital payment method in the year

through November 2025. Adoption has been supported by high smartphone

penetration and the rollout of national payment systems such as FAST and

PayNow.

Retail point-of-sale transactions are now largely cashless.

Digital wallets continue to gain share in both e-commerce and in-store

payments. Millennials and Generation Z account for the majority of wallet

usage. PayNow and GrabPay are among the most commonly used options for younger

consumers.

With domestic adoption close to saturation, the report

suggests future growth will come from areas beyond cash replacement. These

include cross-border payments, embedded finance and new payment instruments.

“Over the past decade, Singapore has transformed its

payments ecosystem,” said Wong Wanyi, FinTech Leader at PwC Singapore. She

pointed to innovation and a strong regulatory framework as drivers of this

development.

Cross-Border Payments Take Priority

Cross-border connectivity is identified as a central focus

of the next phase of payments development. Singapore has already linked PayNow

with Thailand’s PromptPay and Malaysia’s DuitNow. These links allow low-cost,

real-time transfers using mobile numbers.

Singapore

is also participating in Project Nexus. The initiative aims to connect fast

payment systems across Southeast Asia and India. According to the report, these

linkages are intended to reduce friction in regional payments and support local

currency settlement.

As cross-border

infrastructure expands, Singapore’s remittance market is expected to grow.

The report projects that total remittance volumes will increase from USD 8.05

billion in 2022 to USD 13.34 billion by 2032. Growth is linked to mobile-based

payment channels and Singapore’s role as a regional business, tourism and

education centre.

You may find it interesting: “Little

Margin for Error”: Firms See MAS Enforcement as Market-Wide Lesson.

The report also identifies gaps. Consumer awareness remains

lower than merchant readiness. As of mid-2025, only 56% of consumers were

familiar with cross-border digital wallet capabilities.

Stablecoins Move Toward Payments Use

Stablecoins are a central theme of the report. Under the

Monetary Authority of Singapore’s framework, stablecoins are increasingly

positioned as payment and settlement tools rather than speculative instruments.

“In Singapore, MAS’s regulatory framework

for stablecoins remains a global benchmark,” the report states. It highlights

requirements covering reserve backing, redemption rights and transparency.

The report points to recent initiatives that link

stablecoins to consumer payments. These include GrabPay’s integration with OKX

Pay and StraitsX. The setup allows users to pay with USDC or USDT at

participating merchants. Transactions are settled in Singapore dollars,

reducing volatility exposure for merchants.

Institutional developments are also noted. These include

Paxos’ banking partnership with DBS for stablecoin reserve custody and cash

management. The report also references merchant pilots involving licensed

payment providers accepting stablecoin payments.

Together, these cases reflect what the report describes as a

“layered utility approach.” Under this model, stablecoins are

tested across retail payments, treasury functions and tokenised financial

products at the same time.

FX and Payments Infrastructure Intersect

Singapore’s payments role is closely tied to its foreign

exchange market. Average daily FX trading volumes reached USD 1.485 trillion in

April 2025. This represented a 60% increase from April 2022. Singapore ranks as

the world’s third-largest FX trading centre, after London and New York.

The report notes that traditional money changers continue to

operate alongside newer digital platforms. FinTech firms are increasingly

offering digital remittance and FX services, especially for higher-value or

cross-border transactions. As cash usage declines, hybrid models combining

physical and digital services are expected to expand.

Fraud, Interoperability and Oversight

The report identifies fraud and scams as a growing challenge

alongside digital adoption. Scam-related losses in Singapore reached SGD 1.1

billion in 2024. Cryptocurrency-related scams accounted for a notable share of

these losses.

Singapore is one of the best places in the world for stablecoins.Singapore Gulf Bank just launched a new upgrade. It lets large clients manage fiat and stablecoins in one safe, regulated system. They can issue, convert, store and trade them quickly on chains. This is a regional… pic.twitter.com/ggoDFrww7v

— LIA (@Lianatyn) February 2, 2026

Authorities and financial institutions

have responded with tighter controls. Measures include stronger authentication,

real-time transaction monitoring and public education campaigns. The report

frames fraud prevention as a shared responsibility among regulators, payment

firms and consumers.

Holly Fang, President of the Singapore FinTech Association,

said cooperation across the ecosystem will remain important. “Safeguarding

trust requires a shared responsibility framework,” she said, referring to the

need for coordinated action against fraud and scams.

Programmable Money Drives Singapore Payments Growth

According to the report, the next phase of Singapore’s

payments development will be shaped by AI-driven fraud detection, programmable

money, embedded finance and wider use of real-time cross-border payment

systems.

By combining regulatory oversight with continued system

development, Singapore aims to strengthen

its role as a payments and settlement hub. The report also positions

interoperability and consumer protection as ongoing priorities as regional

payment links expand.

This article was written by Tareq Sikder at www.financemagnates.com.

Source link