Following plunging 16pc on Thursday, its biggest fall in one day ever recorded, Bitcoin has risen 3pc. Gold and silver have also bounced back as all three commodities were swept up in traders buying the tech pull-back.

06:06pm

Gold and silver prices have bounced after both suffered significant intraday plunges last week.

Gold has risen almost 2pc to $4,960 an ounce following dropping from an all-time high of $5,600 to $4,400 as investors switched back to the dollar ahead of the announcement of Kevin Warsh as the next Federal Reserve boss.

Silver has climbed 1pc to $77.46 an ounce, above the $68 the precious metal fell to when it plunged 30pc in the space of one day in a historic first.

Both metals rebouded as tech stocks and Bitcoin also reverse losses.

05:00pm

UK and European stocks have rebounded alongside Wall Street as investors bought the pull-back in tech stocks.

The FTSE 100 closed 0.6pc higher with 10,370 points and the mid-cap FTSE 250 rose 0.5pc to 23,208 points.

Germany’s Dax climbed 0.9pc, while France’s Cac edged 0.4pc higher.

04:54pm

Bitcoin has risen 3pc after its price suffered its worst one-day loss recorded on Thursday, falling 14pc and wiping off $200bn (£178bn) from its value.

The world’s biggest cryptocurrency is now hovering close to $70,000 following a drawdown amid a widespread sell-off in tech stocks.

The coin started to rise as traders cashed in on buying the dip, with several software stocks, including Arm and Strategy, now rebounding.

04:41pm

Some of the largest technology companies in the world are planning to spend a combined $650bn on artificial intelligence (AI) in 2026, according to Bloomberg.

Alphabet, Amazon, Meta and Microsoft have all boosted their capital expenditures for this year in an attempt to gain dominance in the AI industry.

On Thursday, Amazon announced that it intends to spend $185bn on AI, a move which has sent shares down 8pc.

It comes as investors have grown more wary of companies cashing in big bets on the relatively new tech tools, with concerns about how AI may disrupt businesses.

04:31pm

The Dow Jones Industrial Average has reached a new high of 49,934 points as US stocks rebound following steep declines over the past few days.

The blue-chip index rose 2pc in late morning trading in New York, with predominantly financial and industrial stocks leading its gains.

However, the Dow’s top performer is chip-making giant Nvidia, which has climbed alongside a number of tech and software stocks like Arm and Strategy.

04:24pm

US stocks have reversed some of their losses from a tech rout driven by a sell-off in the software sector.

The Dow Jones Industrial Average rose 1.8pc, led by gains in Nvidia, which is up almost 7pc, and construction firm Caterpillar, which is up about 5pc.

The benchmark S&P 500 climbed by 1.4pc and the tech-heavy Nasdaq Composite advanced 1.5pc.

04:02pm

A British tech trust said it is considering share buy-backs as investors continue to worry about the impact of artificial intelligence on the software sector.

Shares in HgCapital Trust, a London-listed fund of unquoted software businesses, have declined more than 6pc in the past five days, extending losses to about 20pc since the beginning of the year.

The fund said in a trading updated that the plunge in software stocks had a “pronounced negative impact” on the group’s share price.

“Given the scale of the recent dislocation between the share price and the value placed on the assets within the HgT portfolio, the Board is actively considering a number potential actions to address the current discount to net asset value using the full set of tools at its disposal, including share buy-backs,” HgCapital Trust said.

03:30pm

b’

‘

The chief executive of FTSE 100 accounting giant Sage has said a panic that legacy software could be wiped out by artificial intelligence (AI) is “bewildering” and insisted its technology can survive the rise of digital agents.

Steve Hare, the chief executive of £8bn business, said claims that traditional software products would be wiped out by new AI bots were wide of the mark.

He said: “What I find slightly bewildering is why everyone thinks that an AI era will suddenly mean that applications for specific domains will no longer be relevant.”

Mr Hare said he agreed with Jensen Huang, the chief executive of Nvidia, who last weekend said a stock market panic among traditional software businesses was “illogical”.

He said Mr Huang was right when he suggested that “the idea there won’t be any software applications just makes no sense”.

Dozens of tech stocks making software for accounting, legal advice and data analysis have imploded this week over fears that new AI apps, developed by companies such as Anthropic, could make their products obsolete.

