The fourth quarter earnings season momentum continues this week, with results from Alphabet (GOOG, GOOGL), Amazon (AMZN), AMD (AMD), Qualcomm (QCOM), and Palantir (PLTR) highlighting the calendar.

As of Jan. 30, 33% of S&P 500 (^GSPC) companies have reported fourth quarter results, according to FactSet data, and Wall Street analysts estimate an 11.9% increase in earnings per share for the fourth quarter. If that rate holds, it would represent the 10th consecutive quarter of annual earnings growth for the index and the fifth consecutive quarter of double-digit growth.

Heading into the reporting period, analysts were expecting an 8.3% jump in earnings per share, down from the third quarter’s 13.6% earnings growth rate. Wall Street has raised its earnings expectations in recent months, especially for tech companies, which have driven earnings growth in recent quarters.

Big Tech results set the tone, as capital expenditures continue apace. Plus, the themes that drove the markets in 2025 — artificial intelligence, the Trump administration’s tariff and economic policies, and a K-shaped consumer economy — continue to provide plenty for investors to parse.

This week, investors will hear updates from companies including Disney (DIS), Chipotle (CMG), PepsiCo (PEP), Uber (UBER), and Snap (SNAP).

LIVE 129 updates

-

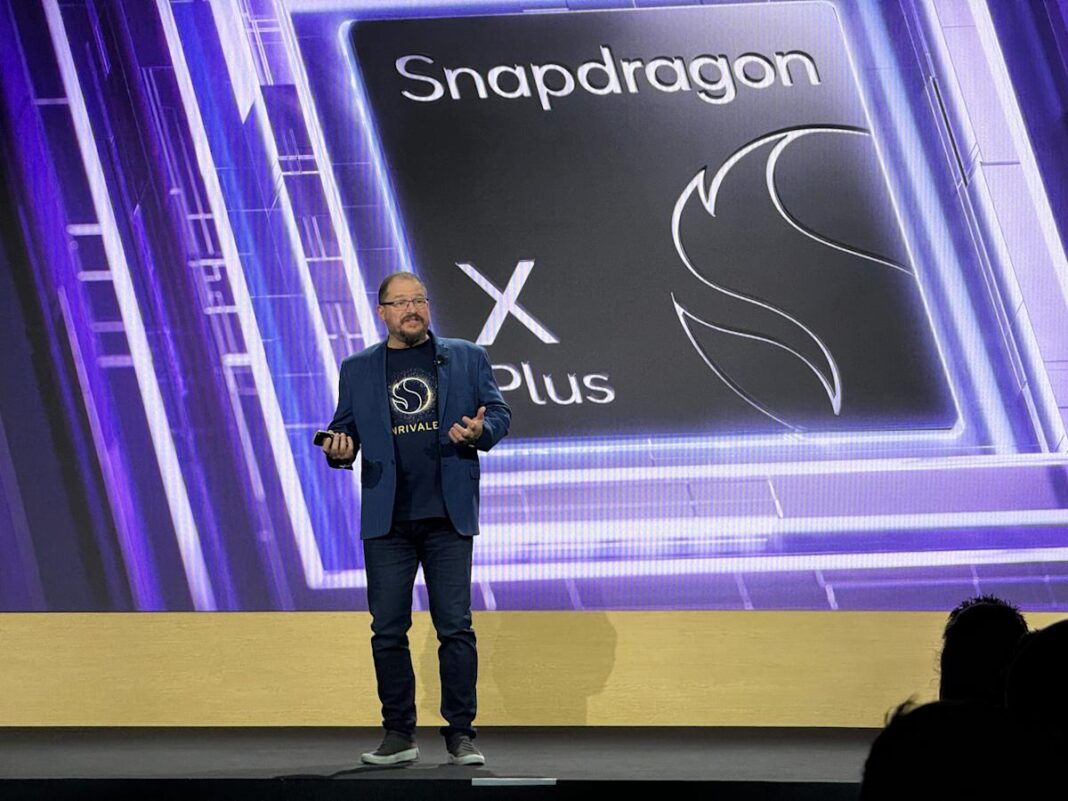

Qualcomm stock dives as memory chip shortage weighs on financial outlook

Qualcomm (QCOM) stock fell around 8% in extended trading after the chip designer’s results beat on the top and bottom lines but its forecast was lighter than expected. A memory chip shortage stemming from data center developers scooping up chips and chipmakers shifting production to cater to AI demand added pressure to the company’s outlook.

In the fiscal first quarter, the company said revenue increased 5% year over year to $12.3 billion, while earnings per share rose to $2.78. Qualcomm beat analyst estimates on the top and bottom lines, with consensus estimates forecasting $12.1 billion in revenue and earnings per share of $2.75, according to S&P Global Market Intelligence.

However, the outlook for the fiscal second quarter dimmed as a supply crunch in memory chips weighs on margins and the smartphone market.

Second quarter revenue is expected in the range of $10.2 billion to $11 billion (analysts were looking for $11 billion at the midpoint). Adjusted diluted earnings per share are expected to be in the range of $2.45 to $2.65 (the Street was hoping for $2.87).

“While our near-term handsets outlook is impacted by industry-wide memory supply constraints, we are encouraged by end-consumer demand for premium and high tier smartphones, and remain on track to achieve our fiscal 2029 revenue goals,” Qualcomm CEO Cristiano Amon said in the earnings release.

Read the latest financial and business news from Yahoo Finance