The European Central Bank (ECB) kept interest rates unchanged at 2.00% on Thursday for a fifth consecutive meeting, signaling confidence in its inflation trajectory even as headline prices fell below the 2% target.

President Christine Lagarde reinforced the message that monetary policy remains “in a good place,” while acknowledging a stronger euro could push inflation lower than currently projected.

Key Takeaways

- ECB held deposit rate at 2.00%, main refinancing at 2.15%, marginal lending at 2.40% for a fifth straight meeting

- The decision was unanimous with no dissent on the rate hold

- Lagarde emphasized ECB “cannot be hostage to one data point” despite below-target inflation

- Inflation fell to 1.7% in January, below ECB’s 2% target, driven primarily by energy prices declining 4.1% year-on-year

- Core inflation eased to 2.2%, lowest since October 2021; services inflation slowed to 3.2%

- Growth projection: 0.3% in Q4 2025, supported by AI-related ICT investment and defense/infrastructure spending

- Lagarde stressed stronger euro is being monitored but remains “within historical average range”

- ECB will send reform “checklist” to EU leaders ahead of February 12 competitiveness summit

- ECB is maintaining a data-dependent, meeting-by-meeting approach with no pre-commitment to rate path

Link to official ECB Monetary Policy Statement (February 2026)

In her presser, Lagarde pushed back on the idea that below-target inflation would automatically lead to rate cuts, saying the recent dip mainly reflects energy base effects. She described the eurozone economy as resilient, supported by AI-related investment and steady government spending on defense and infrastructure.

Bulgaria also officially joined the Euro Area at the start of 2026, gaining a voting seat on the Governing Council.

On the euro, Lagarde said recent strength was already factored into forecasts and remains in line with long-term averages, while noting that a stronger currency and lower energy costs are helping ease inflation pressures.

On reforms, the ECB will send EU leaders a comprehensive checklist ahead of their February 12 summit, outlining critical measures including completing capital markets and banking unions, adopting the digital euro, and deepening the single market.

Link to ECB Governing Council Press Conference (February 2026)

Market Reactions

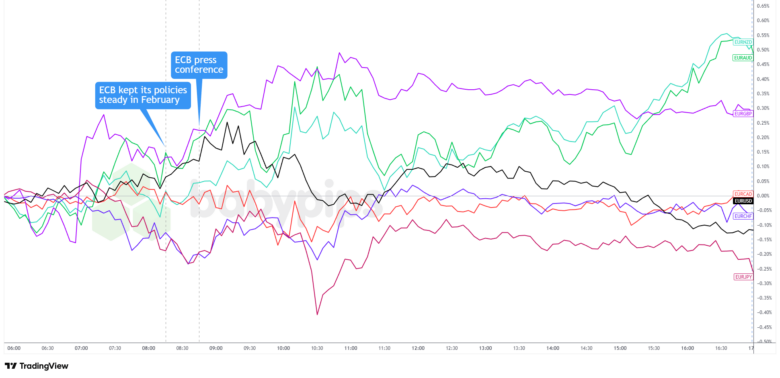

Euro vs. Major Currencies: 5-min

Overlay of EUR vs. Major Currencies Chart Faster with TradingView

The euro, which had been trading mixed ahead of the ECB’s decision, edged higher right after the rate announcement as markets took comfort in a fully expected outcome and a confident inflation message.

The currency picked up another bid during Lagarde’s press conference, briefly hitting session highs as she stressed economic resilience and played down concerns about the recent inflation dip.

EUR’s strength didn’t last, however. As the presser wrapped up and attention shifted to broader market stress, including sharp selloffs in US tech stocks and precious metals, the euro started to fade. By mid-afternoon, it had given back most of its gains and finished broadly lower against most majors.

The muted and ultimately bearish reaction suggests several crosscurrents at work:

- Markets had already priced in the rate hold and largely expected the ECB to downplay inflation weakness, limiting upside surprise potential.

- Lagarde’s refusal to signal any policy shift—neither cuts nor hikes—left traders without clear directional conviction.

- Lagarde’s acknowledgment that a stronger euro “could bring inflation down beyond current expectations” may have planted seeds of doubt about whether the ECB can truly remain on hold if the currency continues appreciating and inflation stays below target through 2026.

- Broader market risk-off dynamics dominated the second half of the session. With U.S. tech stocks sliding sharply, silver plunging over 15%, and bitcoin suffering its worst one-day drop since November 2022, investors gravitated toward defensive positioning. In that environment, even positive ECB signals couldn’t sustain euro strength against safe-haven flows into the dollar and yen.

By Thursday’s close, the euro was mostly range-bound. It ended the day firmer against risk-sensitive currencies like AUD, NZD, CAD, and GBP, but weaker against safe havens including USD, JPY, and CHF.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high-quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top-rated journaling app! ($120 in savings)! Click here for more info!