Sage’s stock has fallen 11pc in the past five days. Anthropic released a new AI bot last Friday that it said could be specialised to legal tech or accountancy.

However, Mr Hare said most AI tools were still not reliable enough to be unleashed on a company’s finances. An AI’s answer cannot be “nearly write” when it comes to a company’s finances, he said, “people want something they can trust”.

He also questioned whether new “vibe coded” AI apps were secure enough to take on critical business functions, such as in payroll or taxes.

Sage has been developing its own AI bots over the past two years that are fine-tuned for company accounts. Mr Hare added most AI bots would not be able to access high quality data for developing specialist software for accountancy.

03:21pm

Nearly $240bn has been wiped off the value of Amazon in a sign that investors have become anxious at the eye watering sums being spent by Wall Street on AI.

The e-commerce giant’s shares plunged by 10pc at the start of trading after it outlined a $200bn (£148bn) spending surge on AI infrastructure.

Its fresh spending plans were announced a day after Google said its AI spending would double this year to $185bn in an arms race between the major companies.

The total capital expenditure on AI projects by Amazon, Google, Meta and Microsoft is on track to hit $650bn this year alone.

03:03pm

Investors have defended investments in AI as the global trade in the emerging technology began to fracture.

Fabiana Fedeli, chief investment officer of equities at M&G Investments, said the recent sell-off was a “meaningful adjustment rather than a structural break in the AI investment cycle”.

Shares on Wall Street have largely rebounded today following a sharp downturn on Thursday, although shares in Amazon plunged sank by 10pc after the tech giant said it would increase capital expenditure (capex) on AI.

Ms Fedeli said: “While some have drawn comparisons to the year 2000, today’s conditions differ significantly: public companies driving the current capex surge generally have strong cash flows and the financial flexibility to invest, even if some of that spending ultimately proves misallocated.

“Investors are rightly questioning whether this is the ‘AI bubble’ deflating or simply another episode of volatility. Concerns around rising capex and software companies over‑promising on AI revenue delivery are legitimate, yet this is not a watershed moment. Instead, it marks a reset as markets reassess expectations.”

02:35pm

US stocks opened higher in a rebound from the huge tech sell-off that gripped Wall Street on Thursday.

The Dow Jones Industrial Average climbed by 1pc to 49,396.84 while the benchmark S&P 500 jumped by 0.9pc to 6,860.69.

The tech-heavy Nasdaq Composite was 0.8pc higher at 22,730.88 a day after a 1.6pc fall.

02:04pm

More than £18bn has been wiped off the value of London-listed software and data giants this week over concerns about AI disrupting the market.

Companies in the sector have seen their share prices fall steadily over the last year but the downturn has been sped up by American artificial intelligence startup Anthropic.

Its latest AI tools have fuelled the sell-off of software stocks over concerns that software development services and products could be disrupted or replaced.

The worst hit company on the FTSE 100 this week has been data giant Relx, which has seen its valuation plunge by around £8bn.

The market capitalisation of London Stock Exchange Group, which has pivoted towards offering financial data, has plunged by as much as £7bn during the week, while accounting software group Sage has lost more than £1bn in value.

01:30pm

b’

‘

Vauxhall owner Stellantis has unveiled a €22bn (£19bn) hit from its botched shift to electric vehicles (EV), as bosses admitted that they overestimated “the pace of the energy transition”.

The automotive giant – which also owns brands such as Alfa Romeo, Ram and Jeep – revealed the impairment as part of a strategy reset announced on Friday, driven by dwindling demand for EVs and higher costs.

As well as the writedown across its business, Stellantis also warned investors it would not pay a dividend in 2026 and confirmed the sale of a stake in its battery joint venture in Canada.

01:11pm

Software companies are being “seriously attacked by their own invention” as fears over AI sweep global markets, a Swiss bank has warned.

Christian Gattiker, head of research at Julius Baer, said “nobody knows” what the impact of AI will be on the real economy.

He said the market was “probably right” that the world is undergoing a “similar big shift” from AI in the way the internet transformed businesses 25 years ago, while at the same time creating the dot-com bubble.

Mr Gattiker said: “We can’t even imagine what life was like before the internet, so we’re now in this really unsteady search for what the real impact of AI is.

“It’s quite telling that with the launch of the first ChatGPT model, the software hirings peaked in Silicon Valley and the US overall and has declined ever since.

“So, in other words, there seems to be at least a perception of a game changer for the software companies in terms of the way they produce their content and their software.

He added: “The statement from the market is the software companies get seriously attacked by their own invention. So it’s basically IT eating itself.”

12:49pm

It is not just software companies in turmoil today.

Metlen Energy & Metals plunged as much as 20pc to hit the bottom of the FTSE 100 after issuing a profit warning.

The Greek company said underlying profits would be about a quarter lower than previously expected “due to unanticipated cost overruns” in its M Power Projects business.

The aluminium producer and electricity generator’s shares fell to their lowest level since making London its primary listing last summer.

12:17pm

The pound rebounded after its sharp fall in the wake of the Bank of England’s hints at future interest rate cuts this year.

Sterling was up 0.4pc against the dollar at nearly $1.36 after dropping nearly 1pc on Thursday.

The pound was also up 0.3pc versus the euro at €1.153 a day after the single currency jumped at its fastest pace against sterling since August.

The drops in the pound came as Andrew Bailey, the Governor of the Bank of England, said there would likely be more interest rate cuts this year.

Meanwhile, sterling was also under political pressure as the Mandelson scandal led to questions about the leadership of Sir Keir Starmer.

Chris Turner, an analyst at ING, said there was “plenty of room” for the pound to fall over the next month.

11:43am

US stock indexes were on track to open higher in the wake of the bruising sell-off that hammered technology companies.

Amazon was down 7.5pc in premarket trading as ⁠it became the latest Big Tech company to ramp up spending on AI.

The company forecast a more than 50pc jump in capital expenditures this year at a time when investors have become sceptical about when they wil begin to see returns.

Microsoft has dropped 17pc over the last month after announcing its own major spending plans.

Software and data-services shares began to find their footing after a punishing week fuelled by worries that AI tools could hit demand for their businesses.

ServiceNow and CrowdStrike were up 2.9pc and 2.1pc, respectively, although software and services companies across the S&P 500 were on track for a near 10pc decline in the week, its worst performance since March 2020.

In premarket trading, the Dow Jones Industrial Average was up 0.4pc, the S&P 500 gained 0.5pc and the Nasdaq 100 rose 0.7pc.

10:59am

Software shares have plunged in a “forced clearance sale” as investors have sought to shield their portfolios from further damage, an investment adviser said.

Stephen Innes of SPI Asset Management said the trade in the software sector had been “thoroughly wrung out”, with large investors already cutting their positions “months ago”.

He said: “Eight straight sessions of pressure, a trillion dollars of market cap erased, and systematic flows dominating the tape rather than discretionary judgment.

“When selling reaches that phase, price stops being about belief and starts being about balance sheet preservation.”

However, he said there was some hope for the sector, adding buyers “are showing up”.

He said: “Some institutional participation is returning, alongside signs of short covering. Retail flows are no longer absent.

“They are not euphoric, but they are no longer hiding. That combination rarely appears at the start of a broader decline.”

10:36am

Want to choose which publishers appear in your search results?

You can now add The Telegraph as a “preferred source” on Google, which means you’ll see more of the journalism that you know and trust.

It’s quick and easy to do – just click here to get started.

10:18am

The software sector may be in turmoil but the FTSE 100 has turned higher thanks to a rally in gold.

Precious metals miners have pushed up the UK’s benchmark index to trade flat on the day. It was earlier down as much as 0.5pc.

Gold rose 1.9pc earlier to $4,859.43 per ounce, helping the miner Fresnillo lead gains on the FTSE 100, up 2.5pc.

Kelvin Wong, an analyst at OANDA, said: “I do see a bit of a safe-haven investment coming in, but bear in mind that there is still some caution after last Friday’s sell-off.”

Gold, a traditional safe haven, does well in times of geopolitical and economic uncertainty. Spot silver was up 4.2pc at $74 an ounce on the day after falling below $65 during early Asia trading.

09:49am

Swiss bank UBS said London Stock Exchange Group was “guilty by association” in the software sector sell-off as its shares were on track for their worst week since last March.

Analyst Michael Werner insisted that he thought the company was “not at risk” from AI disruption but admitted investors “now need to see the deliverables promised by management before they give the company credit”.

Shares in London Stock Exchange Group have plunged by more than 37pc in the last year amid growing concerns that AI will undercut the business models of data-focused businesses.

It purchased the data company Refinitiv in 2021 for $27bn (£20bn). Shares have fallen by 8.3pc so far this week.

Mr Werner added: “Given the AI overhang and the recent underperformance of the stock, there is a limit on what management can do to absolve market concerns.”

09:33am

b’

‘

Some of the most recognisable figures in the world of private capital have rushed to defend their ties to software companies, amid a prolonged sell-off in the sector.

Software stocks have been battered this week after Anthropic, a $350bn Silicon Valley AI lab, unveiled a new legal and accounting tool for its Claude chatbot which threatens to replace existing software services.

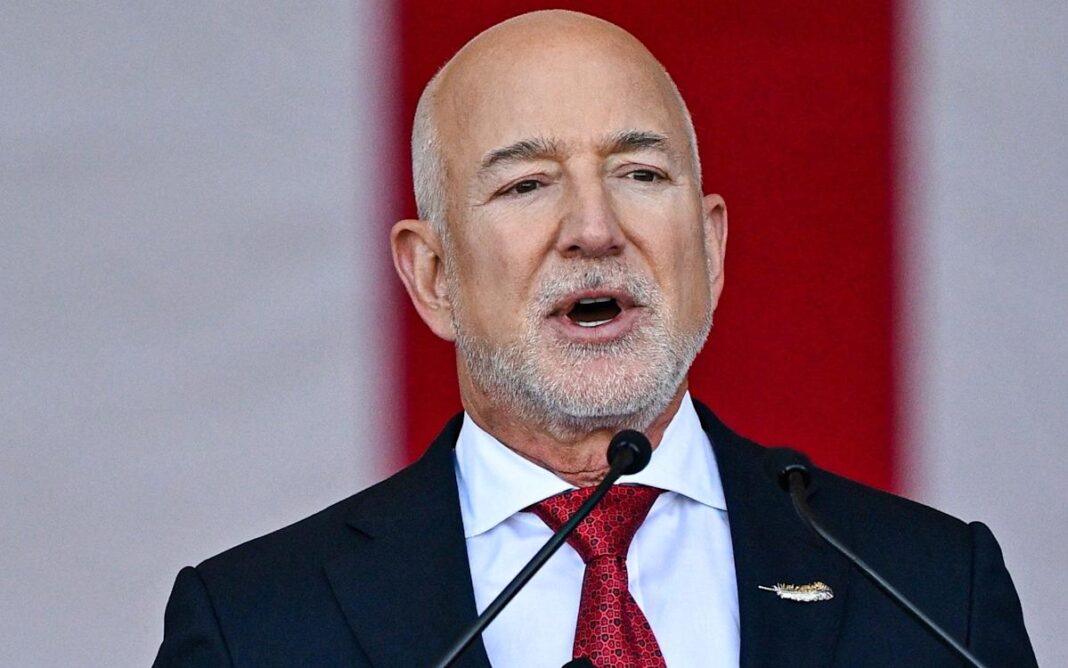

Marc Lipschultz, the billionaire co-chief executive of Blue Owl Capital insisted on an earnings call on Wednesday that there were no “red flags” — or even “yellow flags” — in the firm’s technology loans.

One of the biggest players in the private credit sector, Blue Owl Capital has fared particularly badly over the last few days, with its share price down by 6.9pc between Friday and Wednesday.

Mike Arougheti, the billionaire boss of Ares Management Corp, which has also been caught in the sell-off, claimed that “there is a huge disconnect, and the narrative is wrong” around artificial intelligence in a recent interview on Bloomberg TV.

09:08am

The FTSE 100 fell in early trading as investors turned sour on software companies over the threat from AI.

The UK’s flagship index dropped as much as 0.5pc to 10,253.15 as data-focused businesses dropped sharply again.

The software sector was down 3.3pc across the FTSE 100 and FTSE 250 and has dropped more than 14pc in its worst week since the onset of the first Covid lockdown in 2020.

Data giant Relx was last down as much as 4.9pc today and was also on pace for its worst week in nearly six years.

08:47am

Donald Trump’s cryptocurrency dream has been left in tatters after the market suffered a $2 trillion wipe-out.

Bitcoin plunged to nearly $60,000 overnight, cancelling out all of its gains since the US president returned to the White House.

Mr Trump had promised to turn the US into the “crypto capital of the world” when he returned to the White House last year, promising to create a US Bitcoin strategic reserve.

However, the world’s largest cryptocurrency has lost more than half its value since hitting a record high above $124,000 in mid-October as $1 trillion was pulled out by investors.

More than $2 trillion (£1.5tn) has been wiped off the total digital asset market over the same period, according to Coingecko.

On Thursday, Bitcoin suffered its steepest one-day collapse on record after $200bn was wiped off the cryptocurrency following a Wall Street rout.

The digital currency plunged as much as 14pc after it was swept up in a tech sell-off triggered by artificial intelligence (AI) fears.

So far today, Bitcoin has rebounded from the latest sharp sell-off, and was up 3.1pc towards $68,000.

08:44am

Thanks for joining me. The UK’s software companies fell deeper into the red over fears AI will pull the rug from under their business models.

Companies in the sector across the FTSE 100 and FTSE 250 were on track for their worst week since the onset of the first Covid lockdown in 2020.

The London Stock Exchange Group, which offers data and analytics to companies, plunged as much as 5.3pc today amid the ongoing rout.

More than £25bn has been wiped off the value of the company over the last year, sending its share price down by 40pc, but the downturn has accelerated since the turn of the year.

Data giant Relx fell as much as 4.8pc in early trading and has dropped more than 28pc so far in 2026.

Rory McPherson, chief market strategist at Wren Sterling, said software companies like LSEG, RELX and Wolters Kluwer had fallen as questions were raised about whether their business models could be “permeated by AI”.

The downturn ironically comes as investors also lose faith in the AI boom, with tech stocks down for the third day in a row on Wall Street.

The tech-heavy Nasdaq fell by about 1.6pc on Thursday, extending losses over the past five trading sessions to more than 4pc.

Amazon shares plunged on Thursday night after it outlined a $200bn (£148bn) spending surge on AI infrastructure. Here is what you need to know.

1) London barrister suspended over friendship with Epstein | Matthieu de Boisséson has been suspended by Littleton Chambers pending an investigation after he appeared in documents released by the US department of justice related to the paedophile financier

2) Pandora to replace silver jewellery with platinum as prices go haywire | The world’s largest jewellery maker said it wanted to move away from silver following weeks of volatility in precious metal prices

3) Andrew Bailey ‘hurting taxpayers’ by refusing to cut rates | Economists warned that Bank of England officials were adding “unnecessary strain” to the economy as officials held rates at 3.75pc

4) UK wealth tax is inevitable, says ‘billionaires’ nemesis’ | Gabriel Zucman, nicknamed the “billionaires’ nemesis” in France, said while Emmanuel Macron has retreated from plans for a tax on the rich, this was only a temporary setback and interest in the idea was “bubbling up everywhere”

5) Electric car market goes into reverse amid pay-per-mile tax threat | EV sales flatlined last month with registrations up just 0.1pc, according to figures from the Society of Motor Manufacturers and Traders, which represents UK carmakers

Asian shares traded mostly lower, tracking Wall Street’s losses as technology stocks again dragged on markets.

Bitcoin sank to roughly half its record price, giving back all it gained since Donald Trump returned to the White House for his second term.

Tokyo’s Nikkei 225 closed up 0.8pc to 54,253.68, recovering from losses earlier this week, with technology-related stocks leading gains.

SoftBank Group rose 2.2pc and chipmaker Tokyo Electron rose 2.6pc. Japan will also be holding its general election on Sunday, in which Prime Minister Sanae Takaichi expects to win a stronger public mandate for her policies.

South Korea’s Kospi lost 1.4pc to 5,089.14 as it was weighed down by tech shares. Samsung, the country’s biggest listed company, and chipmaker SK Hynix both fell 0.4pc.

Hong Kong’s Hang Seng fell 1.2pc to 26,559.95 while Australia’s S&P/ASX 200 shed 2pc to end the day at 8,708.83.

US stocks fell as investors responded to the latest employment data and a continued sell-off in tech shares.

The S&P 500 and the Dow Jones Industrial Average both declined 1.2pc after it was revealed that there were 108,000 job cuts in January, the largest amount in the first month of the year since 2009.

The tech-heavy Nasdaq Composite shed 1.6pc as concerns grew about the impact of artificial intelligence on software companies and professional services firms.